- United States

- /

- Electric Utilities

- /

- NYSE:PPL

A Look at PPL's Valuation Following Kentucky Regulatory Deal and $235M Revenue Hike Approval

Reviewed by Simply Wall St

PPL (PPL) has secured an agreement with the Kentucky Public Service Commission that includes a $235 million annual revenue increase, updated return on equity, and new cost recovery mechanisms. The deal supports crucial infrastructure upgrades and sets clear earnings expectations for investors.

See our latest analysis for PPL.

PPL’s regulatory breakthrough comes as momentum builds behind the stock, with a 17.06% year-to-date share price return and a striking 18.96% total shareholder return over the past year. A three-year total return above 60% highlights how sustained infrastructure investments and strategic agreements continue to power investor confidence.

Curious what else could be fueling market momentum right now? This could be the perfect opportunity to broaden your horizons and discover fast growing stocks with high insider ownership

But with shares trading just below analyst targets and a robust three-year return, is PPL still undervalued? Or has the market already accounted for these future gains, leaving little room for a new buying opportunity?

Most Popular Narrative: 2% Undervalued

PPL’s last close at $37.67 sits just below the most widely followed narrative’s fair value of $38.54, hinting at modest upside. The difference reflects ongoing optimism about PPL’s infrastructure investments and market positioning, setting the stage for a growth-focused bull thesis.

Major planned grid infrastructure upgrades and generation capacity expansions, totaling $20B through 2028 (with upside from potential data center-driven transmission and new generation projects), set the stage for nearly 10% average annual rate base growth. This directly supports higher regulated revenues and future earnings.

Curious what bold future assumptions are driving this target? The secret sauce: huge capital plans, ambitious growth in the customer base, and forward-looking profit margins. Can these projections really hold up? Uncover the numbers and see why this narrative is getting attention.

Result: Fair Value of $38.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory setbacks or overestimated demand from data centers could quickly shift the outlook and challenge PPL’s projected earnings growth.

Find out about the key risks to this PPL narrative.

Another View: What Do the Market Multiples Say?

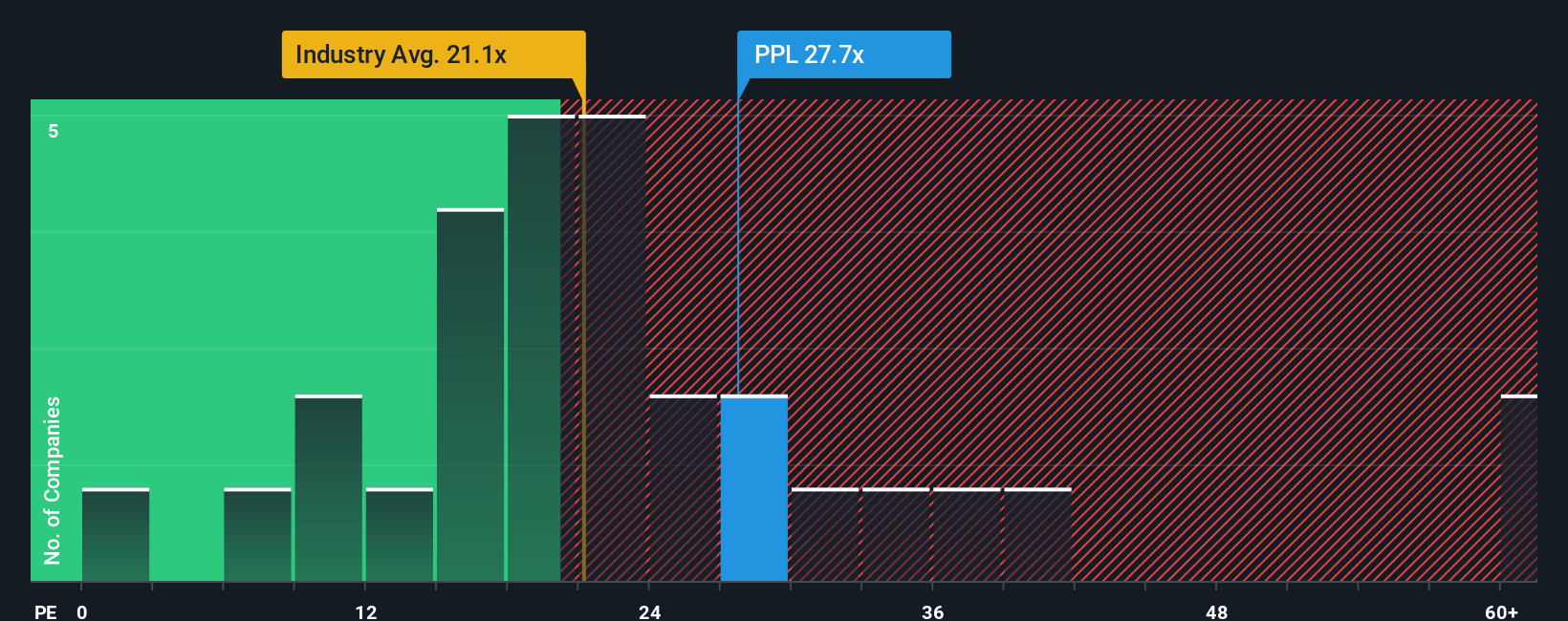

Looking through the lens of price-to-earnings, PPL’s ratio stands at 28.3x, notably higher than both the US Electric Utilities industry average (21.3x) and its peer average (19.1x). Even compared to its fair ratio of 23.8x, PPL appears more expensive than typical benchmarks, which raises questions about potential valuation risk if the market's optimism fades. Does this premium reflect sustainable growth, or could it signal a pullback ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PPL Narrative

If you have a different angle or want to dig into the details yourself, you can easily craft your own view in just a few minutes, so why not Do it your way

A great starting point for your PPL research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't stop at PPL when so many other standout opportunities could boost your returns. Tap into these powerful themes; opportunities like this won't wait for you.

- Unleash the power of breakthrough medical technology by checking out these 33 healthcare AI stocks, featuring the innovators transforming health care with advanced artificial intelligence.

- Spot undervalued front-runners and position yourself ahead of the crowd through these 875 undervalued stocks based on cash flows, where strong fundamentals meet attractive price points.

- Capture income and potential long-term stability: review these 17 dividend stocks with yields > 3% for companies offering yields above 3% to steady your portfolio with regular payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPL

PPL

Provides electricity and natural gas to approximately 3.5 million customers in the United States.

Solid track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives