- United States

- /

- Electric Utilities

- /

- NYSE:NEE

Will Analyst Optimism on Renewables Reshape NextEra Energy's (NEE) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent weeks, NextEra Energy has attracted heightened analyst attention, including new research coverage, as it prepares to report its third-quarter 2025 results at the end of October.

- Analyst interest highlights the company's leadership in renewables and a strong record of dividend growth, even as investors anticipate earnings to show a year-over-year decline.

- We'll explore how renewed analyst optimism around NextEra’s renewable energy profile could influence its forward-looking investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NextEra Energy Investment Narrative Recap

At its core, being a shareholder in NextEra Energy typically means trusting in its ability to harness the long-term demand for clean electricity, supported by its leadership in renewable power generation. The latest surge in analyst attention ahead of Q3 2025 results, despite expectations for a year-over-year earnings decline, focuses investor attention on anticipated policy stability for renewables as a short-term catalyst, while higher project costs from sustained interest rates remain a key near-term risk. These headlines don’t appear to fundamentally change either narrative just yet.

Among recent announcements, regulatory approval for extending operations at the Point Beach Nuclear Plant stands out, as it underscores NextEra’s efforts to maintain reliable baseload capacity, potentially reinforcing its investment case amid ongoing clean energy expansion. This development is relevant since it ties directly into both the company’s growth catalysts and its risk profile, particularly given heightened scrutiny of energy reliability and regulatory processes.

However, with longer-term rates still elevated, investors should also watch for impacts on financing costs and project returns...

Read the full narrative on NextEra Energy (it's free!)

NextEra Energy's narrative projects $35.9 billion revenue and $9.4 billion earnings by 2028. This requires 11.5% yearly revenue growth and a $3.5 billion earnings increase from $5.9 billion today.

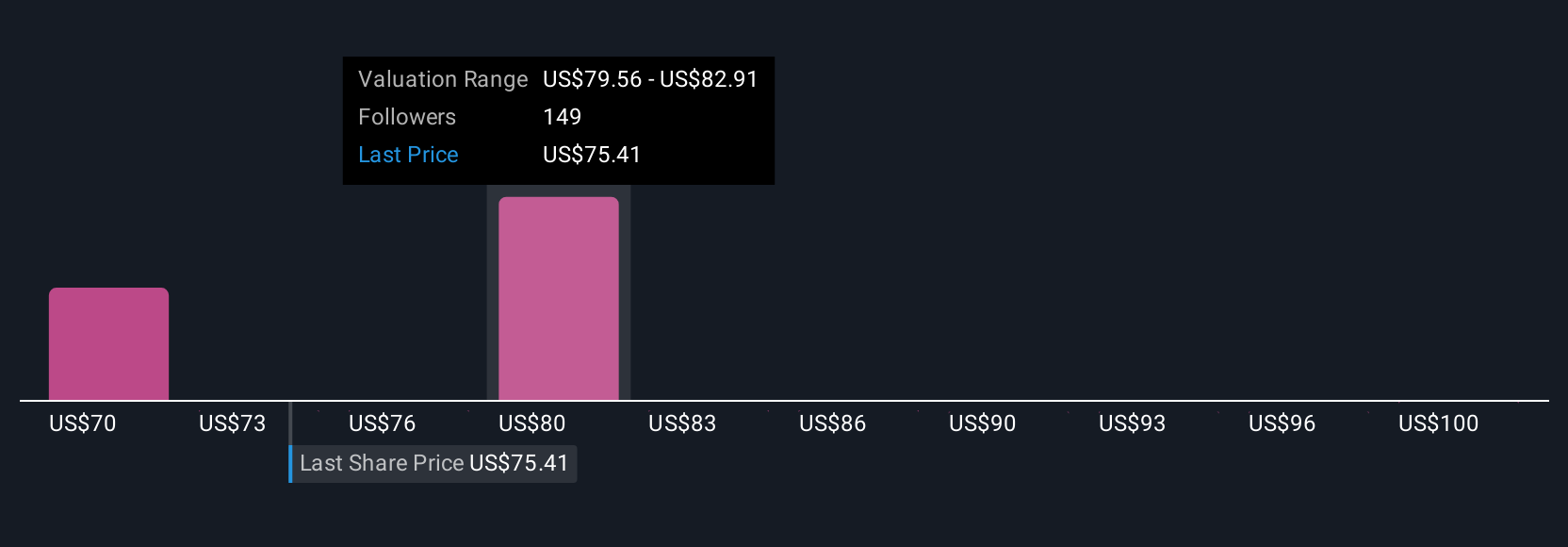

Uncover how NextEra Energy's forecasts yield a $86.79 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were projecting NextEra’s annual revenue to reach US$40.1 billion by 2028, assuming robust margin improvements. This outlook hinges on rapid electrification and outsized demand growth, which could alter risk and reward perspectives for you as new data, such as the recent rally and upcoming earnings, shape further debate.

Explore 10 other fair value estimates on NextEra Energy - why the stock might be worth as much as 22% more than the current price!

Build Your Own NextEra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NextEra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextEra Energy's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives