- United States

- /

- Renewable Energy

- /

- NYSE:VST

Did KeyBanc's Focus on Data Center Partnerships Just Shift Vistra's (VST) Investment Narrative?

Reviewed by Sasha Jovanovic

- KeyBanc recently initiated coverage on Vistra, highlighting the company’s strong presence in the U.S. power sector and its relationships with technology giants such as Amazon and Microsoft.

- One unique angle emphasized by KeyBanc is Vistra’s ability to capitalize on rising U.S. power demand, particularly from fast-growing segments like data centers and industrial electrification.

- We’ll explore how KeyBanc’s recognition of Vistra’s partnerships with leading technology firms could influence the company’s investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Vistra Investment Narrative Recap

To invest in Vistra, you need to believe in a surge in long-term U.S. power demand, fueled by data centers, AI, and electrification, and in the company’s ability to capture this demand through partnerships with major tech firms. KeyBanc’s coverage highlights these themes and supports the idea that tech-fueled demand remains a key short-term catalyst, but recent news does not meaningfully alter the most significant risk: Vistra’s elevated debt position and the pressures it brings if credit conditions tighten.

One recent announcement particularly relevant to this outlook is Vistra’s expanded $1 billion share buyback authorization through 2027, signaling continued confidence in future cash flow and a focus on shareholder returns, important as the company pursues growth tied to its ongoing contracts with hyperscale customers.

However, investors should also consider that, in contrast to growth optimism, sustained high leverage means that...

Read the full narrative on Vistra (it's free!)

Vistra's narrative projects $24.5 billion revenue and $3.4 billion earnings by 2028. This requires 9.8% yearly revenue growth and a $1.2 billion increase in earnings from $2.2 billion currently.

Uncover how Vistra's forecasts yield a $228.26 fair value, a 34% upside to its current price.

Exploring Other Perspectives

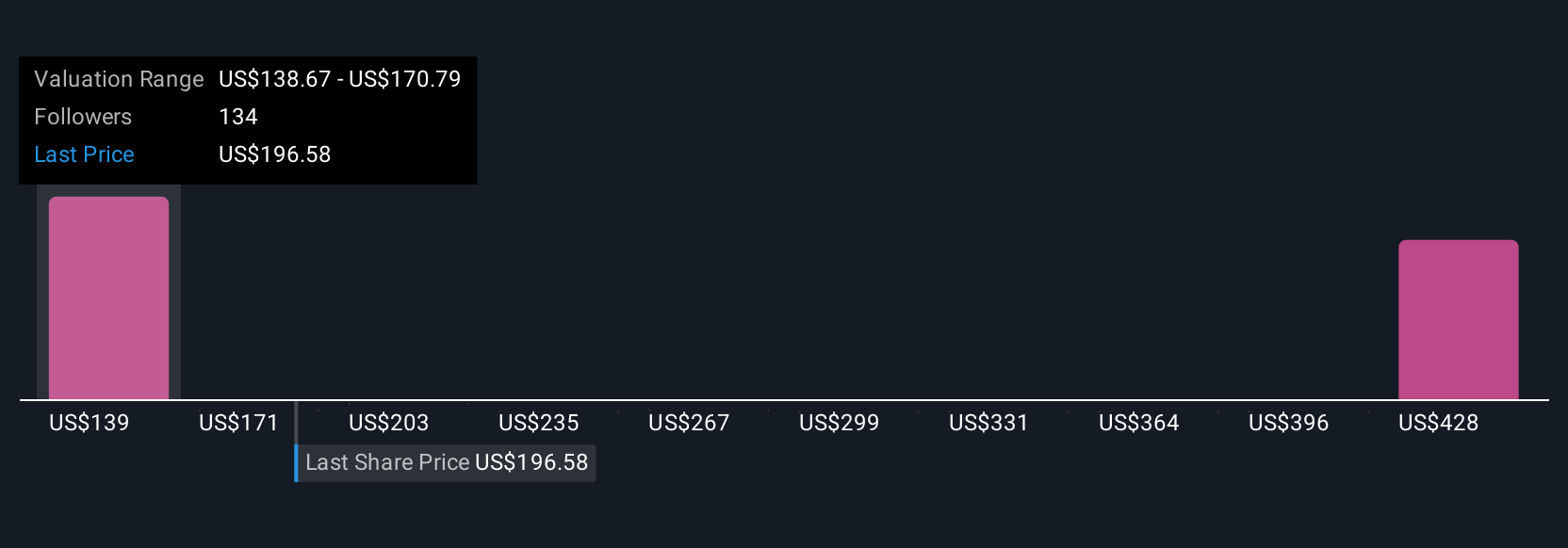

Thirteen members of the Simply Wall St Community place Vistra’s fair value between US$142 and US$386, with some seeing extremely high upside. While many point to robust power demand as a tailwind, elevated debt could weigh on performance if market conditions shift; see what other investors think.

Explore 13 other fair value estimates on Vistra - why the stock might be worth 17% less than the current price!

Build Your Own Vistra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vistra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vistra's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success