- United States

- /

- Electric Utilities

- /

- NYSE:POR

Portland General Electric (POR): Valuation Snapshot After Major Battery Storage and Clean Energy Expansion

Reviewed by Kshitija Bhandaru

Portland General Electric (NYSE:POR) just brought substantial battery storage assets online and outlined plans for billions in clean energy investment. This comes as growing data center demand pushes the utility to expand capacity and boost reliability.

See our latest analysis for Portland General Electric.

Portland General Electric’s major clean energy investments and new battery storage systems arrive as the company posts robust quarterly earnings and maintains its growth outlook, all while data center demand accelerates. While the 1-year total shareholder return is essentially flat, its three- and five-year total shareholder returns of 18% and 41% respectively suggest the long-term story is one of steady progress and building momentum.

If you’re tracking companies leading on sustainability and grid innovation, this is a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares trading near analyst targets and long-term returns trending higher, is Portland General Electric now undervalued in light of its growth trajectory, or has the market already factored in its future potential?

Most Popular Narrative: 5.7% Undervalued

With Portland General Electric's fair value estimate sitting a little above the last close, the market seems closely aligned. Still, the most popular narrative sees a bit more room ahead. There is a compelling logic behind this number, anchored by future earnings power and regulatory tailwinds.

Constructive regulatory progress, including the passage of the POWER Act and the FAIR Energy Act, implements multiyear ratemaking, flexible cost allocation, and contemporary cost recovery mechanisms. This increases earnings predictability and reduces the regulatory lag, directly benefiting net margins and earnings stability.

Curious how these legislative shifts could reshape profits? The detailed narrative unpacks the drivers that market watchers are betting on, hinting at a transformation in Portland General’s earnings capacity. Find out what bold financial assumptions fuel this just-above-market price call. The answer may surprise you.

Result: Fair Value of $46.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid growth in rooftop solar and batteries, or pressures to keep rates low, could challenge Portland General Electric's revenue and margin expansion.

Find out about the key risks to this Portland General Electric narrative.

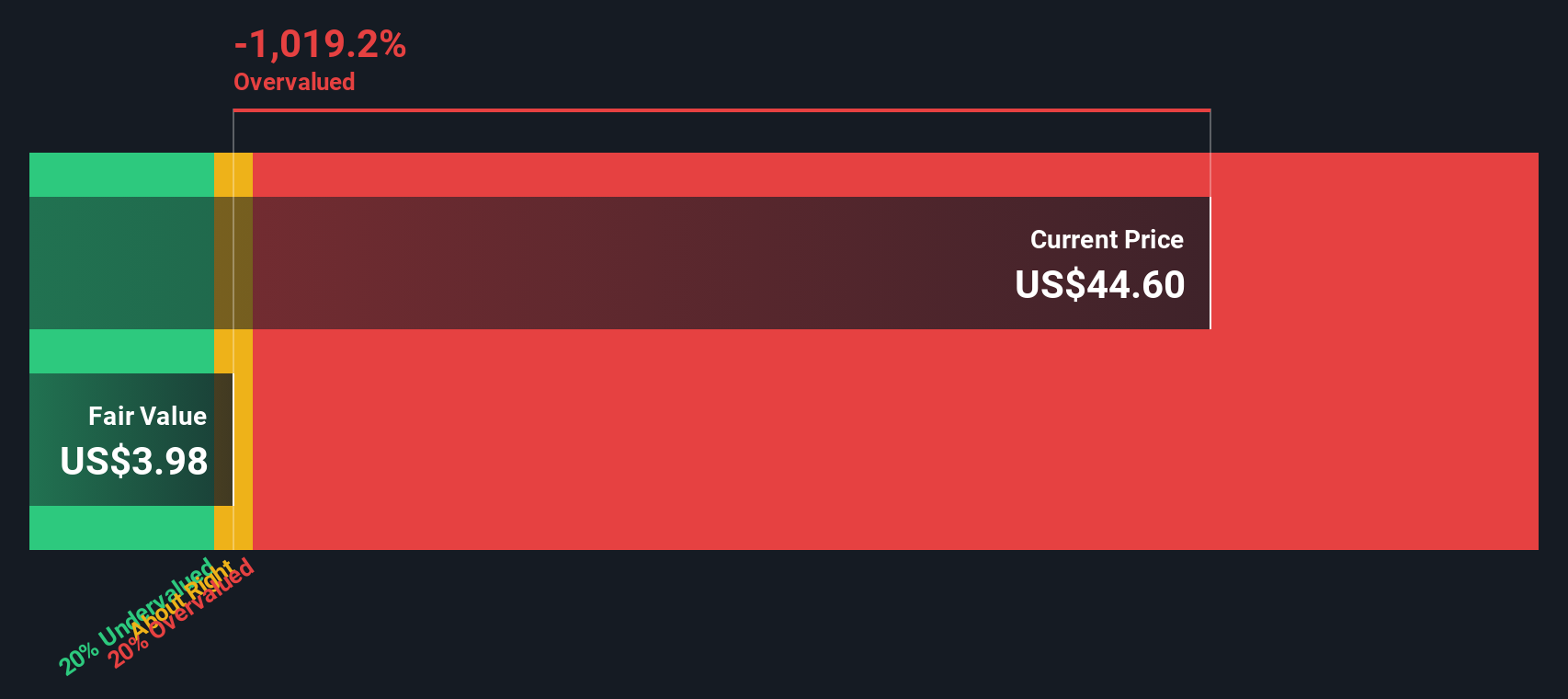

Another View: SWS DCF Model Estimates Overvaluation

While the analyst consensus calls Portland General Electric slightly undervalued, our DCF model takes a far more conservative stance. It estimates the current share price is above our calculated fair value, which hints at increased downside risk from today's valuation. Should investors trust analyst optimism, or is caution the smarter call?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Portland General Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Portland General Electric Narrative

If you see things differently or want to dig deeper into the numbers yourself, it’s easy to craft your own view in just minutes, and Do it your way.

A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop now. Expand your watchlist with stocks tapped for growth and disruption. Take just a minute to check these out before the next market move surprises you.

- Tap into future-shaping AI by uncovering these 25 AI penny stocks poised to benefit as artificial intelligence transforms every industry.

- Boost your passive income with these 19 dividend stocks with yields > 3% offering stable yields above 3 percent, so you don’t miss out on regular returns.

- Catch the wave of blockchain innovation with these 78 cryptocurrency and blockchain stocks leading secure payment revolutions and decentralized finance solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives