- United States

- /

- Electric Utilities

- /

- NYSE:OGE

Oklahoma CWIP Recovery Denial Could Be a Game Changer for OGE Energy (OGE)

Reviewed by Sasha Jovanovic

- In a recent decision, the Oklahoma Corporation Commission denied OG&E’s request to recover Construction Work in Progress (CWIP) costs from customers for new gas-powered units at the Horseshoe Lake Power Plant, while still approving the construction and related capacity agreements.

- This regulatory outcome means OG&E must proceed with its new project without passing upfront financing expenses to customers, adding potential challenges for cost recovery and financial planning.

- We'll assess how the denial of upfront CWIP cost recovery could shift OGE Energy's long-term earnings outlook and risk profile.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

OGE Energy Investment Narrative Recap

To own OGE Energy stock, you need to believe in steady utility demand growth and the company's ability to expand generation capacity while effectively recovering its costs. The recent Oklahoma regulatory decision denying upfront customer recovery of Horseshoe Lake plant financing does not materially alter the near-term catalyst of consistent earnings and infrastructure expansion, but it does highlight a persistent risk around capital cost recovery that could influence long-term financial flexibility.

Among recent announcements, management's reaffirmed 2025 earnings guidance in the top half of the US$2.21 to US$2.33 per share range stands out, underscoring confidence in ongoing operational strength despite regulatory headwinds. This supports the view that, for now, OGE's principal growth initiatives remain intact, but investors are reminded that the ability to realize fair returns on future capital projects remains an ongoing concern.

In contrast, while OGE’s forward outlook reflects stability, investors should watch for changes in cost recovery mechanisms that could affect...

Read the full narrative on OGE Energy (it's free!)

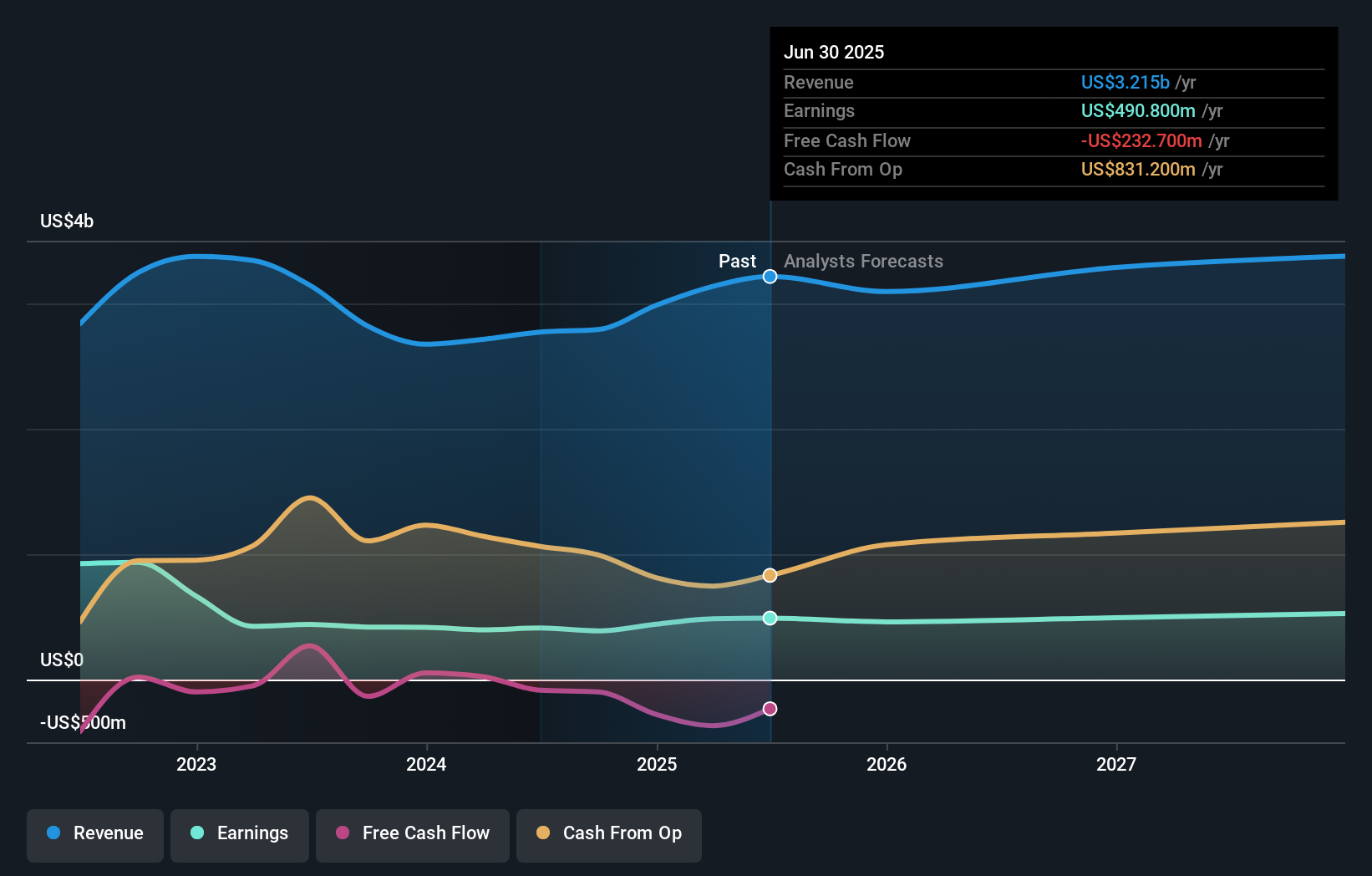

OGE Energy's outlook suggests revenues of $3.5 billion and earnings of $545.7 million by 2028. This is based on analysts forecasting 2.7% annual revenue growth and a $54.9 million increase in earnings from the current $490.8 million.

Uncover how OGE Energy's forecasts yield a $47.55 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate exists from the Simply Wall St Community, pegging OGE at US$47.55. As regulatory risk around new project cost recovery comes into focus, readers can see how diverging views on value and risk lead to different market expectations.

Explore another fair value estimate on OGE Energy - why the stock might be worth as much as 6% more than the current price!

Build Your Own OGE Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OGE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OGE Energy's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGE

OGE Energy

Through its subsidiary, operates as an energy services provider in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives