- United States

- /

- Gas Utilities

- /

- NYSE:NJR

Did a Dividend Hike and Board Addition Just Shift New Jersey Resources' (NJR) Investment Narrative?

Reviewed by Simply Wall St

- Earlier this month, New Jersey Resources Corporation announced an increase in its quarterly dividend to US$0.475 per share, and appointed Amy B. Mansue, President and CEO of Inspira Health Network, to its Board of Directors, effective November 1, 2025.

- These developments highlight the company's ongoing commitment to steady shareholder returns and leadership with broad executive and regulatory experience.

- We'll explore how the board-approved dividend increase reflects management's confidence and could influence New Jersey Resources' investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

New Jersey Resources Investment Narrative Recap

To be a shareholder in New Jersey Resources, you need to believe that the company's reliable gas utility business and its steady dividend growth can offset the rising risks from policy changes aimed at decarbonization and electrification. The recent dividend increase and board expansion do not materially shift the current short-term catalyst, which remains focused on regulatory support for energy efficiency and clean energy transition initiatives. However, the company's ongoing dependence on traditional natural gas infrastructure still represents the most significant risk to future growth and margins.

Of the recent announcements, the board-approved dividend increase stands out as most relevant. With NJR raising its quarterly dividend to US$0.475 per share and maintaining a 30-year streak of annual increases, this update underscores management’s confidence in stable cash flows. It also supports the ongoing catalyst of customer growth and recurring revenues in its key service territories, which remain vital as regulatory and policy environments continue to evolve.

In contrast, investors should also be aware that despite solid cash flow, reliance on regulatory approval for capital-intensive projects means that...

Read the full narrative on New Jersey Resources (it's free!)

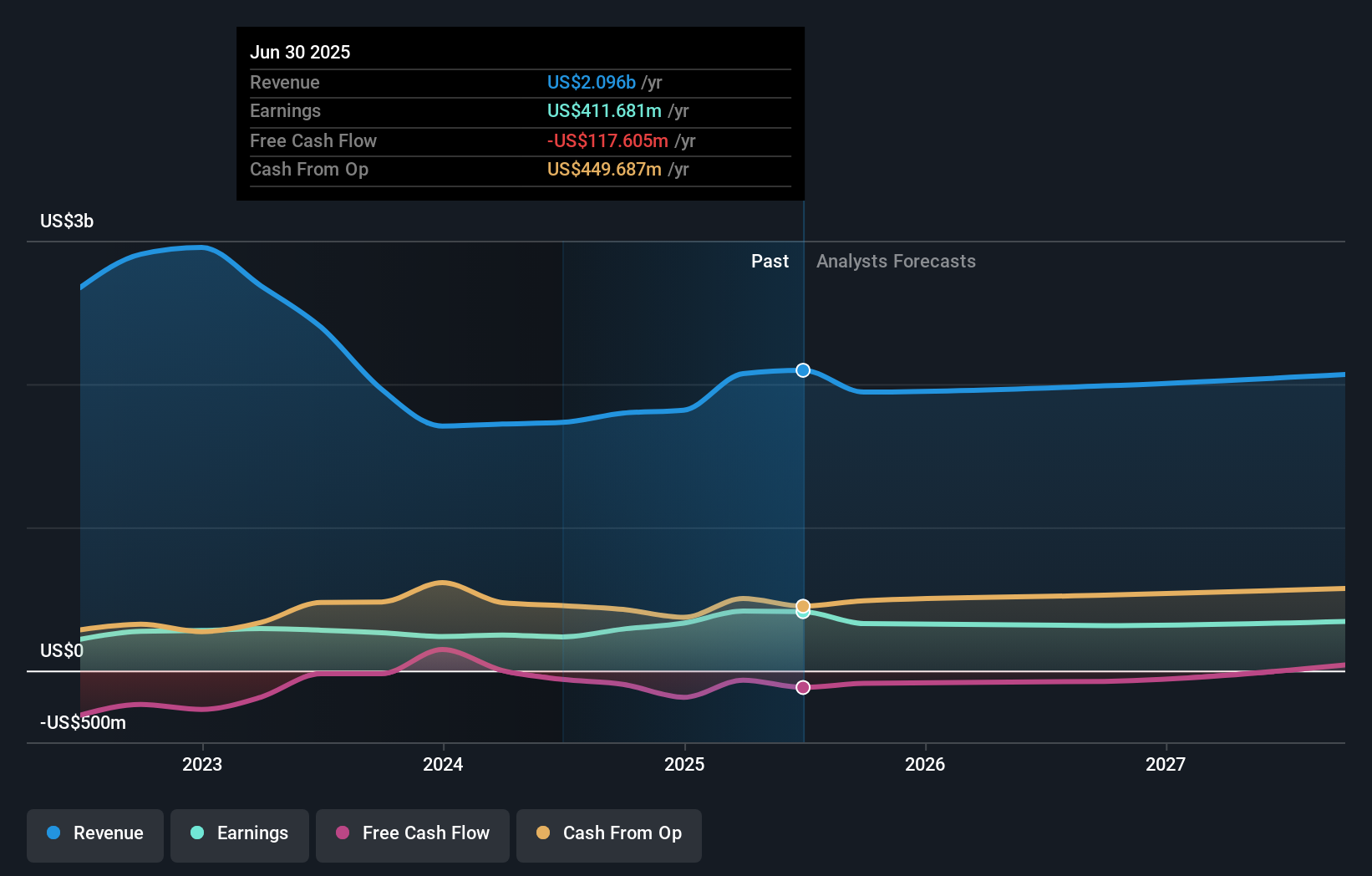

New Jersey Resources is projected to report $2.1 billion in revenue and $399.3 million in earnings by 2028. This outlook assumes an annual revenue decline of 0.1% and a decrease in earnings of $12.4 million from the current $411.7 million.

Uncover how New Jersey Resources' forecasts yield a $53.57 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Every recent fair value estimate in the Simply Wall St Community landed at US$53.57, based on one contributor. While community opinions can differ, remember that future regulatory shifts remain a key risk that could impact New Jersey Resources profitability and valuation over time.

Explore another fair value estimate on New Jersey Resources - why the stock might be worth just $53.57!

Build Your Own New Jersey Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Jersey Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free New Jersey Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Jersey Resources' overall financial health at a glance.

No Opportunity In New Jersey Resources?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Jersey Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NJR

New Jersey Resources

An energy services holding company, distributes natural gas.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives