- United States

- /

- Gas Utilities

- /

- NYSE:SPH

Will Refinancing 2027 Notes With 2035 Debt Change Suburban Propane Partners' (SPH) Narrative?

Reviewed by Sasha Jovanovic

- Suburban Propane Partners, L.P. recently priced and completed a private offering of US$350,000,000 6.500% senior unsecured notes due December 15, 2035, with interest payable semi-annually under Rule 144A and Regulation S.

- The partnership plans to use the proceeds, alongside its revolving credit facility, to redeem its existing 5.875% senior notes due 2027, reshaping both the maturity profile and cost of its debt capital.

- We’ll now examine how refinancing the 2027 notes with new 2035 debt could influence Suburban Propane Partners’ investment narrative and risk profile.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Suburban Propane Partners Investment Narrative Recap

To own Suburban Propane Partners, you need to believe its core propane business and emerging renewable assets can keep generating enough cash to support distributions despite weather, policy and cost headwinds. The new US$350,000,000 senior notes slightly extend debt maturities but at a higher coupon, so they do not fundamentally change the near term earnings catalyst from RNG ramp up or the key risk around leverage and interest coverage.

The recent affirmation of the quarterly US$0.325 per unit distribution is particularly relevant here, because refinancing the 2027 notes with 2035 debt affects interest costs and, indirectly, future room to fund both distributions and growth projects. How comfortably Suburban Propane balances this fixed income burden against RNG investments and propane seasonality will shape whether that payout remains attractive relative to its risk profile.

Yet investors should be aware that higher interest costs and already elevated leverage could leave less flexibility if propane demand weakens or RNG credits stay under pressure...

Read the full narrative on Suburban Propane Partners (it's free!)

Suburban Propane Partners’ narrative projects $1.5 billion revenue and $132.3 million earnings by 2028.

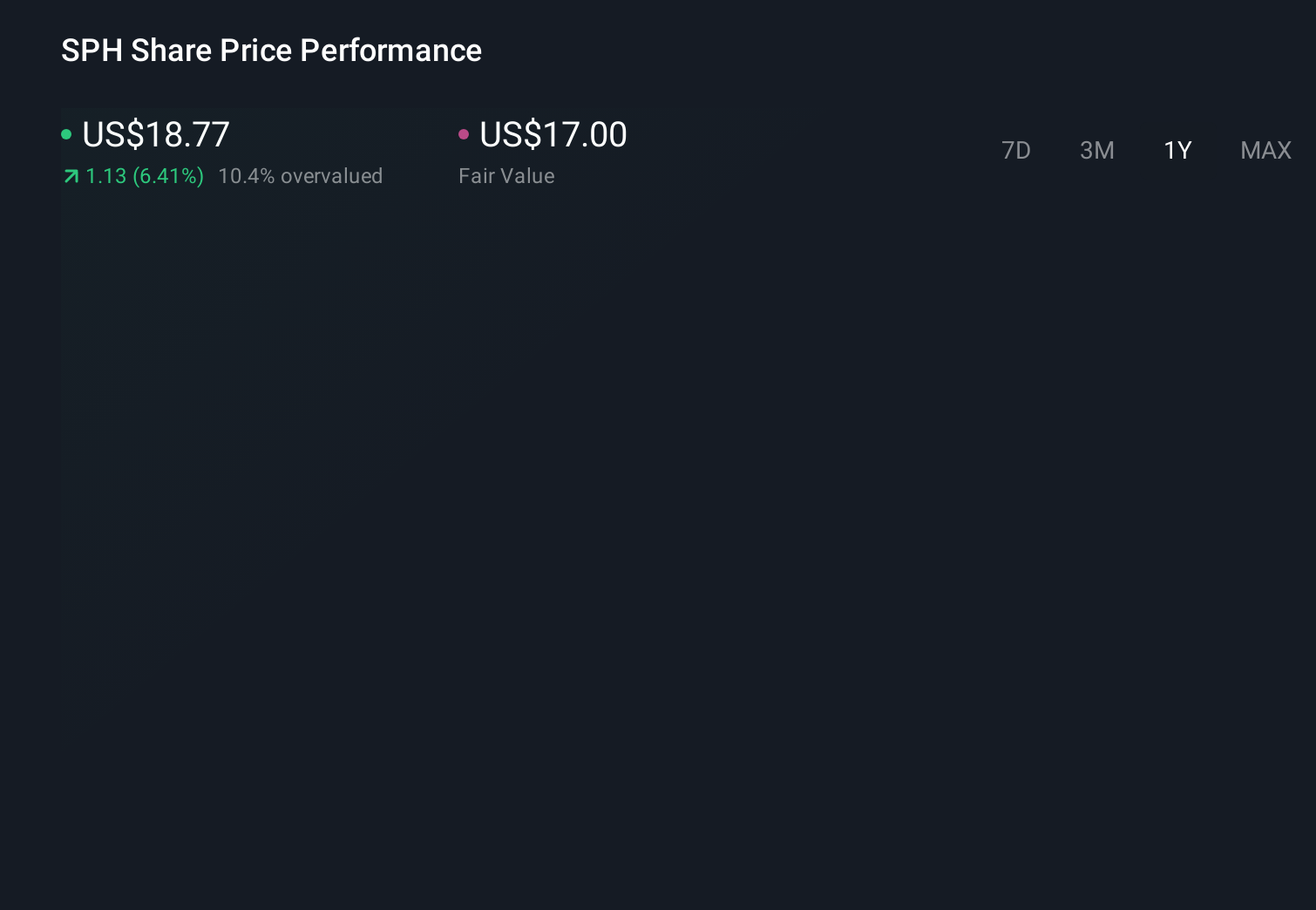

Uncover how Suburban Propane Partners' forecasts yield a $17.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community currently has 1 fair value estimate at US$17 per unit, underscoring how even a single view can differ from market pricing. You should weigh that against Suburban Propane Partners’ high leverage and interest coverage concerns, which may influence how comfortably it can manage this new 2035 debt and support long term performance.

Explore another fair value estimate on Suburban Propane Partners - why the stock might be worth 9% less than the current price!

Build Your Own Suburban Propane Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suburban Propane Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Suburban Propane Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suburban Propane Partners' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPH

Suburban Propane Partners

Through its subsidiaries, engages in the retail marketing and distribution of propane, renewable propane, renewable natural gas, fuel oil, and refined fuels in the United States.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion