- United States

- /

- Electric Utilities

- /

- NYSE:PNW

Pinnacle West Capital (NYSE:PNW) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Pinnacle West Capital Corporation (NYSE:PNW) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Pinnacle West Capital

What Is Pinnacle West Capital's Debt?

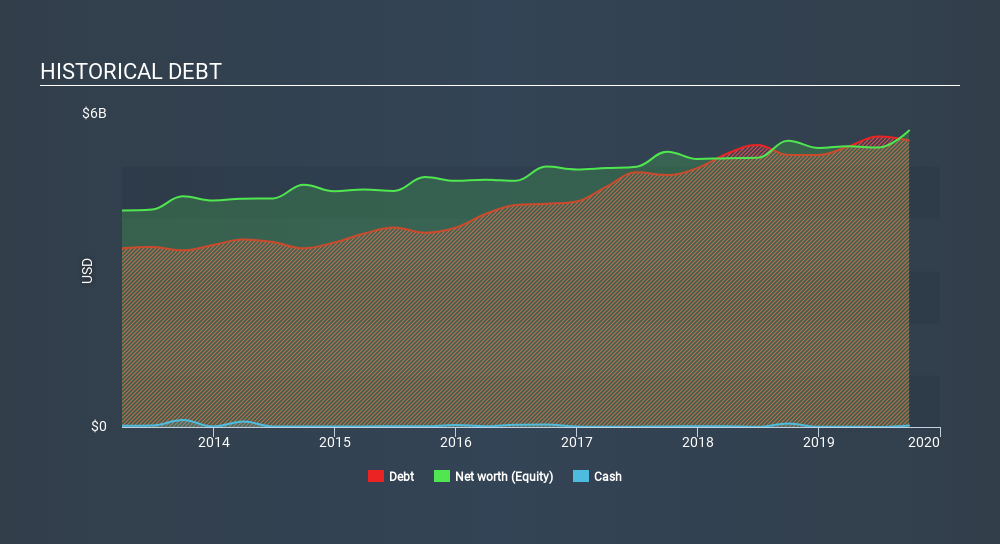

You can click the graphic below for the historical numbers, but it shows that as of September 2019 Pinnacle West Capital had US$5.49b of debt, an increase on US$5.2k, over one year. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Pinnacle West Capital's Balance Sheet?

According to the last reported balance sheet, Pinnacle West Capital had liabilities of US$1.59b due within 12 months, and liabilities of US$11.1b due beyond 12 months. Offsetting this, it had US$29.9m in cash and US$524.6m in receivables that were due within 12 months. So its liabilities total US$12.1b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's massive market capitalization of US$10.5b, we think shareholders really should watch Pinnacle West Capital's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Pinnacle West Capital's debt is 3.9 times its EBITDA, and its EBIT cover its interest expense 3.3 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. More concerning, Pinnacle West Capital saw its EBIT drop by 9.4% in the last twelve months. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Pinnacle West Capital's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Pinnacle West Capital recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

On the face of it, Pinnacle West Capital's level of total liabilities left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its net debt to EBITDA also fails to instill confidence. It's also worth noting that Pinnacle West Capital is in the Electric Utilities industry, which is often considered to be quite defensive. Overall, it seems to us that Pinnacle West Capital's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Pinnacle West Capital , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:PNW

Pinnacle West Capital

Through its subsidiary, provides retail and wholesale electric services primarily in the state of Arizona.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives