- United States

- /

- Other Utilities

- /

- NYSE:SRE

Sempra (SRE): Revisiting Valuation After CPUC Ruling on Utility Return on Equity

Reviewed by Simply Wall St

The California Public Utilities Commission’s decision to let Sempra (SRE) keep roughly 10% returns on equity at its California utilities in 2026 gives investors clearer visibility on earnings, even as consumer advocates push back.

See our latest analysis for Sempra.

Even with the CPUC decision shoring up earnings visibility, Sempra’s recent share price return has cooled, with a roughly 6% one month pullback after a stronger 90 day gain. Its five year total shareholder return above 60% still signals durable compounding.

If this kind of regulated stability has you rethinking your portfolio mix, it could be worth scanning other fast growing stocks with high insider ownership that might offer a more aggressive growth twist.

With regulators affirming solid future returns yet the stock still trading below analyst targets, is Sempra quietly undervalued after its pullback, or has the market already priced in its regulated growth runway?

Most Popular Narrative: 13.2% Undervalued

With Sempra’s fair value estimate sitting meaningfully above the last close at $86.94, the most widely followed narrative leans toward a valuation gap that hinges on future earnings power.

The rollout and completion of major LNG export projects (ECA Phase 1 nearing completion, Port Arthur Phase 1 advancing, and strong commercial momentum for Phase 2) positions Sempra to benefit from sustained global demand for U.S. LNG as a transition fuel, significantly increasing future cash flows and long-term revenue generation.

Want to see how steady revenue growth, expanding margins, and a leaner share count are stitched together into that higher valuation playbook? The full narrative reveals the exact earnings path, the implied future multiple, and the growth runway underpinning that fair value call.

Result: Fair Value of $100.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, long term regulatory shifts in California or Texas, along with volatility in global LNG demand, could still derail those upbeat earnings and valuation expectations.

Find out about the key risks to this Sempra narrative.

Another Angle on Valuation

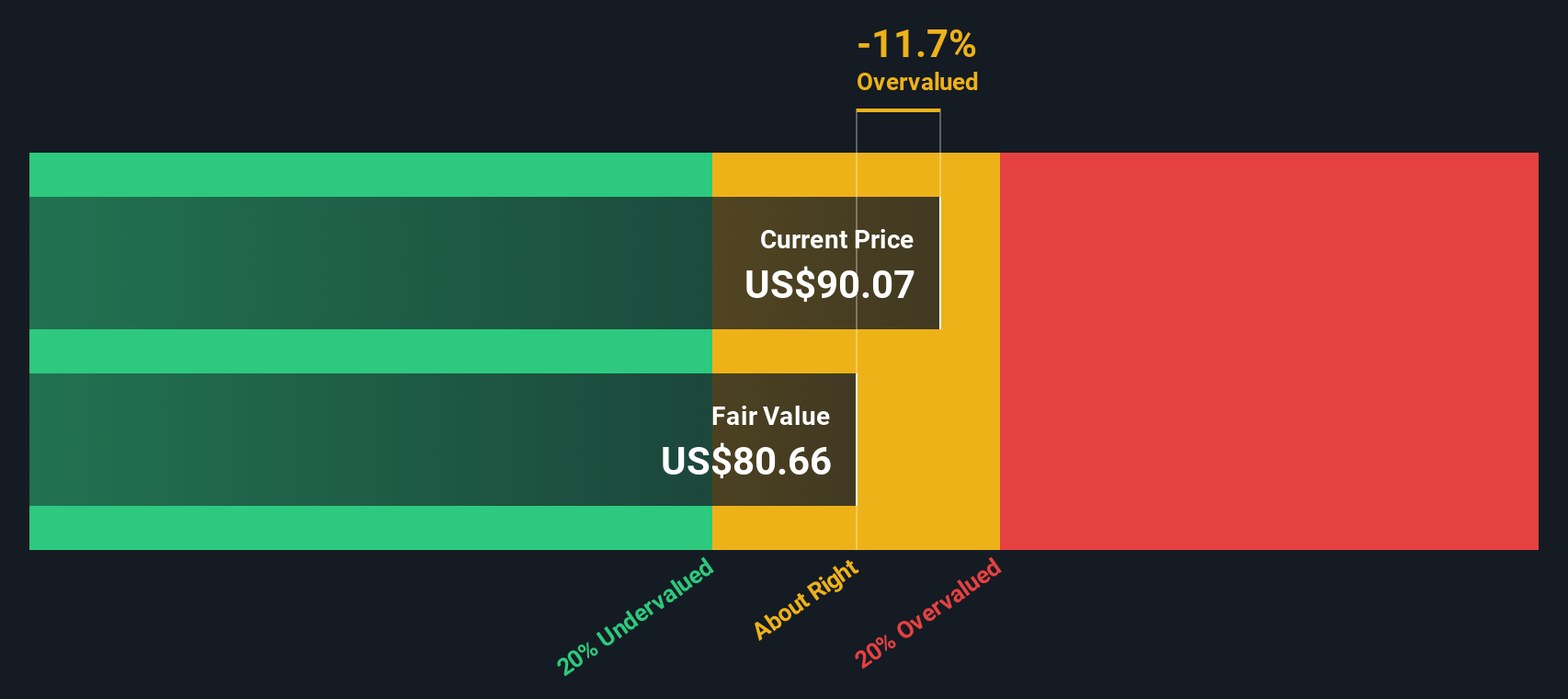

Our DCF model takes a different tack, suggesting Sempra is slightly overvalued, with an estimated fair value of $80.34 versus the current $86.94. If cash flows are closer to this more cautious path, is today’s price leaving enough margin of safety?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sempra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sempra Narrative

If you are not fully convinced by this view, or prefer digging into the numbers yourself, you can craft a personalised narrative in minutes: Do it your way.

A great starting point for your Sempra research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, you may want to consider using the Simply Wall Street Screener to uncover focused ideas that most investors are still overlooking.

- Target dependable income streams by scanning these 12 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

- Look for potential mispriced opportunities by reviewing these 911 undervalued stocks based on cash flows where future cash flows may not yet be fully reflected in the share price.

- Explore the leading edge of digital disruption by assessing these 79 cryptocurrency and blockchain stocks shaping the evolution of blockchain and decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRE

Sempra

Operates as an energy infrastructure company in the United States and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion