- United States

- /

- Electric Utilities

- /

- NYSE:PCG

PG&E (PCG): Assessing Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

PG&E (PCG) shares have shown resilience over the past month, gaining more than 12%. Its longer-term performance is recovering after a challenging year. Investors are watching to see if these recent gains can continue.

See our latest analysis for PG&E.

PG&E’s recent momentum, with a 1-month share price return of 12.3% and 22% over the past 90 days, suggests that investor sentiment is shifting after last year’s poor showing. Despite the longer-term 1-year total shareholder return still down 18%, the multi-year trend has been strong, with a 70% five-year total return. This indicates potential for renewed optimism if positive developments continue.

If you’re curious where else the action is, this could be a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding and analysts setting a price target above current levels, the key question is whether PG&E is truly undervalued or if the market has already factored in its prospects. This could leave limited upside for buyers.

Most Popular Narrative: 19.1% Undervalued

PG&E's most widely followed narrative sees the fair value sitting well above the latest close. This reflects confidence in its operational turnaround and a supportive regulatory environment. Analyst consensus indicates that the stock is trading at one of its largest discounts in recent years, raising expectations for a potential re-rating.

Expanding opportunities for capital investment in grid modernization, wildfire mitigation, and resilience, fueled by both regulatory mandates and the need to serve new electrification and decarbonization requirements, position PG&E to grow its rate base and regulated earnings steadily over the next decade.

Why are analysts betting so heavily on the rebound? The numbers behind this valuation hint at a leap in future profitability, margin expansion, and aggressive infrastructure growth. Want to know what ambitious forecasts and powerful financial levers drive this narrative’s higher price target? Unlock the full story inside the detailed narrative.

Result: Fair Value of $20.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and the continuing threat of California wildfires still have the potential to undermine PG&E’s recovery outlook.

Find out about the key risks to this PG&E narrative.

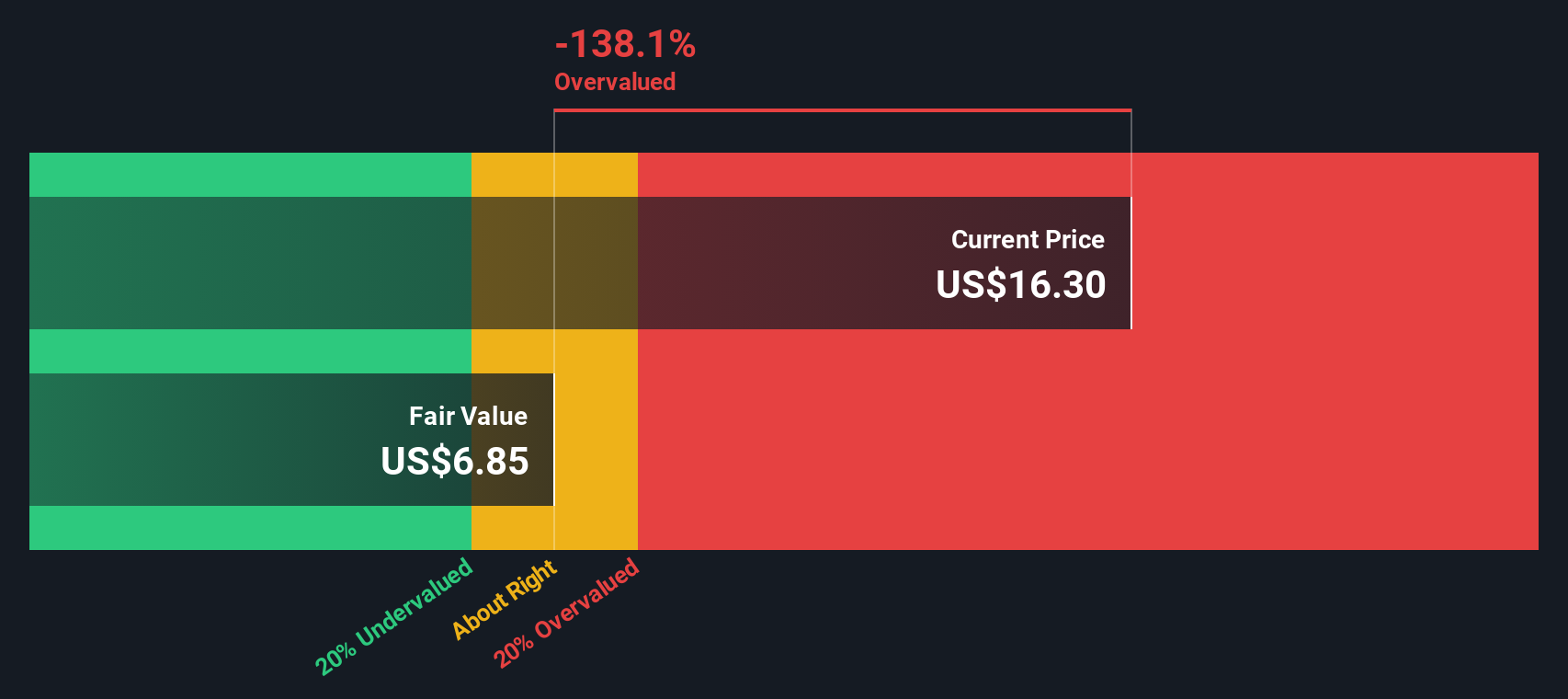

Another View: Discounted Cash Flow Model

While analyst-driven multiples suggest PG&E is undervalued, our DCF model presents a much more cautious outlook. According to this approach, the fair value estimate is significantly lower than the current price. This implies the market may be overestimating future growth or underestimating potential risks. Which perspective offers more insight for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PG&E for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PG&E Narrative

If you see things differently or want to examine the numbers from your own perspective, you can easily create your own narrative in just a few minutes with Do it your way.

A great starting point for your PG&E research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't sit on the sidelines while other investors seize promising opportunities. The Simply Wall Street Screener makes it easy to find stocks matching your goals right now.

- Generate income and secure attractive yields by targeting these 17 dividend stocks with yields > 3% with strong dividends above 3%.

- Unleash growth potential by targeting these 24 AI penny stocks at the forefront of artificial intelligence innovation.

- Position yourself ahead of the curve by uncovering these 79 cryptocurrency and blockchain stocks transforming the future of finance and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with very low risk.

Similar Companies

Market Insights

Community Narratives