- United States

- /

- Electric Utilities

- /

- NYSE:SO

Southern Company (SO) Valuation in Focus After Scotiabank Downgrade on Growth and Pricing Concerns

Reviewed by Kshitija Bhandaru

Scotiabank has downgraded Southern (SO) from Outperform to Sector Perform, citing the company’s high valuation and relatively slower earnings and dividend growth. This move has brought renewed attention to Southern’s overall growth outlook and investor positioning.

See our latest analysis for Southern.

Southern’s share price has shown steady resilience in 2025, with the latest close at $94.54 and long-term total shareholder returns comfortably outpacing short-term moves. Recent leadership announcements and participation in industry events add to the mix, but the modest 1-year total shareholder return suggests momentum is steady rather than accelerating as investors digest slower growth signals against a premium valuation.

If you’re weighing your next move, this could be an ideal moment to broaden your focus and discover fast growing stocks with high insider ownership.

With a valuation close to analyst targets and steady long-term returns, is Southern now offering hidden value to patient investors or is the market already factoring in every bit of future growth potential?

Most Popular Narrative: 2.3% Undervalued

Southern's current share price is narrowly trailing the most influential fair value estimate, hinting that investors may be overlooking several major business catalysts and future growth levers that support this valuation.

The expansion of large-scale electrification projects, including hyperscaler data centers and industrial developments across Alabama, Georgia, and Mississippi, is materially increasing Southern's load outlook. This is resulting in regulatory approvals and filings for up to 10 GW of new generation and $13 billion of incremental capital investment, driving long-term earnings and rate base growth.

Curious about the assumptions driving this pricing power? One critical factor revolves around how demand surges from industry transformation are channeled into Southern's long-term earnings and growth targets. But that is just the start. Hidden inside the narrative are numbers that could change your view on the company’s next chapter.

Result: Fair Value of $96.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher capital costs or uncertain long-term demand could disrupt projected growth and result in lower earnings than analysts currently expect.

Find out about the key risks to this Southern narrative.

Another View: Market Multiples Tell a Different Story

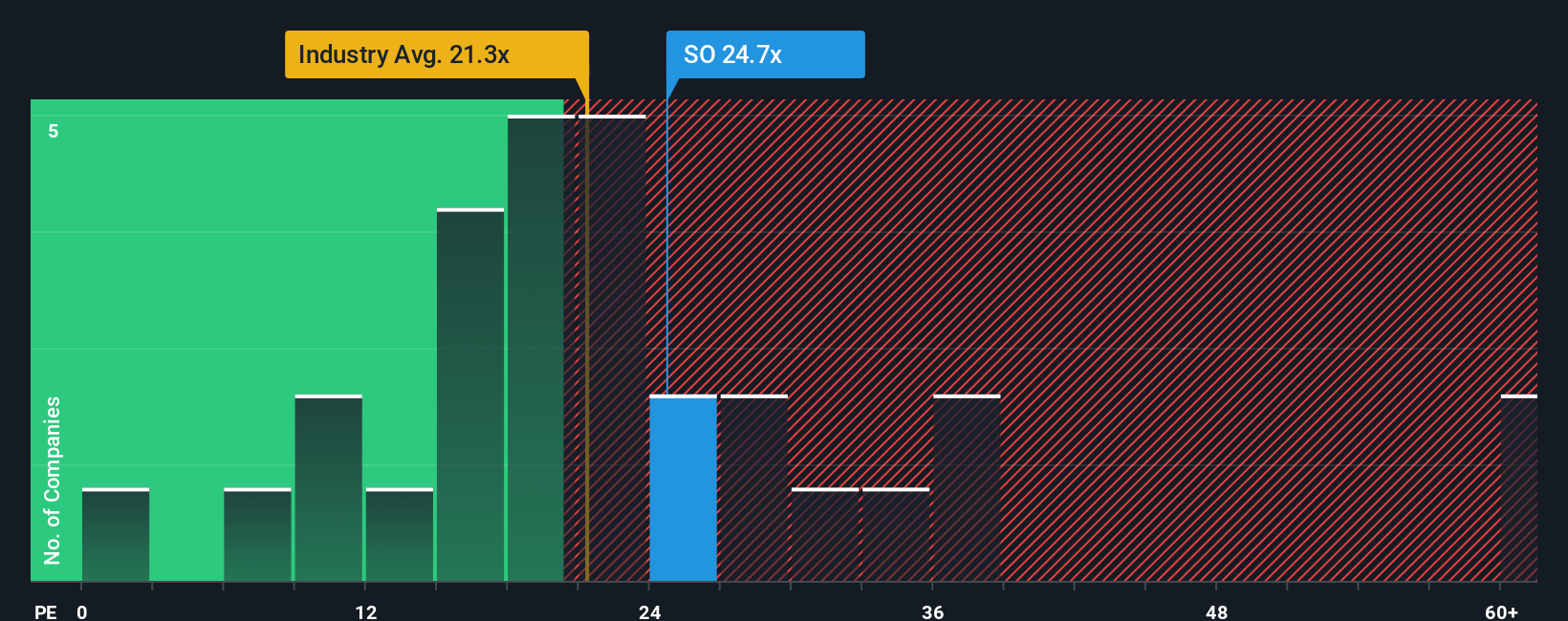

Looking at Southern’s price-to-earnings ratio, the stock stands at 24.3x, which is above both the US Electric Utilities industry average of 21.1x and its own fair ratio of 22.9x. This suggests investors are paying a premium for Southern compared to industry peers and where the market could shift. Does this premium reflect justified confidence, or could it signal limited near-term upside if growth does not meet expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southern Narrative

If you see the numbers differently or want to follow your own path, you can build your own Southern narrative and insights in just a few minutes with Do it your way.

A great starting point for your Southern research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Upgrade your watchlist with other smart picks using our top investment shortlists. Miss this, and you could miss your next outperformer.

- Jump on fast-growing trends by scanning these 24 AI penny stocks, which power innovation through artificial intelligence, automation, and advanced business models.

- Capture reliable income streams with these 19 dividend stocks with yields > 3%, featuring companies that consistently reward shareholders with strong dividend yields.

- Boost your portfolio’s future potential by exploring these 26 quantum computing stocks, which highlights breakthroughs in quantum computing and transformational technology applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SO

Southern

Through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives