- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Is Siemens Energy’s Deal Accelerating Oklo's Path to Nuclear-Powered Data Centers (OKLO)?

Reviewed by Sasha Jovanovic

- In November 2025, Siemens Energy announced it signed a binding contract to engineer and deliver the power conversion system for Oklo's Aurora powerhouse project at Idaho National Laboratory.

- This agreement is intended to accelerate progress on key reactor components and highlights the intersection of advanced fission technology with established industrial equipment expertise.

- We'll explore how Oklo's new partnership addresses supply chain risks while questions remain about future demand for nuclear-powered data centers.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Oklo's Investment Narrative?

To believe in Oklo right now, an investor needs conviction that next-generation nuclear power can carve out a real role as a long-term supplier for energy-intensive sectors like data centers and advanced manufacturing. The recent Siemens Energy contract offers a meaningful step forward, directly targeting one of Oklo's most significant near-term risks: supply chain bottlenecks for its Aurora project at Idaho National Laboratory. With Siemens now involved in engineering and procuring critical systems, Oklo not only gains industrial expertise but also addresses concerns about project execution and manufacturing delays. However, market reactions show that execution on technology is only part of the story, recent share price declines followed news that major AI firms may need less energy due to more efficient chips. This weighs on the core demand thesis for advanced nuclear, raising questions about sustained revenue growth if AI power needs plateau. While the Siemens partnership reduces some immediate operational risk, the longer-term risk profile remains tied to unproven demand and the drawn-out regulatory path. Investors face the reality that Oklo is still pre-revenue, unprofitable, and navigating both technology risks and external shifts in energy demand, making conviction in its ultimate market potential critical if you want to hold through the volatility.

However, not all investors are focused on the slow-moving regulatory and revenue hurdles that cloud Oklo's timeline.

Exploring Other Perspectives

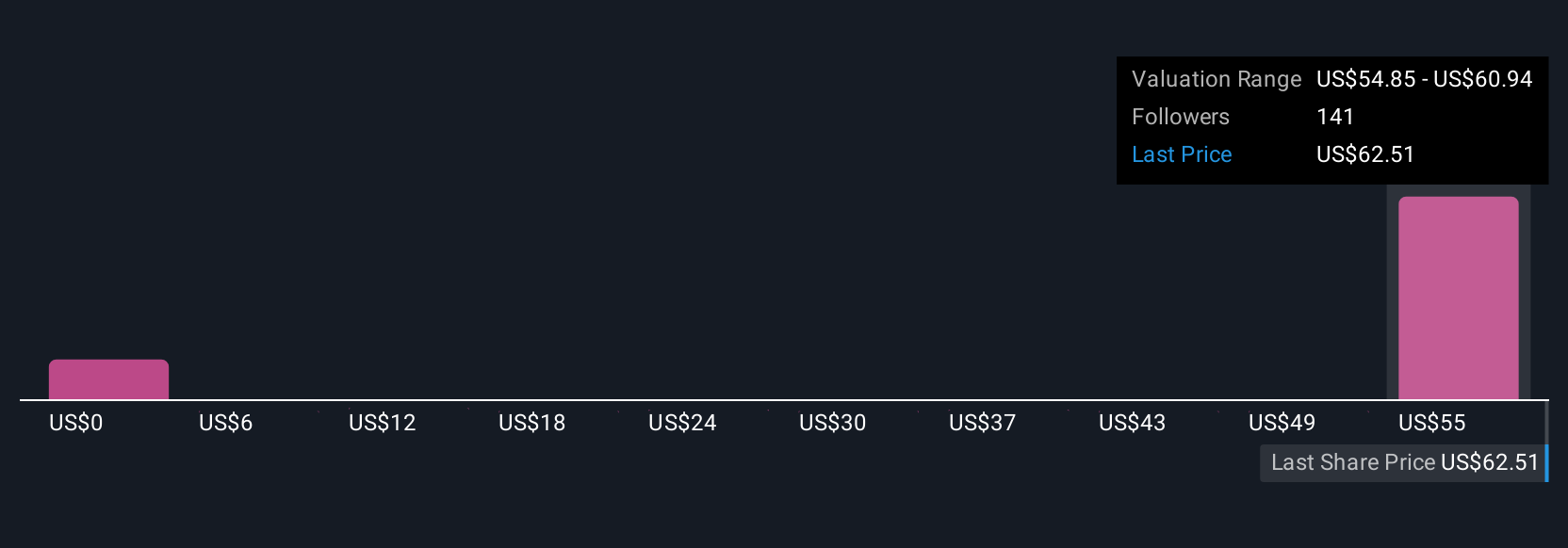

Explore 69 other fair value estimates on Oklo - why the stock might be worth as much as 18% more than the current price!

Build Your Own Oklo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oklo research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oklo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oklo's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026