- United States

- /

- Electric Utilities

- /

- NYSE:SO

Southern (SO): Valuation Insights After $13 Billion Expansion and New Strategic Partnerships

Reviewed by Kshitija Bhandaru

If you’ve been watching Southern (SO) lately, you probably noticed the company’s recent announcement: it’s expanding its five-year capital plan by an impressive $13 billion, bringing the total up to $76 billion. That move is a clear response to surging electricity demand, driven heavily by hyperscale clients, new data centers, and growing tech infrastructure needs across the Southeastern U.S. For investors weighing their next moves, the big question is whether this rapid escalation in planned investment marks the start of a new growth era or reflects riskier, long-term bets on shifting energy consumption trends.

Southern’s shares are up nearly 8% over the past year and have gained 15% year-to-date, comfortably outpacing the broader market. The stock’s solid three-year return of 55% suggests that momentum has been building, not just from core utility operations, but also from moves like launching SouthernWaves, a strategic alliance for advanced fiber-optic networks, and bold energy storage and smart city initiatives. In other words, Southern’s approach has been to meet future demand head-on by stacking innovation on top of traditional strengths.

After such a decisive shift and run-up in share price, is Southern offering a real value opportunity for investors today, or are the markets already baking in all the growth Southern’s been working toward?

Most Popular Narrative: 2% Undervalued

According to the most widely followed narrative on Southern, the stock is trading slightly below its estimated fair value at current levels.

The expansion of large-scale electrification projects, including hyperscaler data centers and industrial developments, across Alabama, Georgia, and Mississippi is materially increasing Southern's load outlook. This has resulted in regulatory approvals and filings for up to 10 GW of new generation and $13 billion of incremental capital investment, which is driving long-term earnings and rate base growth.

Curious about why Southern's valuation looks resilient? The real story is hidden in forecasts of future growth, margin expansion, and a premium multiple that rivals the industry average. The narrative's bold projections suggest there is more than meets the eye in this electricity heavyweight's future.

Result: Fair Value of $96.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent inflation or unexpected regulatory shifts could undermine Southern’s ambitious projections and place pressure on near-term earnings momentum.

Find out about the key risks to this Southern narrative.Another View: Market-Based Valuation

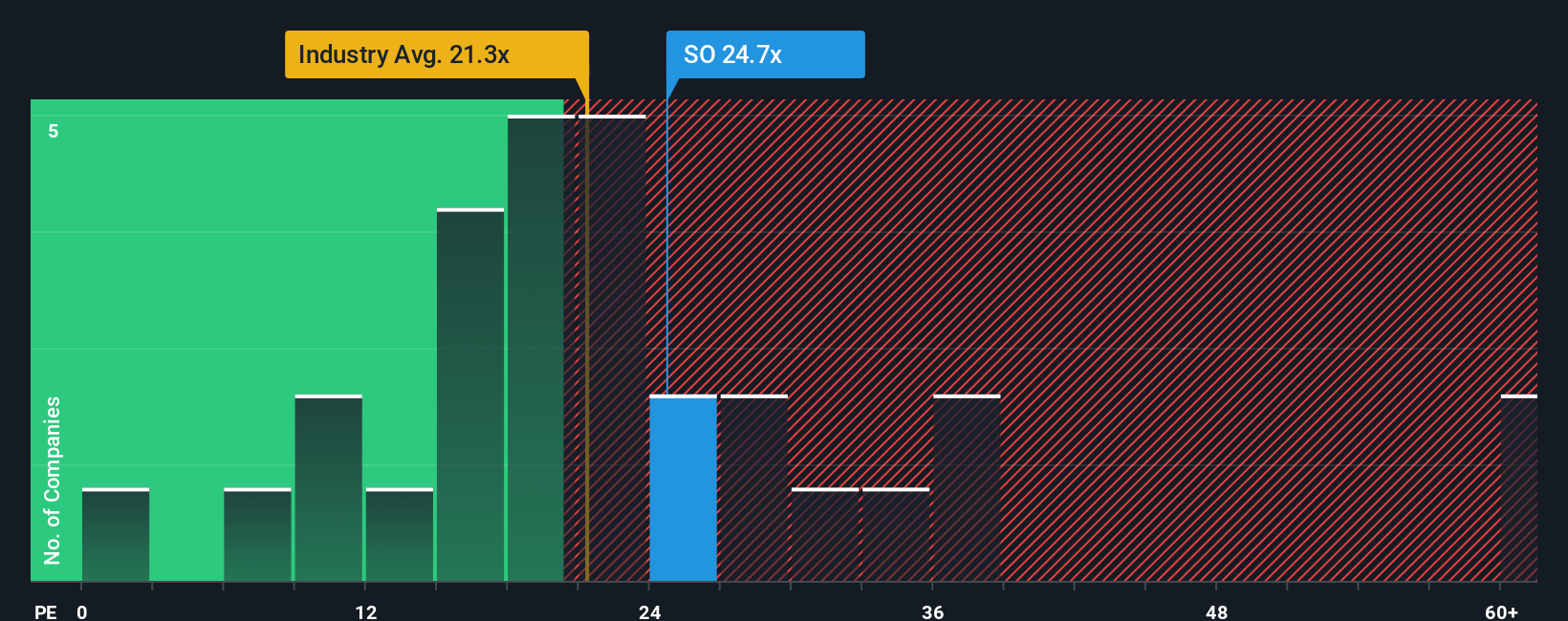

Taking a look from a different angle, Southern’s current market price appears expensive compared to the industry average using traditional earnings multiples. This raises some doubts about how much value remains for new investors. Could market optimism be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Southern to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Southern Narrative

If you’d rather dive into the numbers and shape your own perspective, you can piece together a fresh story for Southern in just a few minutes. Do it your way.

A great starting point for your Southern research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Run ahead of the market by tapping into unique stocks and fresh trends you may be overlooking with these timely ideas below.

- Target value with companies currently trading below their true worth using our shortcut to undervalued stocks based on cash flows.

- Capture high and steady cash flow by uncovering reliable income sources through dividend stocks with yields > 3%, which is ideal for building wealth over time.

- Gain an edge on tomorrow’s breakthroughs by searching for trailblazers in computing and innovation using quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SO

Southern

Through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives