- United States

- /

- Electric Utilities

- /

- NYSE:NEE

These 4 Measures Indicate That NextEra Energy (NYSE:NEE) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies NextEra Energy, Inc. (NYSE:NEE) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for NextEra Energy

How Much Debt Does NextEra Energy Carry?

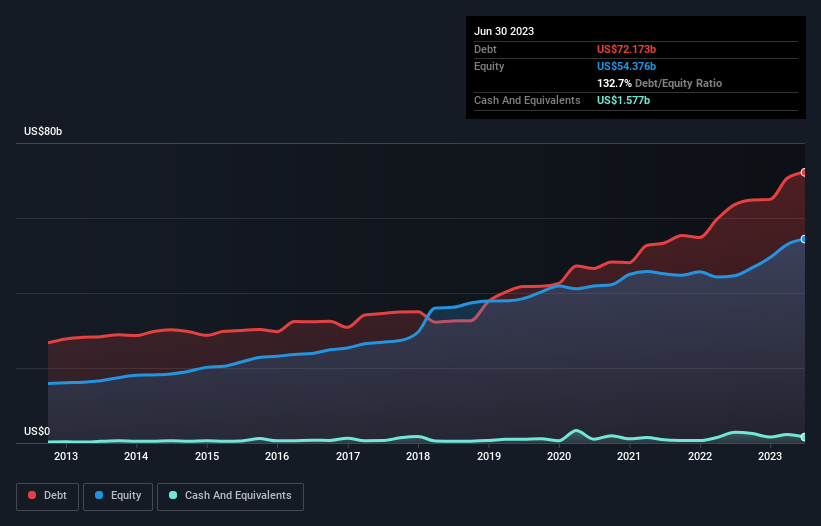

The image below, which you can click on for greater detail, shows that at June 2023 NextEra Energy had debt of US$72.2b, up from US$63.6b in one year. However, because it has a cash reserve of US$1.58b, its net debt is less, at about US$70.6b.

How Strong Is NextEra Energy's Balance Sheet?

According to the last reported balance sheet, NextEra Energy had liabilities of US$24.9b due within 12 months, and liabilities of US$89.0b due beyond 12 months. On the other hand, it had cash of US$1.58b and US$4.92b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$107.4b.

This is a mountain of leverage even relative to its gargantuan market capitalization of US$138.7b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

NextEra Energy's debt is 4.9 times its EBITDA, and its EBIT cover its interest expense 4.9 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Notably, NextEra Energy's EBIT launched higher than Elon Musk, gaining a whopping 332% on last year. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if NextEra Energy can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, NextEra Energy burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Neither NextEra Energy's ability to convert EBIT to free cash flow nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But the good news is it seems to be able to grow its EBIT with ease. It's also worth noting that NextEra Energy is in the Electric Utilities industry, which is often considered to be quite defensive. Taking the abovementioned factors together we do think NextEra Energy's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with NextEra Energy (including 1 which makes us a bit uncomfortable) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives