- United States

- /

- Gas Utilities

- /

- NYSE:NFG

What National Fuel Gas (NFG)'s Income Growth and Expansion Plans Mean for Shareholders

Reviewed by Sasha Jovanovic

- National Fuel Gas Co. recently reported strong year-over-year growth in net income, supported by its integrated operations across exploration, production, pipeline, and utility services in the Appalachian region.

- The company is pursuing further growth through infrastructure expansion and technological innovation, while navigating regulatory and environmental challenges in the natural gas sector.

- We'll examine how National Fuel Gas's focus on infrastructure expansion and integration could reshape its investment narrative and long-term prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

National Fuel Gas Investment Narrative Recap

To be a shareholder in National Fuel Gas, investors need to believe in long-term US natural gas demand, the resilience of integrated operations in the Appalachian region, and the company’s ability to manage regulatory pressures. The recent strong net income figures reinforce confidence in near-term earnings growth, but do not fundamentally change the biggest immediate catalyst, execution of infrastructure expansion projects, or the primary risk, which remains long-term policy uncertainty around decarbonization in key markets.

Most relevant to the recent results, the company’s latest quarterly dividend increase highlights both management's focus on capital returns and its positive outlook for future cash flows. This announcement bears directly on the importance of maintaining strong free cash flow as National Fuel Gas continues to invest in large-scale pipeline and system modernization initiatives that underpin future revenue growth.

Yet, despite earnings momentum, investors should be aware that intensifying policy efforts to curb emissions may...

Read the full narrative on National Fuel Gas (it's free!)

National Fuel Gas' outlook forecasts $3.3 billion in revenue and $1.1 billion in earnings by 2028. This implies an annual revenue growth rate of 14.9% and a $856.5 million increase in earnings from the current $243.5 million.

Uncover how National Fuel Gas' forecasts yield a $102.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

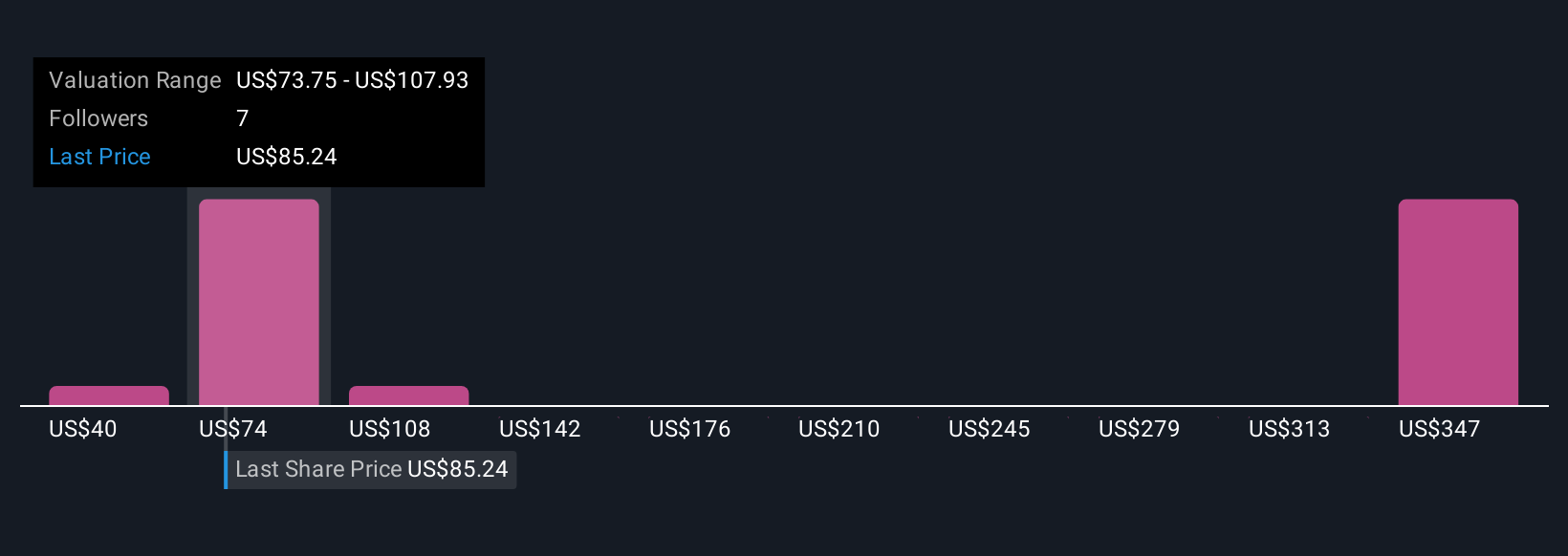

Simply Wall St Community members' fair value estimates for National Fuel Gas span from US$39.58 to US$152.74 across four views. With policy pressures on gas demand as a central risk, you can compare how others weigh potential revenue growth versus regulatory uncertainty.

Explore 4 other fair value estimates on National Fuel Gas - why the stock might be worth as much as 89% more than the current price!

Build Your Own National Fuel Gas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Fuel Gas research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National Fuel Gas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Fuel Gas' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Fuel Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NFG

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success