- United States

- /

- Electric Utilities

- /

- NYSE:PCG

PG&E (PCG): $609M One-Off Loss Undermines Margin Narrative Despite Earnings Growth

Reviewed by Simply Wall St

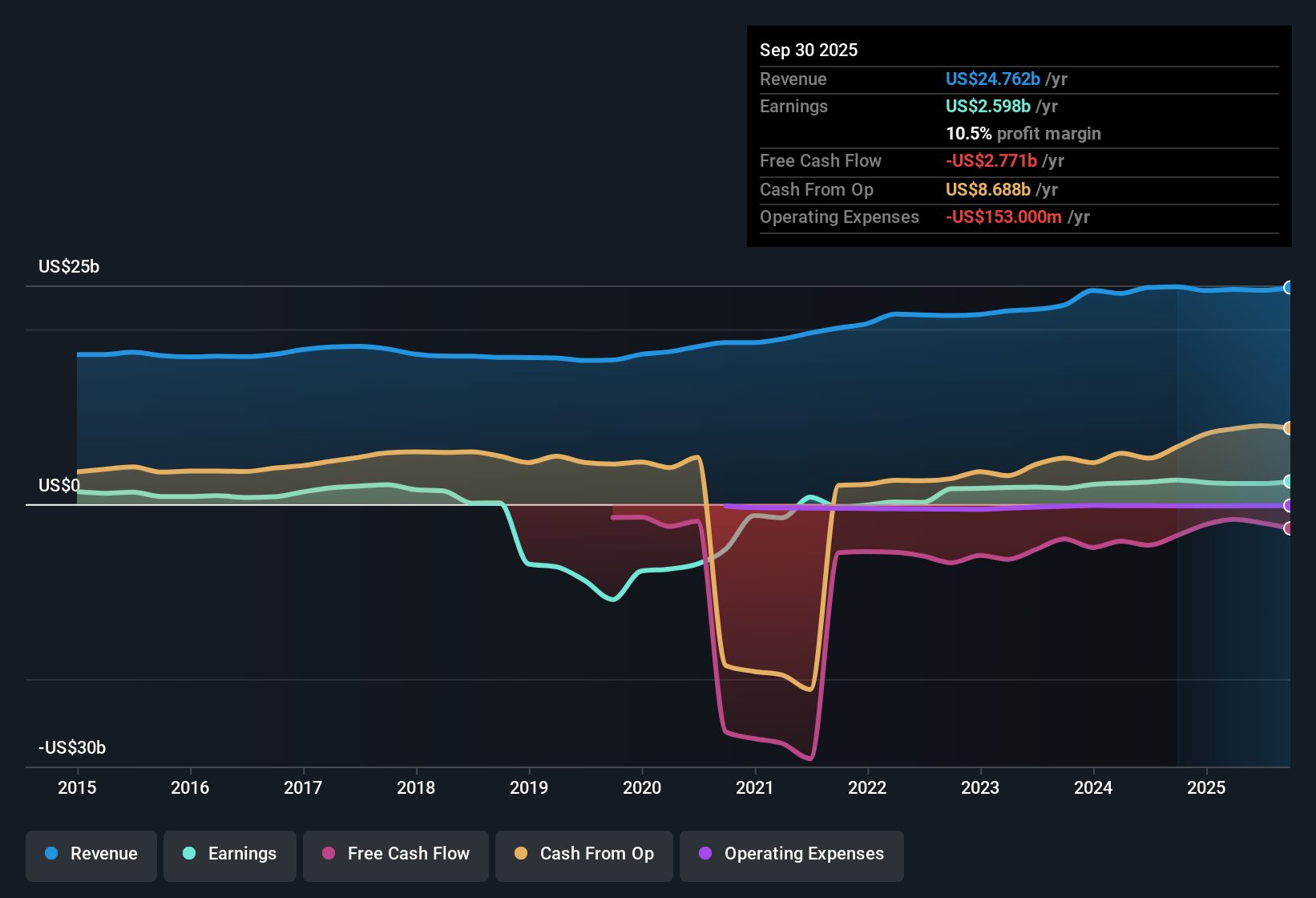

PG&E (PCG) reported modest revenue growth of 3.1% per year and an annual earnings growth rate of 9.73%, both of which trail the broader US market averages. Net profit margins came in at 9.6%, down from 10.2% last year, as a significant one-off loss of $609.0 million weighed on results. Despite these mixed figures, investors may focus on PG&E’s lower price-to-earnings ratios compared to peers and the potential for positive sentiment if growth trends continue. At the same time, concerns remain about margins and the quality of earnings.

See our full analysis for PG&E.Next, we will see how these headline results stand up when we put them side by side with the key narratives investors are watching right now.

See what the community is saying about PG&E

Margin Expansion on the Horizon

- Analysts predict net profit margins will climb from 9.6% today to 14.4% within three years, reflecting expectations for operational efficiencies and cost controls to steadily strengthen profitability.

- Consensus narrative notes that ongoing reductions in non-fuel operating expenses, targeting annual O&M savings above $200 million and over 2% a year, are expected to widen margins. However, persistent wildfire risk mitigation costs and regulatory challenges could limit the pace of improvement.

- While efficiency gains favor the bullish case for improving margins, the need for heavy spending on grid resilience and disaster prevention creates tension and leaves less room for error if costs rise faster than forecast.

- Consensus sees margin growth as achievable, yet emphasizes that execution risks remain elevated due to unpredictable external events and regulatory shifts.

- For a balanced look at how these moving pieces fit into PG&E's broader outlook, see the full consensus perspective: 📊 Read the full PG&E Consensus Narrative.

Wildfire Liability Still Looms Large

- A recent one-off loss of $609.0 million highlights the persistent financial drag from wildfire claims, insurance premiums, and disaster-related expenses.

- Bears argue these ongoing liability risks could sharply increase funding costs, inject earnings volatility, and dampen any margin gains over the next several years.

- Bears highlight how legislative uncertainty, such as potential changes to wildfire funds or mandated insurer contributions, creates potential for surprise expenses that overshadow operational wins.

- The sharp decrease in profit margin from 10.2% to 9.6% year-over-year is seen by critics as early evidence that wildfire costs are not yet contained.

Valuation Gap Versus Industry Peers

- PG&E’s price-to-earnings ratio stands at 14.0x, well below the US Electric Utilities industry average of 19.9x, and shares trade at $16.30, nearly 22% below the current analyst target price of $20.89.

- According to the consensus narrative, this discount could attract investors focused on long-term recovery and capital deployment. However, the lower valuation properly reflects both slower forecasted growth and significant unresolved risks.

- Consensus notes that while industry-level catalysts such as tech-driven electricity demand and grid modernization offer a path to recovery, execution stumbles or adverse regulatory moves could leave the gap justified or even widen further.

- The market’s hesitation stems as much from PG&E’s historical volatility as from its future outlook, keeping shares attractively priced for optimists but possibly value-trapped without clearer progress on the risk front.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PG&E on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Share your perspective and shape the story in just a few minutes. Do it your way

A great starting point for your PG&E research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

PG&E's progress is overshadowed by lingering wildfire liabilities, regulatory uncertainty, and downward pressure on profit margins. These factors make consistent growth elusive.

If you want to focus on reliable performers with steadier expansion and less headline risk, check out companies showing proven track records of consistent results through cycles with stable growth stocks screener (2091 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with very low risk.

Similar Companies

Market Insights

Community Narratives