- United States

- /

- Gas Utilities

- /

- NYSE:SWX

A Look at Southwest Gas Holdings’s Valuation Following New CFO Appointment

Reviewed by Simply Wall St

Southwest Gas Holdings (SWX) announced that Justin S. Forsberg will become Chief Financial Officer and Senior Vice President on December 1, following Robert J. Stefani’s departure. This leadership shift brings new finance expertise to the company’s executive team.

See our latest analysis for Southwest Gas Holdings.

Southwest Gas Holdings’ recent executive moves come as the company’s share price builds momentum, climbing 18.1% year-to-date and closing at $83.05. With renewed leadership, the company affirmed its quarterly dividend last week. This has helped support a one-year total shareholder return of 9.8% and reinforces confidence in long-term performance.

If leadership changes at Southwest Gas have you thinking bigger, now’s the perfect opportunity to discover fast growing stocks with high insider ownership.

With shares up notably this year and leadership changes underway, the question remains for investors: Is Southwest Gas Holdings now trading at an attractive value, or has the market already priced in the company’s growth prospects?

Most Popular Narrative: 4% Undervalued

According to the most widely followed narrative, the fair value for Southwest Gas Holdings lands at $86.50, about 4% above the recent close. The gap is narrow and raises questions about the assumptions supporting this price target.

Robust customer growth facilitated by ongoing population and economic expansion in the Southwest, with 40,000 new meter connections in the last 12 months, suggests extended demand for natural gas in core service territories. This directly underpins long-term revenue and earnings growth.

What financial bet underpins this price? The narrative assumes aggressive gains in core markets with customer expansion powering profitability, but only the full narrative reveals the future growth formula. Curious about the numbers that drive this optimistic forecast? Unpack which forward-looking projections produce this fair value and see what’s driving debate.

Result: Fair Value of $86.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating decarbonization trends or regulatory hurdles could challenge Southwest Gas Holdings’ future growth story and introduce fresh earnings uncertainty.

Find out about the key risks to this Southwest Gas Holdings narrative.

Another View: What Do Valuation Ratios Tell Us?

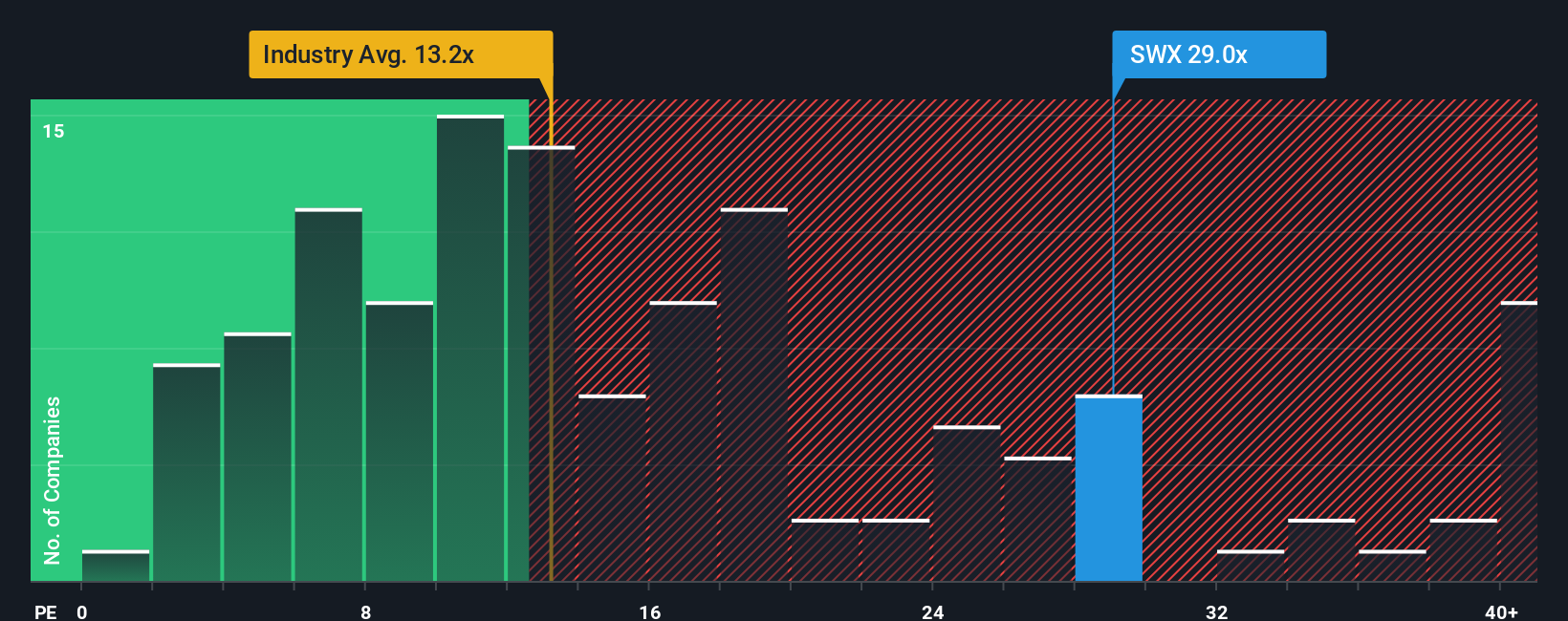

Looking beyond fair value estimates, Southwest Gas Holdings is priced at 25.1 times its recent earnings. This is noticeably higher than both the industry average of 14.3x and peers at 17.2x. Given that the fair ratio is closer to 20.4x, this signals the stock is trading at a notable premium. Could this premium reflect confidence in management or is it a risk if the expected growth does not materialize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southwest Gas Holdings Narrative

If you see the story unfolding differently, try your own analysis. Our tools make it easy to craft a custom outlook in just a few minutes. Do it your way

A great starting point for your Southwest Gas Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors often stay ahead by remaining open to new opportunities. Take initiative and consider putting your money to work by exploring high-potential strategies designed for today’s market.

- Unlock the potential of breakthrough health technology when you browse these 30 healthcare AI stocks, advancing innovation across patient care and medical diagnostics.

- Tap into steady income streams by checking out these 15 dividend stocks with yields > 3%, which features robust yields above 3% and a track record of rewarding shareholders.

- Fuel your portfolio’s growth with these 920 undervalued stocks based on cash flows, offering attractive entry points, strong cash flows, and potential that others may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWX

Southwest Gas Holdings

Through its subsidiaries, purchases, distributes, and transports natural gas for residential, commercial, and industrial customers in Arizona, Nevada, and California.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.