- United States

- /

- Other Utilities

- /

- NYSE:PEG

A Look at Public Service Enterprise Group’s Valuation After Strong Q3 Results and Customer Satisfaction Wins

Reviewed by Simply Wall St

Public Service Enterprise Group (PEG) posted higher sales and net income for the third quarter compared to last year, which has drawn attention from investors. The company also earned fresh recognition for customer satisfaction, adding to the upbeat momentum.

See our latest analysis for Public Service Enterprise Group.

This stretch of upbeat news comes on the heels of a solid multi-year run for Public Service Enterprise Group, even though recent share price moves have been a bit subdued. Despite a 1-year total shareholder return of -4.0%, PEG’s robust three- and five-year total returns, at 59% and 68% respectively, highlight its long-term momentum and ability to reward patient investors. The market’s recent signals suggest optimism is holding, especially as the company wins recognition for steady execution and regulatory savvy.

If you’re weighing where stable returns and momentum could take you next, it’s worth broadening your search and discovering fast growing stocks with high insider ownership

With upbeat earnings, positive analyst commentary, and customer satisfaction accolades all stacking up, investors may wonder whether there is still a bargain to be found or if the company's future growth is already fully reflected in the stock price.

Most Popular Narrative: 8.6% Undervalued

Public Service Enterprise Group’s fair value, according to the consensus narrative, is estimated at $90.61, about 8.6% above the latest close. The narrative builds on long-term growth prospects and high capital investment, with big assumptions about future earnings that drive the higher target.

Sustained and increasing levels of utility capital investment ($3.8B in 2025; $21 to $24B through 2029) focused on grid modernization, infrastructure resilience, and clean energy programs position PSEG to capture value from regulatory-approved rate increases and expand its regulated asset base, driving future earnings and net margin growth.

Want to understand what’s powering this valuation? The numbers behind this target rest on future revenue growth, margin expansion, and a bold earnings target. Click in to unravel the story; there may be surprises hiding in those forecasts.

Result: Fair Value of $90.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains around whether data center demand will actually convert to new customers, and regulatory hurdles in New Jersey could also impact long-term growth.

Find out about the key risks to this Public Service Enterprise Group narrative.

Another View: A Look Through the Earnings Lens

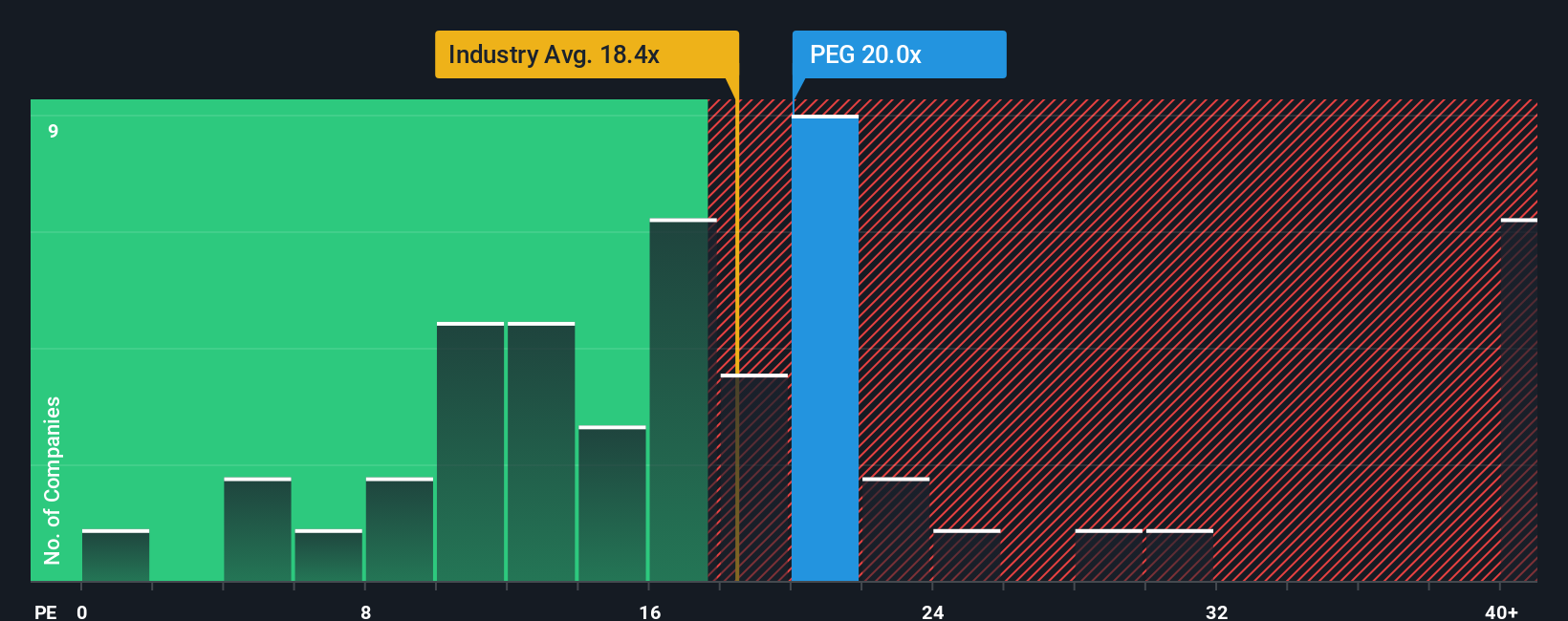

Stepping away from analyst forecasts, PEG's current price-to-earnings ratio of 19.9x is actually below the peer average of 21.1x and beneath its fair ratio of 21x. Yet, it remains slightly pricier than the broader global industry at 18.1x, reflecting both local optimism and a modest premium risk. This suggests investors see room for stable value but leaves little cushion if expectations falter. Could the real opportunity be in the gaps between these benchmarks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Public Service Enterprise Group Narrative

If you want to question these forecasts or dig deeper on your own, it only takes a few minutes to explore the numbers and craft your own story. Do it your way

A great starting point for your Public Service Enterprise Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step into fresh opportunities beyond PEG and stay ahead with Simply Wall Street’s screeners curated for smart investors. Don’t let the next big winner pass you by. Start your search right now:

- Access reliable income by checking out these 16 dividend stocks with yields > 3% for companies boasting robust yields above 3% and the financial strength to sustain them.

- Seize cutting-edge advances in machine learning by selecting these 25 AI penny stocks, where you’ll find emerging leaders set to transform industries with artificial intelligence.

- Benefit from discounted prices and strong balance sheets when you review these 879 undervalued stocks based on cash flows, revealing undervalued stocks ripe for smart portfolio growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEG

Public Service Enterprise Group

Through its subsidiaries, operates in electric and gas utility, and nuclear generation businesses in the United States.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives