- United States

- /

- Gas Utilities

- /

- NYSE:SPH

Suburban Propane Partners (SPH): Evaluating Valuation Following Strong Full-Year Earnings Growth

Reviewed by Simply Wall St

Suburban Propane Partners (SPH) has just released its full-year earnings, showing clear growth in both revenue and net income compared to last year. The company's results have definitely caught investors' attention.

See our latest analysis for Suburban Propane Partners.

Suburban Propane Partners' strong earnings have certainly drawn fresh interest, reflected in a steady 6.45% share price return year-to-date. While momentum has been modest in recent months, its 6.03% total shareholder return over the past year and an impressive 43% total return over three years highlight steadily compounding value for long-term holders.

If you’re curious about where else growth and ownership trends are converging, now is a good time to explore fast growing stocks with high insider ownership.

With such steady results and a strong track record, is Suburban Propane Partners still trading at a discount, or is the market already anticipating further growth? Could this be a rare buying window, or is all the upside priced in?

Most Popular Narrative: 10.6% Overvalued

Suburban Propane Partners’ last close of $18.81 sits slightly above the $17.00 fair value implied by the most widely followed narrative. This gap offers investors a clear view into what is driving current expectations. Now, let’s see what underpins these projections.

Expanding renewable natural gas (RNG) capacity through ongoing upgrades and new facilities in Columbus, Ohio and Upstate New York positions the company to access higher-growth, lower-carbon markets and capitalize on a shift in demand toward cleaner fuels, which is likely to support future revenue and margin growth once projects are operational.

Curious about the assumptions that fuel this price? The fair value calculation leans on bold future profit margins and a dramatic transformation in the company’s earnings mix. Discover which pivotal growth levers the narrative is counting on as Suburban Propane Partners moves into new markets and untested business lines.

Result: Fair Value of $17.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unpredictable propane demand and low renewable fuel credit prices could quickly derail Suburban Propane Partners’ positive earnings outlook.

Find out about the key risks to this Suburban Propane Partners narrative.

Another View: Market Ratios Tell a Different Story

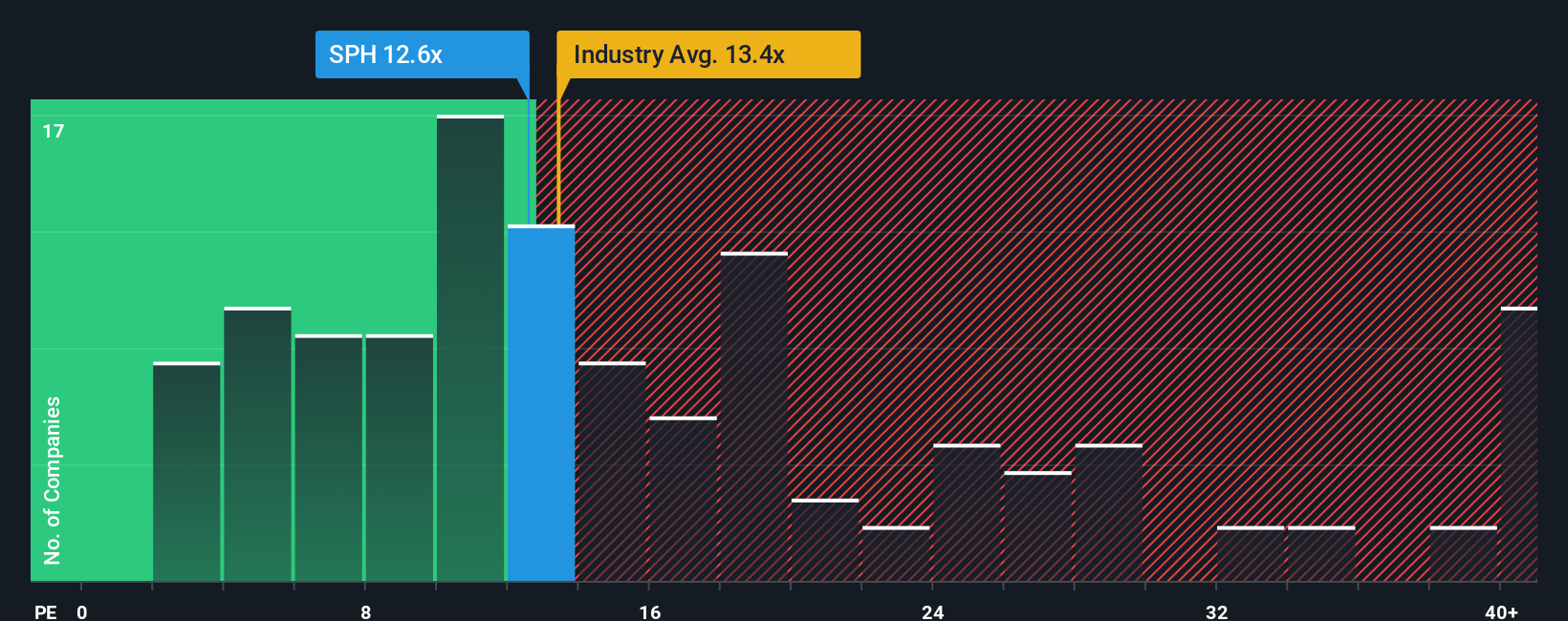

While analysts see Suburban Propane Partners as slightly overvalued, the market’s favored price-to-earnings ratio says something else. At 11.6x, it is much lower than both the global industry average (14.1x) and comparable peers (17.8x), and even sits well below the fair ratio of 16.5x. This considerable discount could signal opportunity for investors willing to look past prevailing fears, unless that gap is based on risks the market sees coming. Is the valuation gap a bargain or a trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Suburban Propane Partners Narrative

If you’re keen to dig into the numbers and craft a different story, you can easily build your own in just a few minutes. Do it your way.

A great starting point for your Suburban Propane Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity. Smarter, faster gains could be within reach. Sharpen your edge and be the investor who always spots the next big trend.

- Target tomorrow’s market leaders by browsing these 926 undervalued stocks based on cash flows, as their strong fundamentals suggest real upside.

- Catch the momentum of cutting-edge innovation by studying these 26 AI penny stocks that are shaping the next era of technology.

- Accelerate your passive income goals by evaluating these 15 dividend stocks with yields > 3%, which deliver reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPH

Suburban Propane Partners

Through its subsidiaries, engages in the retail marketing and distribution of propane, renewable propane, renewable natural gas, fuel oil, and refined fuels in the United States.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.