- United States

- /

- Electric Utilities

- /

- NYSE:OGE

OGE Energy (OGE): Earnings Growth Outpaces 5-Year Trend, Reinforcing Bullish Margin Narratives

Reviewed by Simply Wall St

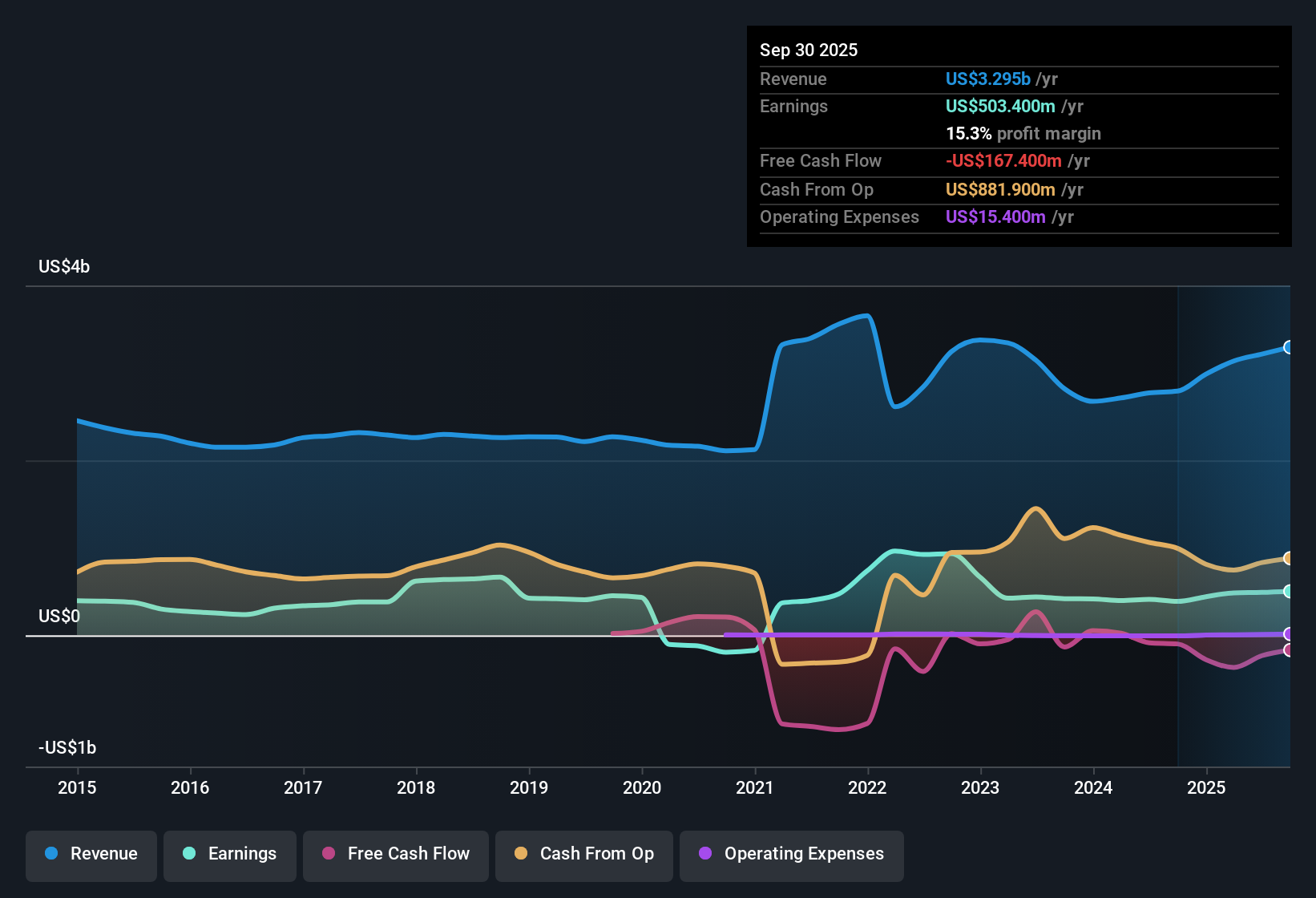

OGE Energy (OGE) reported earnings growth of 29.8% over the past year, marking a sharp acceleration compared to its five-year average growth rate of 7.1%. Net profit margin improved to 15.3% from last year’s 13.9%, while the stock currently trades at $44.46, above its estimated fair value of $39.11. Investors are weighing the company’s consistent profit growth and valuation against signs of slower future expansion and minor risks to its financial position. The latest margin gains are a notable highlight.

See our full analysis for OGE Energy.Next up, we will see how these headline results compare with the main narratives shaping market expectations. Some assumptions may hold, while others could face a reality check.

See what the community is saying about OGE Energy

Margin Expansion Points to Sustained Profitability

- OGE Energy’s net profit margin has increased to 15.3%, and projections show it could reach 15.7% within three years.

- According to the analysts' consensus view, margin resilience is underpinned by ongoing investment in infrastructure and supportive policies, which:

- Allow the company to deploy capital into generation and transmission projects. This supports earnings stability and long-term returns.

- Help offset risks associated with region-specific market exposure and regulatory headwinds, as noted by the focus on Oklahoma and Arkansas operations.

- Consensus narrative notes that federal and state incentives for grid modernization and reliability remain key to securing cost recovery and supporting margin stability.

Consensus expectations are being tested as margins steadily improve, but risks tied to regional concentration linger. 📊 Read the full OGE Energy Consensus Narrative.

Growth Rates Trail Industry, But Demand Remains Visible

- Revenue is forecast to increase by 3.2% annually. Analysts see annual earnings growth averaging 5.4%. Both rates are running slower than overall US market averages.

- Analysts' consensus view suggests that while OGE’s revenue expansion lags industry benchmarks, visible upside remains from several areas:

- Sustained demand driven by new industrial projects, electrification, and large-scale customers (such as data centers) is expected to keep baseline growth positive.

- However, ongoing softness in industrial and oilfield load could put pressure on topline gains if the segment does not recover as anticipated.

Valuation Discount Signals Cautious Optimism

- OGE trades at a 17.8x Price-To-Earnings ratio, below both its peers at 24.1x and the US utilities average of 21.2x. However, the current share price of $44.46 exceeds the DCF fair value estimate of $39.11.

- From the analysts' consensus view, this valuation gap shows investors are weighing:

- The company’s improving profitability and stable outlook against moderate growth and a narrow premium to fair value. This is reflected in the slim 4.7% difference between the current share price and the consensus analyst target of $47.83.

- Consensus sees the shares as largely fairly priced, so further upside would likely need new catalysts beyond stable fundamentals and margin gains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OGE Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from another angle? Share your take and shape your view into a fresh narrative in just a few minutes. Do it your way

A great starting point for your OGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

OGE Energy’s revenue and earnings growth are trailing industry averages, highlighting concerns about its ability to sustain momentum beyond stable margins.

If consistent long-term performance matters to your portfolio, use stable growth stocks screener (2113 results) to uncover companies posting steady revenue and earnings expansion across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGE

OGE Energy

Through its subsidiary, operates as an energy services provider in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion