- United States

- /

- Electric Utilities

- /

- NYSE:NRG

How Texas’s Record $562 Million Loan to NRG Energy (NRG) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In September 2025, NRG Energy secured a US$562 million low-interest loan from the Texas Energy Fund to support construction of a 721-megawatt gas-fired power plant near Baytown, marking the largest loan approved under the Texas program to date. This sizable state-backed financing signals robust state and investor confidence in NRG's ability to deliver increased grid reliability amid rising electricity demand in Texas.

- We'll examine how this major capital infusion for natural gas infrastructure is likely to impact NRG Energy's forward-looking investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NRG Energy Investment Narrative Recap

To own shares of NRG Energy today, you need conviction in the company's ability to capitalize on surging electricity demand, especially from data centers and large-scale electrification, while navigating headwinds from heavy investment in new gas generation. The recent US$562 million Texas Energy Fund loan for Cedar Bayou 5 bolsters NRG's short-term growth catalyst by funding new capacity and enhanced grid reliability, but it also underscores the key risk: increased leverage and long-term exposure to fossil fuel assets in a shifting regulatory and capital market environment.

Of all recent company actions, the major fixed income offerings in September 2025, totaling US$1.25 billion in new secured and unsecured notes, are most relevant here. This comprehensive refinancing effort is aimed at funding acquisitions like the LSP portfolio and repaying existing obligations, directly impacting NRG's financial flexibility and interest expense at a time of heightened capital deployment.

Yet, set against the promise of new capacity and recurring demand, investors should closely track how NRG manages higher debt levels if market or regulatory conditions change...

Read the full narrative on NRG Energy (it's free!)

NRG Energy's outlook forecasts $34.5 billion in revenue and $1.6 billion in earnings by 2028. This projection is based on a 5.5% annual revenue growth rate and a $1.1 billion increase in earnings, up from $455 million currently.

Uncover how NRG Energy's forecasts yield a $176.95 fair value, a 6% upside to its current price.

Exploring Other Perspectives

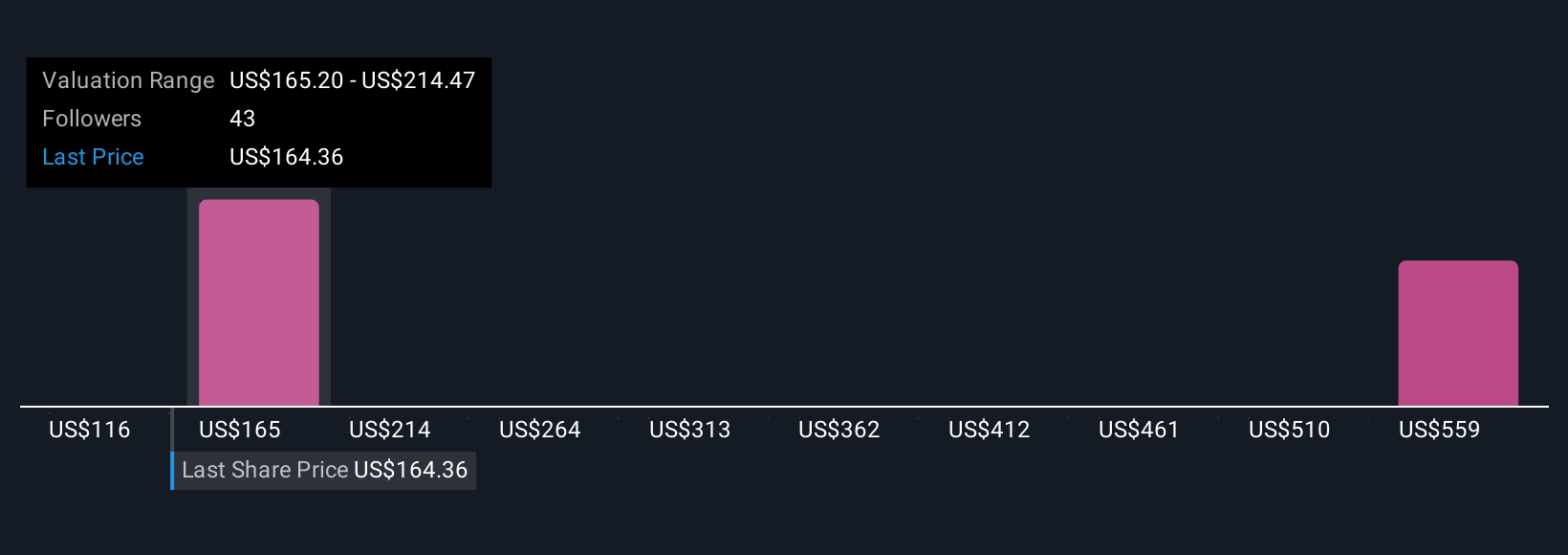

Fair value estimates from four investors in the Simply Wall St Community span from US$115.93 to US$608.64 per share. Strong capital spending and reliance on new gas-fired infrastructure shape very different outlooks for the company's performance, explore how these varied perspectives could influence your thinking.

Explore 4 other fair value estimates on NRG Energy - why the stock might be worth over 3x more than the current price!

Build Your Own NRG Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NRG Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NRG Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NRG Energy's overall financial health at a glance.

No Opportunity In NRG Energy?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives