- United States

- /

- Gas Utilities

- /

- NYSE:OGS

Is ONE Gas (OGS) Undervalued? A Fresh Look at Its 2024 Valuation and Market Position

Reviewed by Simply Wall St

ONE Gas (OGS) has shown steady performance over recent months, with investors watching for further signs of momentum. The stock’s return year to date sits at around 19%, offering a point for comparison with sector peers.

See our latest analysis for ONE Gas.

ONE Gas has enjoyed a robust 18.6% year-to-date share price return, with the latest uptick partly reflecting investors’ constructive outlook on its steady fundamentals and recent gains. Momentum has generally built through 2024, leaving the 1-year total shareholder return at a healthy 12.4%.

If solid returns from reliable operators have you thinking about what else the market is offering, now is the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading close to analyst targets after solid gains so far this year, the key question becomes whether ONE Gas is currently undervalued or if the market is already factoring in all its future growth prospects.

Most Popular Narrative: 1.7% Undervalued

ONE Gas’s most widely followed narrative says the current share price of $81.07 sits just below a fair value estimate of $82.50. Momentum in the utility sector and recent legislative tailwinds are providing fuel for this valuation, hinting at potential upside if these factors persist.

Favorable regulatory developments, particularly Texas House Bill 4384, enable full recovery of capital expenditures and reduce regulatory lag. This is anticipated to drive higher earnings and more predictable net profit margins in the coming years.

Curious what numbers power this price target? The fair value here is built on upward profit margins, optimistic earnings growth, and a premium multiple not typical for traditional gas utilities. Want to find out which projections could prove pivotal? See what’s behind this bold valuation scenario.

Result: Fair Value of $82.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should keep in mind that rising costs or unexpected changes in regulatory support could quickly challenge the current upbeat outlook.

Find out about the key risks to this ONE Gas narrative.

Another View: Looking at Market Comparisons

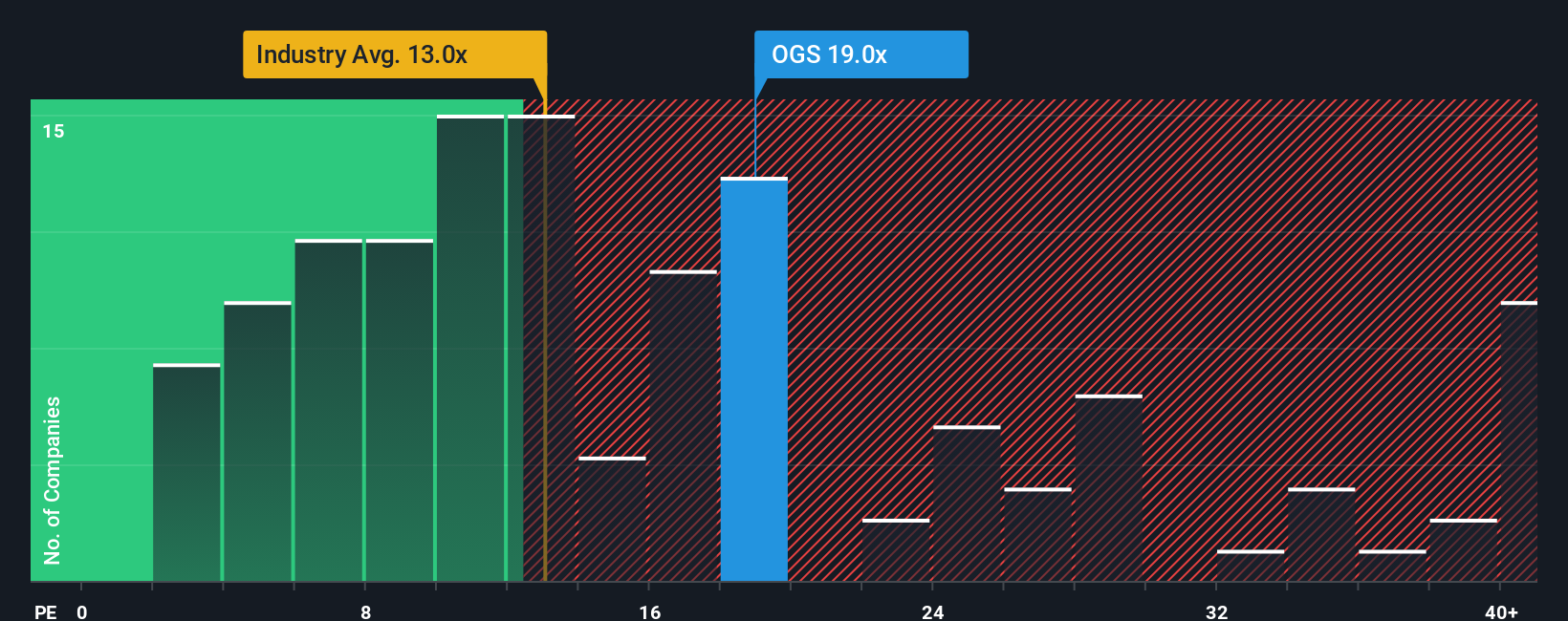

While the previous valuation suggests a modest upside, comparing ONE Gas's current price-to-earnings ratio of 19.1x against the US peer average of 17.3x and the fair ratio of 18.6x presents a different picture. Shares look relatively expensive, meaning the market may be pricing in more growth than analysts expect. Could this signal caution or opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ONE Gas Narrative

If your take on ONE Gas trends differs or you want to dig into the numbers yourself, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your ONE Gas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye out for new opportunities. Uncover stocks outside your current watchlist and maximize your next move by putting these powerful SWS tools to work for you.

- Uncover growing sectors by checking out these 25 AI penny stocks, which are transforming how businesses and consumers use technology.

- Boost your portfolio stability and growth by selecting from these 16 dividend stocks with yields > 3%, which offer reliable income with attractive yields.

- Get ahead of Wall Street by targeting these 879 undervalued stocks based on cash flows, which might be flying under the radar but have solid fundamentals and upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGS

ONE Gas

Operates as a regulated natural gas distribution utility company in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives