- United States

- /

- Gas Utilities

- /

- NYSE:NWN

Northwest Natural Holding (NWN): Assessing Valuation After Leadership Change and Dividend Increase Post-Earnings Miss

Reviewed by Kshitija Bhandaru

Northwest Natural Holding (NWN) just announced a quarterly dividend increase to $0.4925 per share, even after reporting earnings that came in below expectations. In addition to this, the company welcomed Kyra Patterson as its new Chief People Officer.

See our latest analysis for Northwest Natural Holding.

Despite some bumps in earnings and insider selling, Northwest Natural Holding’s momentum is building. The company has seen a 9% 1-month share price return and an impressive 18.6% total shareholder return over the past year. Strategic moves such as the dividend raise and the addition of new leadership may be helping to shift sentiment for both short- and long-term investors.

If you’re interested in finding other companies where leadership changes and growth potential align, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a double-digit discount to analyst targets despite solid long-term returns, the question now is whether Northwest Natural Holding offers a true value opportunity, or if the market is already factoring in its recovery prospects.

Price-to-Earnings of 18.2x: Is it justified?

Northwest Natural Holding’s price-to-earnings ratio of 18.2x sits just below the US market average, suggesting the stock trades at a modest discount to most American companies, as reflected in the recent $45.97 closing price.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay per dollar of earnings. For utilities like NWN, this metric is key to evaluating if shareholders are getting value for stable profits and steady growth.

At 18.2x, Northwest Natural Holding’s multiple is higher than the global gas utilities industry average, but stands below the peer group’s 18.9x. This signals relative value among domestic companies, even as it looks expensive in the global context. Compared to the estimated fair price-to-earnings ratio of 19.6x, the current valuation leaves room for upward movement if earnings growth continues and sentiment improves toward the sector.

Explore the SWS fair ratio for Northwest Natural Holding

Result: Price-to-Earnings of 18.2x (ABOUT RIGHT)

However, slowdowns in revenue growth or unexpected operational challenges could quickly change investor sentiment and limit further upside in Northwest Natural Holding’s share price.

Find out about the key risks to this Northwest Natural Holding narrative.

Another View: SWS DCF Model Tells a Different Story

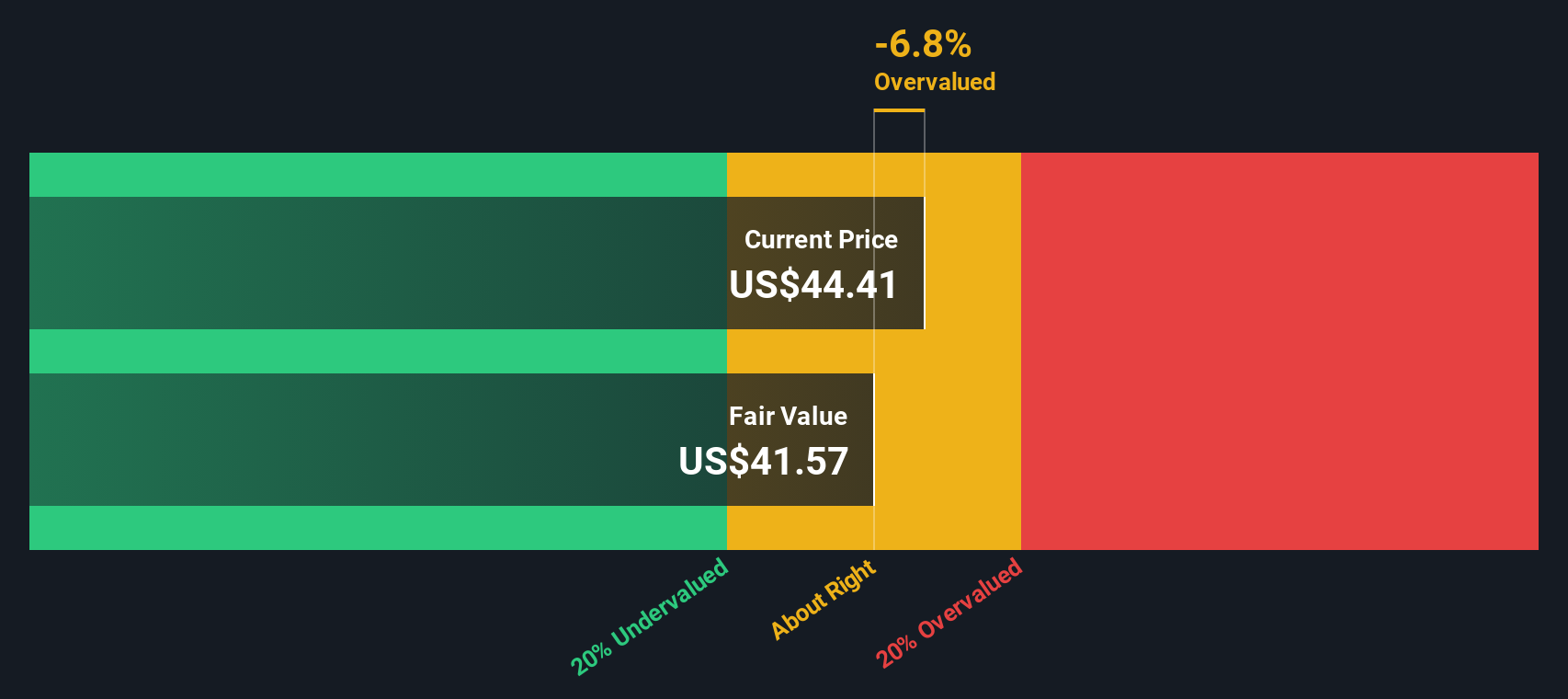

While price-to-earnings suggests Northwest Natural Holding could be fairly valued, our DCF model estimates the shares trade slightly above fair value at $45.97 compared to an intrinsic value of $41.57. This presents a different perspective and raises the question: Is the market too optimistic about the company’s future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northwest Natural Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northwest Natural Holding Narrative

If you'd rather dig into the numbers yourself or have a different perspective on Northwest Natural Holding, it’s quick and easy to craft your own take on the data. Do it your way

A great starting point for your Northwest Natural Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't wait around while opportunities pass by. The smartest investors always keep searching for their next winner using the right set of tools.

- Uncover quality picks with impressive cash flow potential by tracking these 100+ undervalued stocks based on cash flows, which are poised for strong upside as markets shift.

- Get ahead of the curve and tap into growth with these 100+ AI penny stocks, featuring companies leading advancements in artificial intelligence innovation.

- Boost your portfolio’s income stream by targeting steady-paying opportunities among these 100+ dividend stocks with yields > 3%, offering yields above 3% and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Natural Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NWN

Northwest Natural Holding

Through its subsidiary, Northwest Natural Gas Company, provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives