- United States

- /

- Electric Utilities

- /

- NYSE:OGE

OGE Energy (OGE): Assessing Valuation as Shares Deliver Steady 19% Total Return for Investors

Reviewed by Simply Wall St

OGE Energy (OGE) has seen its stock deliver a total return of 19% over the past year. The utility giant's performance has drawn some attention lately, and several investors are now weighing whether shares remain appealing as the company posts steady revenue and net income gains.

See our latest analysis for OGE Energy.

OGE Energy’s latest share price of $46.37 reflects a steady climb, with a year-to-date share price return of 12.3% and a one-year total shareholder return of 19.1%. This momentum points to growing investor confidence, especially as OGE continues to post consistent profit and revenue growth. This reinforces the view that its fundamentals are solid for both the short and long term.

If steady progress from OGE Energy has you curious about broader trends, now’s a great moment to discover fast growing stocks with high insider ownership.

The question now is whether OGE Energy’s recent gains are setting the stage for more upside, or if the current price already factors in all of its future growth potential and leaves little room for further appreciation.

Most Popular Narrative: Fairly Valued

The narrative consensus places OGE Energy’s fair value at $46.56, just above the last close at $46.37. This suggests the market price closely matches the average forecast and invites a closer look at what is driving this alignment.

Ongoing and planned investments in generation capacity and transmission infrastructure, supported by legislative and regulatory mechanisms such as CWIP and PISA, enable accelerated asset deployment with minimized lag in rate recovery. This supports consistent future earnings and improved return on equity.

Want to know the engine behind this valuation call? Discover how confident expectations about rising energy demand and margins might be shaping the story. The real surprise lies in the bold projections for revenue, profit, and the premium multiple they expect for OGE. See what sets these apart.

Result: Fair Value of $46.56 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in industrial demand or shifting regulatory pressures on carbon emissions could quickly change the outlook for OGE’s growth trajectory.

Find out about the key risks to this OGE Energy narrative.

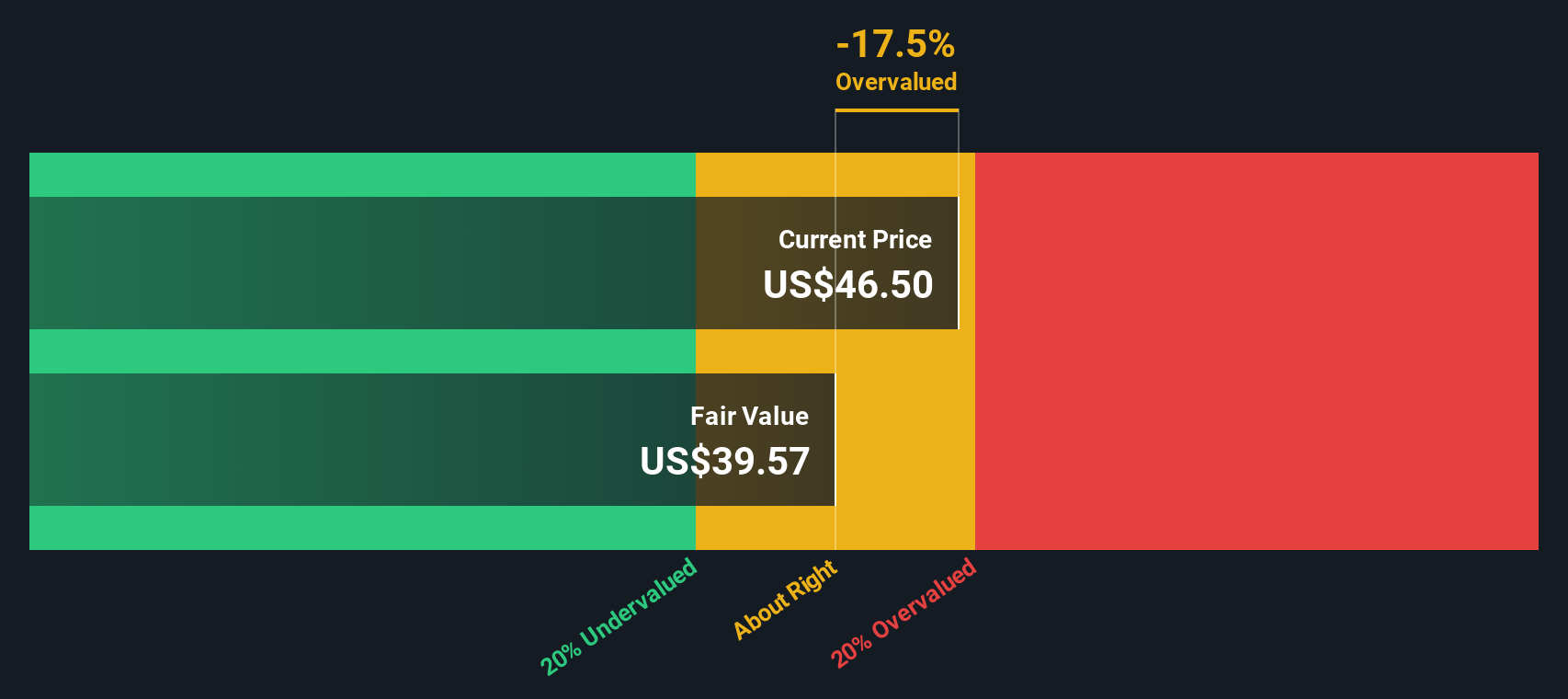

Another View: DCF Model Suggests Less Upside

While analyst forecasts point to fair valuation, our SWS DCF model presents a more cautious perspective. According to this method, OGE trades above its intrinsic value. This suggests limited room for upside at the current price. Which approach best captures OGE’s real long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OGE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OGE Energy Narrative

If you want to dig into the numbers or share your own take, you can piece together a custom narrative in just a couple of minutes. Do it your way

A great starting point for your OGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart opportunities don’t wait around. Take charge of your portfolio by finding unique stocks with standout potential. You could be missing tomorrow’s success stories.

- Unlock fresh value by sorting through these 877 undervalued stocks based on cash flows that are poised for strong growth based on future cash flows and financial momentum.

- Power up your returns by scanning these 27 AI penny stocks, where artificial intelligence leads the next wave of industry transformation and market leadership.

- Grow your passive income stream by choosing from these 17 dividend stocks with yields > 3% that consistently deliver yields above 3% for reliable cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGE

OGE Energy

Through its subsidiary, operates as an energy services provider in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives