- United States

- /

- Renewable Energy

- /

- NYSE:VST

A Look at Vistra’s Valuation Following New Nuclear Deal and Dividend Increases

Reviewed by Simply Wall St

Vistra (VST) has been active on multiple fronts lately. The company has kicked off a 20-year nuclear power deal, announced plans to boost natural gas capacity in Texas, and rolled out incremental increases to both common and preferred dividends.

See our latest analysis for Vistra.

Vistra’s strategic moves have kept its momentum going after a blockbuster twelve months, with a 53% one-year total shareholder return and cumulative five-year returns now topping 900%. The latest 2% dividend hike comes alongside continued investments in nuclear and gas. However, shares have recently cooled off and given up some ground in the past month, even as the long-term trajectory remains firmly positive.

If you’re curious where else major catalysts might be hiding, now’s a perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership

With shares sitting below analyst targets and trading at a significant intrinsic discount, investors now face a crucial question: is Vistra truly undervalued, or is the market already factoring in all the future growth?

Most Popular Narrative: 18.2% Undervalued

Vistra’s widely followed narrative suggests a fair value well above the last closing price, hinting that there is room for further upside if assumptions hold. This reveals an intriguing gap between analyst expectations and where the shares currently trade.

Accelerated diversification into grid-scale battery storage and renewable projects, leveraging existing sites and interconnects, positions Vistra to capture growth from rising demand for grid flexibility, reliability services, and support for decarbonization. This widens future revenue streams and improves net margins.

Want to know the quantitative logic behind this bullish outlook? Dive deeper to uncover the growth rates, profit margins, and future multiples driving that premium price target. The pivotal assumptions are bolder than you might think.

Result: Fair Value of $227.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing debt pressures and the uncertainty of decarbonization regulations could easily undermine these bullish expectations for Vistra's continued growth.

Find out about the key risks to this Vistra narrative.

Another View: What Do the Multiples Say?

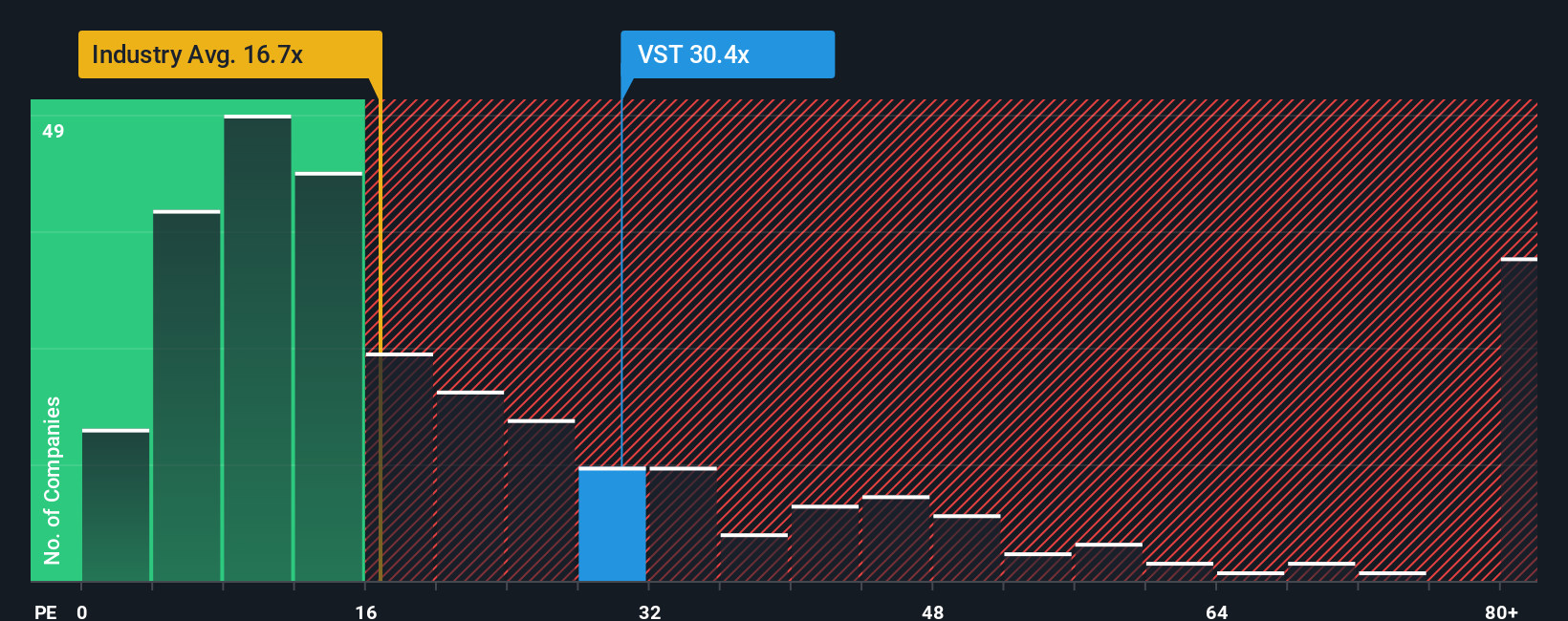

Looking through a different lens, Vistra currently trades at a price-to-earnings ratio of 28.7x. That is higher than the global renewable energy industry average of 17.6x, but still below its peer group average of 35.3x. Notably, the company's fair ratio is calculated at 45x, which the market could move towards if sentiment shifts. This mix of numbers hints at both risk and reward. Is current pricing a warning sign or simply the starting line?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vistra Narrative

If you like to dig deeper or want to follow your own instincts, you can shape your own Vistra narrative in just a few minutes. Do it your way

A great starting point for your Vistra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Ready to supercharge your portfolio? Don’t limit yourself; other smart opportunities are waiting for you right now in tomorrow’s most promising sectors.

- Supercharge your returns by targeting companies with market-beating yields using these 20 dividend stocks with yields > 3% and make your money work harder for you.

- Tap into the innovation surge with these 26 AI penny stocks and get ahead of the curve in artificial intelligence breakthroughs.

- Capitalize on price inefficiencies by seeking value-packed picks through these 840 undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives