- United States

- /

- Gas Utilities

- /

- NYSE:SR

Assessing Spire (SR) Valuation Following $450 Million Junior Subordinated Note Issuance

Reviewed by Simply Wall St

Spire (SR) has completed a $450 million fixed income offering, issuing junior subordinated, unsecured notes with a variable rate. Moves like this can prompt investors to revisit the company’s capital position and outlook.

See our latest analysis for Spire.

Spire’s $450 million junior note issue comes at a time when momentum is clearly picking up for the stock. The 90-day share price return stands at 15.1%, and the year-to-date climb is 28.9%. That surge is reflected over the longer haul as well, with total shareholder returns reaching 25.7% over one year and nearly 68% over five. This hints at renewed optimism as investors digest both new financing moves and recent earnings trends.

If Spire’s recent capital raise has you interested in markets beyond utilities, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock surging and analyst targets just ahead, the question is whether Spire is trading at a compelling valuation or if the market has already recognized its growth potential, leaving investors little room for future upside.

Most Popular Narrative: 1.6% Undervalued

With Spire trading just below the most widely followed fair value estimate of $89.61, the narrative suggests room for incremental upside from current levels near $88.16. The market appears to be closely matching analyst expectations for growth and profitability, with only a modest discount remaining.

Significant and ongoing investments in infrastructure modernization and system resilience, supported by constructive regulatory frameworks and reliable cost recovery mechanisms, are growing Spire's regulated asset base. This may result in higher allowed returns and gradual increases in net income.

Curious why Spire's fair value edges past its current price? The answer hides in ambitious revenue expansion and projected margin performance that challenge sector norms. Which number tips the scale in this closely contested narrative? Click through to discover the surprising financial forecast behind the fair value calculation.

Result: Fair Value of $89.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, changing energy regulations or accelerating adoption of electric alternatives could reduce long-term demand for natural gas. This could challenge Spire’s growth outlook.

Find out about the key risks to this Spire narrative.

Another View: Looking at Price Ratios

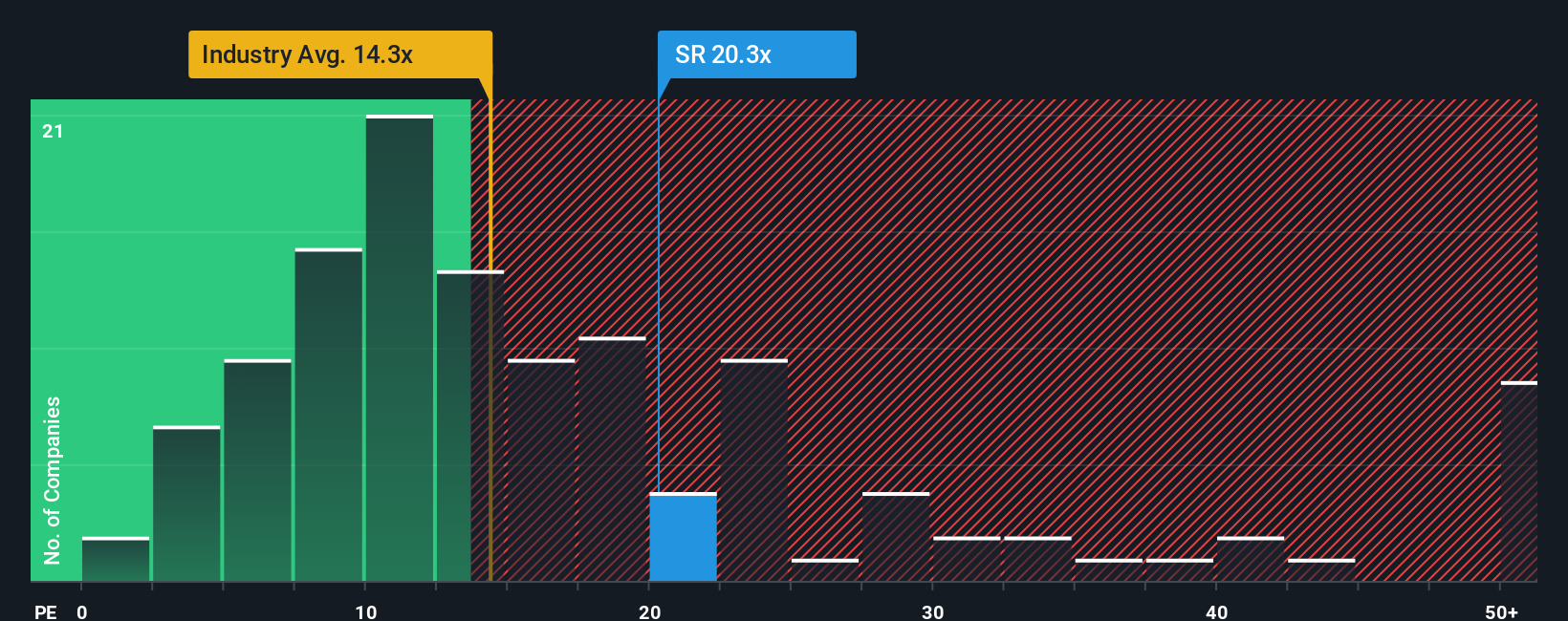

Switching perspective to market multiples, Spire’s price-to-earnings ratio stands at 20.3x. This is higher than both the US Gas Utilities industry average of 17.6x and its peer group average of 18.3x. It also runs above the fair ratio, which may indicate the stock commands a premium that could signal overvaluation. With numbers like these, is the market too optimistic, or is there a bigger story behind this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spire Narrative

If you see the story differently or want to dig into the numbers on your own, you can assemble your own view in just a few minutes. Do it your way

A great starting point for your Spire research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize the chance to uncover standout stocks and strategies with the Simply Wall Street Screener. Missing out could mean skipping the next winning trend, so why wait?

- Capitalize on emerging tech by scanning these 25 AI penny stocks, a tool packed with companies transforming industries through artificial intelligence and automation advances.

- Boost potential returns by evaluating these 15 dividend stocks with yields > 3%, which highlights companies that consistently offer attractive yields while maintaining strong financial health.

- Stay ahead with these 923 undervalued stocks based on cash flows, uncovering opportunities where market prices may not have fully reflected strong cash flow stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SR

Spire

Engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.