- United States

- /

- Gas Utilities

- /

- NYSE:SR

Spire (SR): Assessing Valuation After Strong 25% Year-to-Date Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Spire.

Spire’s recent share price momentum has caught more eyes than usual, with the stock climbing 24.8% year-to-date and adding over 12% in the past month alone. This run has pushed its latest share price to $85.35. Its total shareholder return stands out at nearly 36.5% over the past year and almost 80% over five years, hinting at solid growth potential and shifting risk perceptions as investors revisit the utility sector.

If you're looking for what's trending beyond the usual names, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

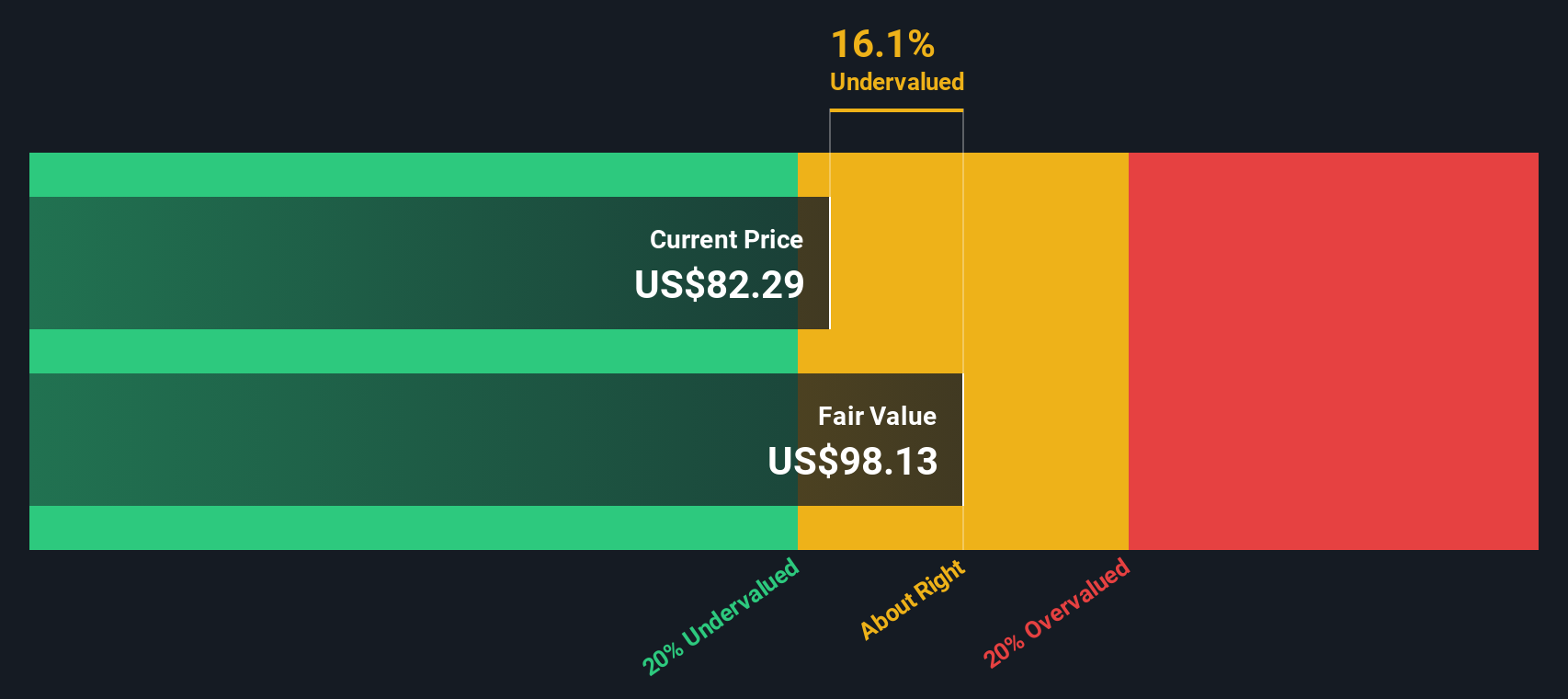

With Spire trading above some analyst targets but showing strong momentum, investors are asking whether the current valuation is stretching beyond fundamentals or if there is still a buying opportunity if future growth is not fully priced in.

Most Popular Narrative: 2% Overvalued

With Spire’s last close at $85.35, the consensus narrative sees fair value at $83.69, placing the stock slightly above what analysts believe is justified. This narrow gap frames an intriguing scenario, particularly as recent results point to both progress and new challenges for the company.

Significant and ongoing investments in infrastructure modernization and system resilience, supported by constructive regulatory frameworks and reliable cost recovery mechanisms, are growing Spire's regulated asset base. This could result in higher allowed returns and gradual increases in net income.

Curious why analysts think Spire deserves this aggressive fair value? The consensus is counting on an ambitious combination of sustained growth and strategic expansion to justify the premium. Want a glimpse at the key financial assumptions and sector shifts fueling this high-stakes price call? Read the full narrative for all the details.

Result: Fair Value of $83.69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if rapid electrification or stricter climate policies accelerate, Spire’s optimistic growth narrative could face unexpected headwinds and valuation pressure.

Find out about the key risks to this Spire narrative.

Another View: DCF Suggests Hidden Value

While market multiples currently have Spire looking pricey, our DCF model points in a different direction. The SWS DCF model values Spire at $98.57, which is 13.4% above its recent trading price. Could the crowd be underestimating Spire’s long-term earnings potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Spire for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Spire Narrative

If you see things differently or want to dig into the numbers yourself, crafting your own perspective takes just a few minutes. Do it your way

A great starting point for your Spire research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to one opportunity. Cutting-edge stocks, new megatrends, and untapped segments are just a click away. Take action now; smart moves start here.

- Tap into future tech and spot untapped potential with these 24 AI penny stocks driving artificial intelligence breakthroughs.

- Secure income streams by targeting these 18 dividend stocks with yields > 3% offering reliable yields over 3%, perfect for building a resilient portfolio.

- Ride the digital finance wave and power up your watchlist with these 79 cryptocurrency and blockchain stocks making ripples across global markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SR

Spire

Engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives