- United States

- /

- Other Utilities

- /

- NYSE:NI

NiSource (NI): Valuation Check After Expanded $2.5 Billion Credit Facility Boosts Financial Flexibility

Reviewed by Simply Wall St

NiSource (NI) has secured a larger, longer-dated revolving credit facility, increasing total capacity to $2.5 billion and extending maturity to 2030, which enhances its financial flexibility.

See our latest analysis for NiSource.

Against that backdrop, NiSource’s 14.16% year to date share price return and 5 year total shareholder return of 122.67% suggest momentum is gradually building as investors reward steadier growth and reduced perceived balance sheet risk.

If this kind of quietly improving utility story appeals to you, it may be a moment to explore other regulated and infrastructure plays via healthcare stocks as a potential source of resilient opportunities.

With shares up strongly and analysts still seeing double digit upside to their targets, investors face a familiar dilemma: is NiSource quietly undervalued here, or is the market already baking in its next leg of growth?

Most Popular Narrative: 10.5% Undervalued

With NiSource last closing at $41.51 versus a narrative fair value near $46.36, followers see meaningful upside grounded in long range earnings power.

Strong visibility into multi-year, rate-based capital expenditure ($19.4B base plan, plus $2B+ in upside/incremental projects) positions NiSource for 6 to 8% annual EPS growth and compound growth in regulated revenue.

Want to see how a classic regulated utility story supports a richer earnings multiple, faster margin expansion, and higher long run revenue than today implies? The full narrative spells out the load growth, capital plan, and profitability assumptions that power this fair value case, and how they could reshape NiSource’s earnings profile.

Result: Fair Value of $46.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat outlook could be challenged if regulatory approvals lag or if long term gas demand erodes faster than NiSource currently anticipates.

Find out about the key risks to this NiSource narrative.

Another Angle on Value

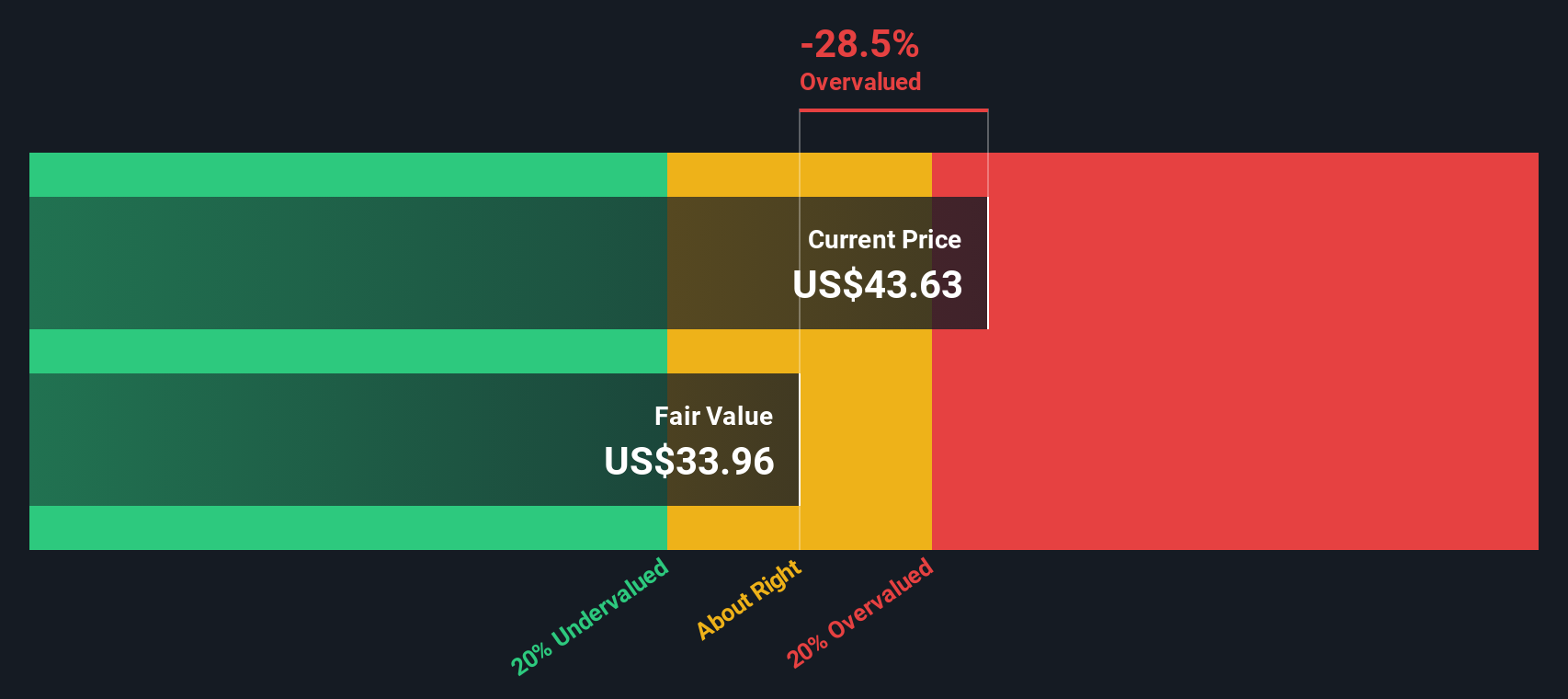

Our SWS DCF model paints a cooler picture, suggesting NiSource is trading above an estimated fair value of $34.19 per share, which implies the stock may be overvalued. If the cash flows are right, is today’s price already assuming too much growth and regulatory goodwill?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NiSource for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NiSource Narrative

If you see the story differently, or just prefer to dig into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your NiSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market moves on without you, put your research momentum to work by scanning fresh opportunities with the Simply Wall St screener in just minutes.

- Target reliable income streams by focusing on companies in these 13 dividend stocks with yields > 3% that offer attractive yields backed by solid fundamentals.

- Position yourself at the frontier of innovation by evaluating these 28 quantum computing stocks that could reshape computing, security, and data processing.

- Capitalize on potential mispricings by reviewing these 918 undervalued stocks based on cash flows to spot quality businesses trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NiSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NI

NiSource

An energy holding company, operates as a regulated natural gas and electric utility company in the United States.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion