- United States

- /

- Electric Utilities

- /

- NYSE:PNW

Did Delayed Regulatory Benefits and Weaker Results Just Shift Pinnacle West Capital's (PNW) Investment Narrative?

Reviewed by Simply Wall St

- Mizuho recently downgraded Pinnacle West Capital's rating, citing regulatory lag that is expected to delay meaningful earnings impact for several years.

- Cooler weather contributed to lower second-quarter results year over year, with downward earnings estimate revisions putting further pressure on investor sentiment.

- We’ll explore how Mizuho’s concerns about delayed regulatory benefits shift the outlook for Pinnacle West’s investment thesis.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Pinnacle West Capital Investment Narrative Recap

To be a shareholder in Pinnacle West Capital, you need confidence in Arizona's long-term population and economic growth supporting demand, balanced against the company's ability to secure timely regulatory relief for its large-scale capital investments. The latest downgrade from Mizuho reinforces that regulatory delays remain the primary short-term risk, with no material near-term catalyst likely until late 2026; this largely maintains the risk profile already understood by many stakeholders.

The company recently reaffirmed its 2025 earnings guidance of US$4.40 to US$4.60 per diluted share on a weather-normalized basis, even as Q2 results reflected weather-driven revenue softness. This announcement is directly relevant, as it shows Pinnacle West actively communicating operational stability despite current pressures on earnings, signaling an ongoing focus on cost control and transparency until regulatory matters shift the outlook.

But even with these public reassurances, investors should also weigh the risk that...

Read the full narrative on Pinnacle West Capital (it's free!)

Pinnacle West Capital is projected to reach $6.1 billion in revenue and $791.6 million in earnings by 2028. This outlook assumes a 5.1% annual revenue growth rate and a $215.5 million increase in earnings from the current $576.1 million.

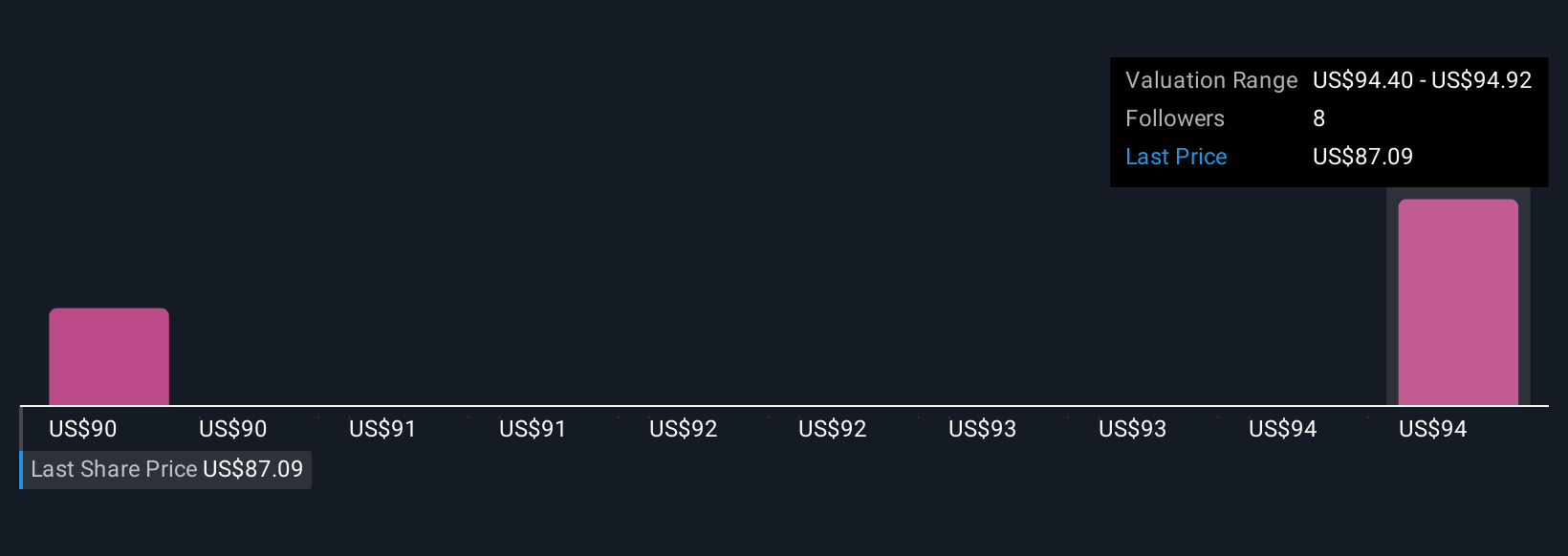

Uncover how Pinnacle West Capital's forecasts yield a $94.92 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members published two independent fair value estimates, ranging from US$89.72 to US$94.92 per share. While investor opinions vary, keep in mind that regulatory lag and delayed rate relief could shape the company's earnings path for years and are top of mind for many participants.

Explore 2 other fair value estimates on Pinnacle West Capital - why the stock might be worth just $89.72!

Build Your Own Pinnacle West Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pinnacle West Capital research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pinnacle West Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pinnacle West Capital's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNW

Pinnacle West Capital

Through its subsidiary, provides retail and wholesale electric services primarily in the state of Arizona.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives