- United States

- /

- Gas Utilities

- /

- NYSE:SWX

Did SWX’s Appointment of Fabio Pineda as CAO Just Shift Its Investment Narrative?

Reviewed by Simply Wall St

- On July 2, 2025, Southwest Gas Holdings, Inc. and Southwest Gas Corporation appointed Fabio A. Pineda as Vice President, Controller, and Chief Accounting Officer, effective July 17, 2025, marking a key shift in their financial leadership.

- Pineda’s experience at Sempra and background in large-scale utility accounting signal a focus on financial expertise as the company advances major operational changes.

- We'll examine how appointing a new Chief Accounting Officer positions Southwest Gas Holdings for financial leadership during its ongoing operational transition.

Southwest Gas Holdings Investment Narrative Recap

Southwest Gas Holdings shareholders are primarily betting on the utility’s ability to deliver steady earnings growth, driven by infrastructure investment and regulatory approvals in key territories. The recent appointment of Fabio A. Pineda as Chief Accounting Officer is unlikely to materially shift the most important near-term catalyst, the planned separation of Centuri, or the largest risk, which remains uncertainty around market conditions and regulatory processes supporting rate base growth.

Among the latest company actions, the extension of the term loan and establishment of a new revolving credit facility align with near-term priorities to improve financial flexibility. This announcement is directly relevant to the broader operational changes underway, providing additional liquidity as the company positions itself for Centuri’s separation and ongoing capital investments.

Yet in contrast, investors should be aware that success hinges on Centuri’s spin-off amid uncertain market conditions, and if those markets don’t...

Read the full narrative on Southwest Gas Holdings (it's free!)

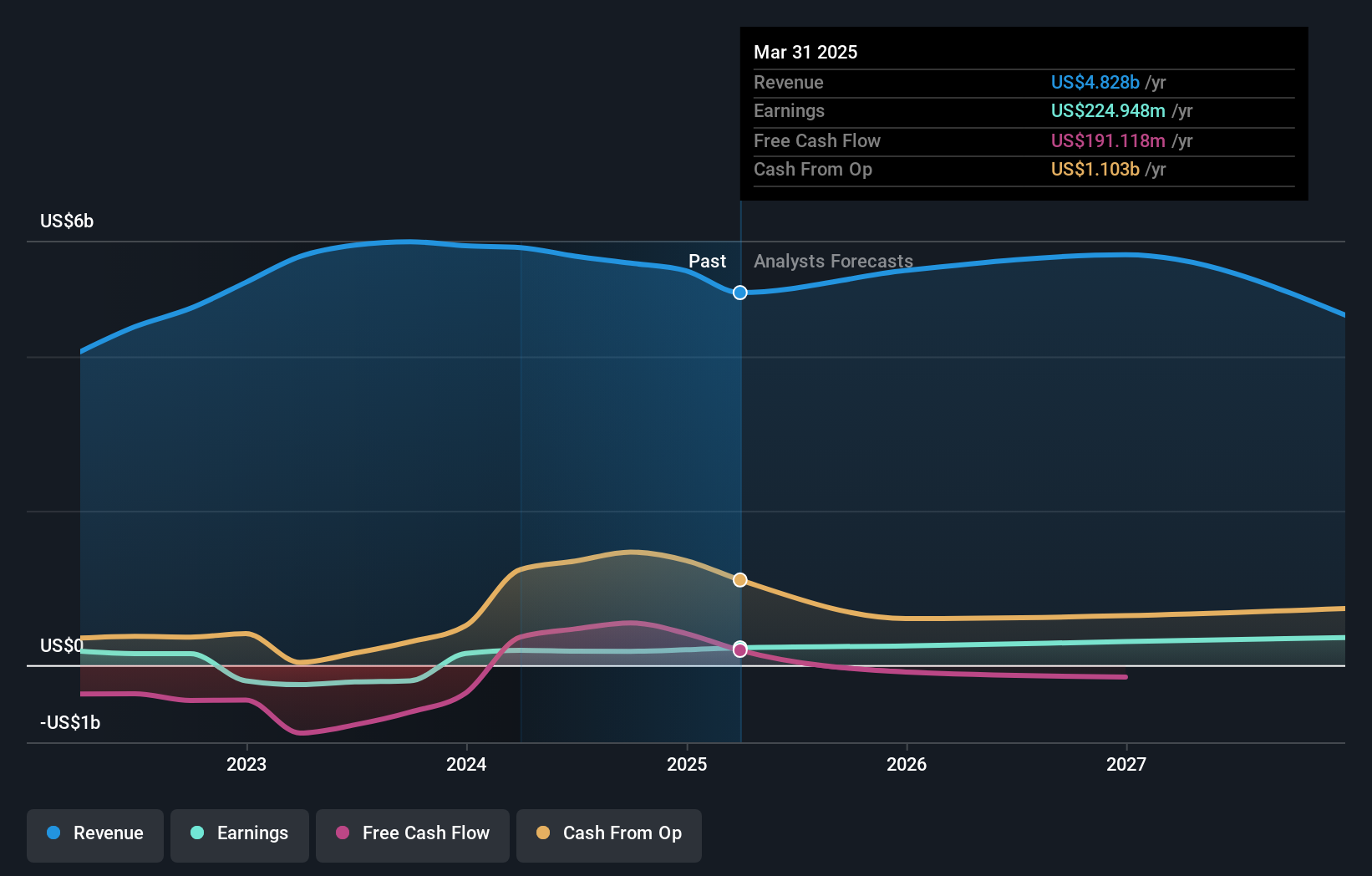

Southwest Gas Holdings is projected to reach $4.5 billion in revenue and $371.7 million in earnings by 2028. This outlook is based on an anticipated annual revenue decline of 2.1% and an earnings increase of $146.8 million from current earnings of $224.9 million.

Exploring Other Perspectives

Three Simply Wall St Community contributors have estimated Southwest Gas Holdings’ fair value from as low as US$33.14 to as high as US$79.57. While you consider these diverse viewpoints, keep in mind that favorable market timing for Centuri’s separation remains crucial for Southwest Gas Holdings’ broader strategy.

Build Your Own Southwest Gas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Gas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Southwest Gas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Gas Holdings' overall financial health at a glance.

No Opportunity In Southwest Gas Holdings?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, purchases, distributes, and transports natural gas for residential, commercial, and industrial customers in Arizona, Nevada, and California.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives