- United States

- /

- Other Utilities

- /

- NYSE:WEC

How Investors May Respond To WEC Energy Group (WEC) Surpassing Q2 Estimates Amid Strong Residential Demand

Reviewed by Simply Wall St

- WEC Energy Group recently reported strong second-quarter results for 2025, with net income rising to US$245.4 million and sales reaching US$2.01 billion, both exceeding the prior year's figures and analyst estimates.

- The company's performance was driven primarily by increased residential electricity demand during a period of extreme summer heat, and management reaffirmed full-year earnings guidance, reflecting continued confidence in ongoing operations.

- We'll explore how WEC Energy Group’s reaffirmation of earnings guidance and robust residential demand impacts its investment outlook and growth narrative.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

WEC Energy Group Investment Narrative Recap

To be a shareholder in WEC Energy Group, you need to believe in the company's ability to execute its long-term capital plan and capitalize on economic and regulatory stability in its core markets. The recent strong Q2 results and reaffirmed earnings guidance reinforce the company's short-term outlook, with robust residential demand acting as a key catalyst. At the same time, this update does not materially change the larger risks tied to regulatory shifts or macroeconomic pressures, which remain the most important watch points.

The company's reaffirmation of its 2025 earnings guidance, projecting US$5.17 to US$5.27 per share, stands out as the most relevant announcement. This guidance reflects ongoing confidence in the company's major projects and sustained demand, while also indicating a steady approach despite some evolving industry pressures. The guidance serves as a near-term reference point for investors tracking catalysts like the rollout of large-scale regional projects.

However, it’s equally important for investors to stay alert to changes in regulatory requirements, which could...

Read the full narrative on WEC Energy Group (it's free!)

WEC Energy Group's outlook anticipates $10.6 billion in revenue and $2.0 billion in earnings by 2028. This scenario assumes annual revenue growth of 5.3% and a $0.4 billion increase in earnings from the current $1.6 billion level.

Uncover how WEC Energy Group's forecasts yield a $109.96 fair value, in line with its current price.

Exploring Other Perspectives

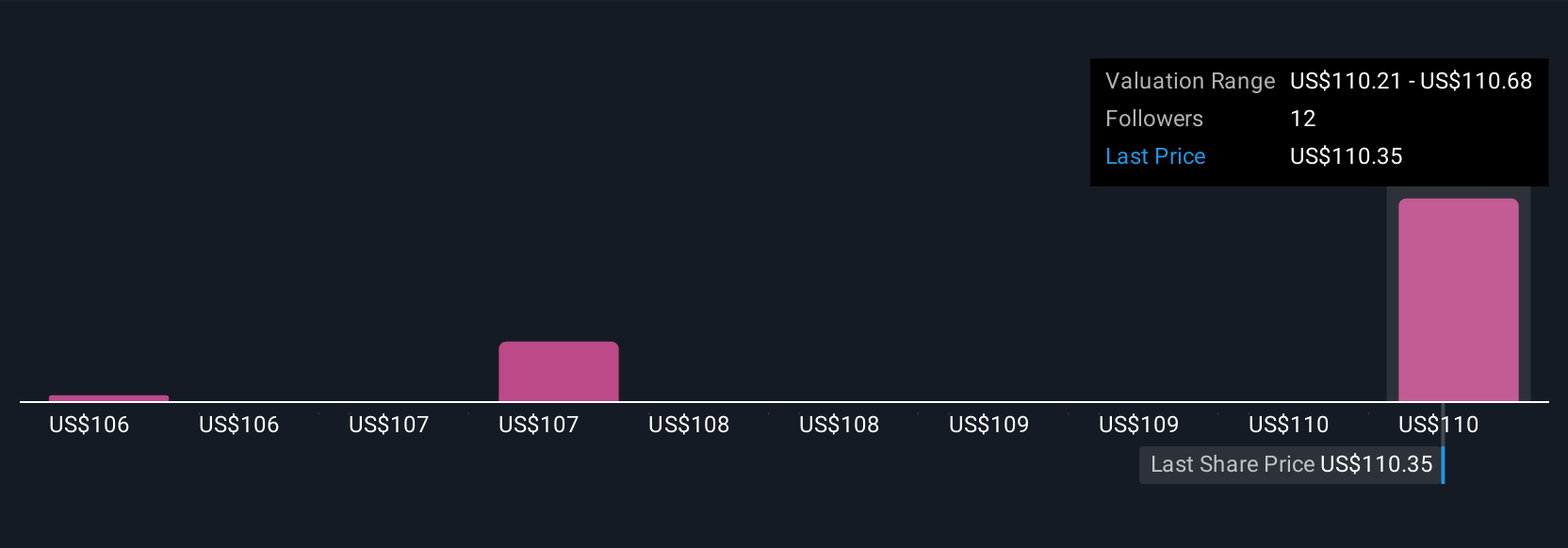

Retail investors in the Simply Wall St Community see fair value for WEC Energy Group shares spanning from US$106 to US$115.02, based on three unique approaches. While opinions can differ, the company's reaffirmed earnings outlook underlines how expectations about regulated market stability can influence these assessments, consider how both risks and opportunities may shift with regulatory changes.

Explore 3 other fair value estimates on WEC Energy Group - why the stock might be worth as much as 5% more than the current price!

Build Your Own WEC Energy Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WEC Energy Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WEC Energy Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WEC Energy Group's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEC Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEC

WEC Energy Group

Through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives