- United States

- /

- Gas Utilities

- /

- NYSE:NWN

Dividend Commitment Could Be a Game Changer for Northwest Natural Holding (NWN)

Reviewed by Simply Wall St

- Northwest Natural Holding's board recently declared a quarterly dividend of US$0.49 per share, with payment scheduled for August 15, 2025, to shareholders of record as of July 31, 2025, maintaining its indicated annual dividend rate at US$1.96 per share.

- This ongoing commitment to regular dividends highlights the company's confidence in its financial stability and continued focus on rewarding shareholders.

- We will explore how Northwest Natural Holding's ongoing dividend commitment shapes perspectives on its long-term earnings outlook and growth initiatives.

Northwest Natural Holding Investment Narrative Recap

To be a shareholder in Northwest Natural Holding, you typically need to believe in the company’s ability to deliver consistent returns through reliable dividends and steady earnings from regulated utilities. The recent dividend affirmation reinforces this stability, but it does not materially change the key short-term catalyst, ongoing integration of recent acquisitions, or the main risk, which is the potential for regulatory lag impacting margin recovery.

Among recent developments, Northwest Natural’s appointment of Peter Bragdon as an independent director stands out, especially as the board sees new leadership amid industry transformation. Changes in board composition can be relevant for oversight of major catalysts, including recently announced growth initiatives in Texas and renewable energy, both of which have been central to the company’s outlook.

Yet, in contrast to the steady dividend, investors should be alert to how future regulatory decisions could...

Read the full narrative on Northwest Natural Holding (it's free!)

Northwest Natural Holding's narrative projects $1.6 billion revenue and $140.6 million earnings by 2028. This requires 10.9% yearly revenue growth and a $61.7 million earnings increase from $78.9 million today.

Exploring Other Perspectives

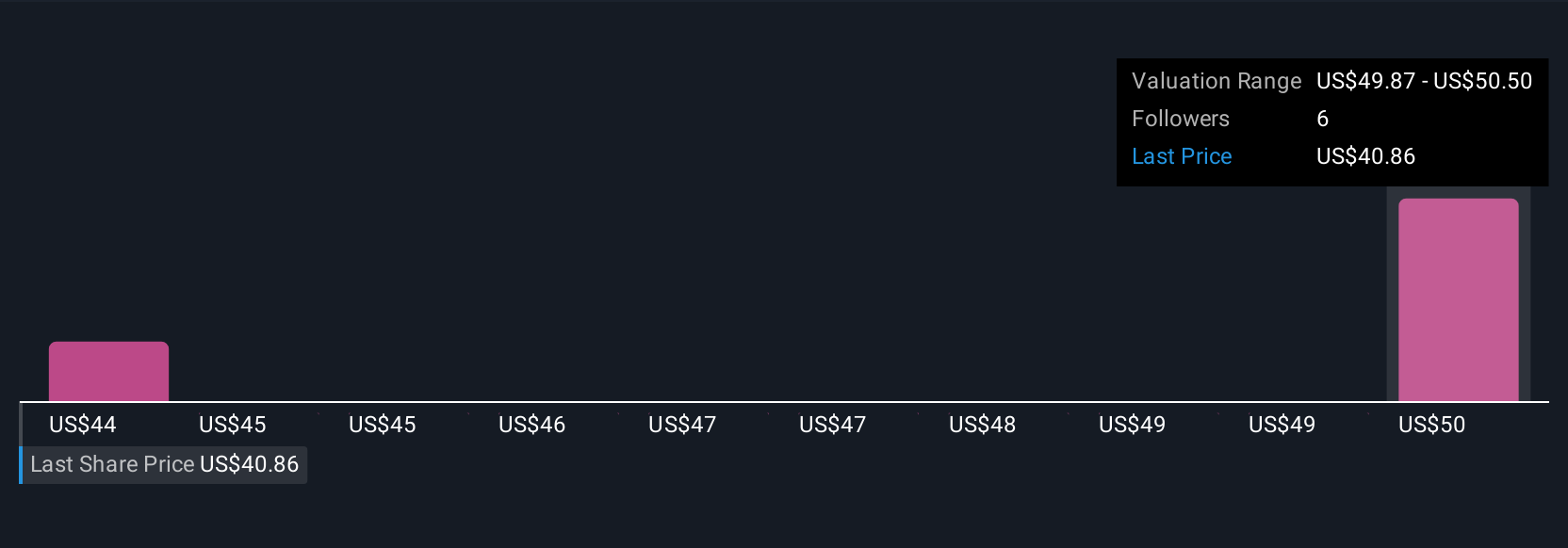

Two fair value estimates from the Simply Wall St Community range from US$44.21 to US$48.49 per share. With regulatory lag risk remaining a concern for earnings consistency, you will find plenty of alternative viewpoints worth exploring.

Build Your Own Northwest Natural Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northwest Natural Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northwest Natural Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northwest Natural Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Natural Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NWN

Northwest Natural Holding

Through its subsidiary, Northwest Natural Gas Company, provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives