- United States

- /

- Electric Utilities

- /

- NYSE:NEE

NextEra Energy (NYSE:NEE) Reports Q1 Sales Increase But Net Income Decline

Reviewed by Simply Wall St

NextEra Energy (NYSE:NEE) announced its earnings for Q1 2025, revealing a significant 63% drop in net income despite a 9% increase in sales. This mixed financial performance coincided with a 2.48% rise in the company's share price over the past week. The price movement remained in line with the broader market, where indexes like the Nasdaq saw gains driven by investor enthusiasm around earnings reports and potential tariff news from Washington. While the declining net income might have tempered enthusiasm, the company's share price move still reflected the overall upward momentum in the market.

NextEra Energy's Q1 2025 earnings report revealed a mixed performance, which could influence investor sentiment moving forward. Despite a 63% decline in net income, the 9% rise in sales might indicate resilience in certain areas of the business. Over a five-year period, the company achieved a total return of 29.10%, reflecting a solid long-term performance. However, this year, NextEra has underperformed compared to the broader US Electric Utilities industry and the overall US market, both of which saw higher returns.

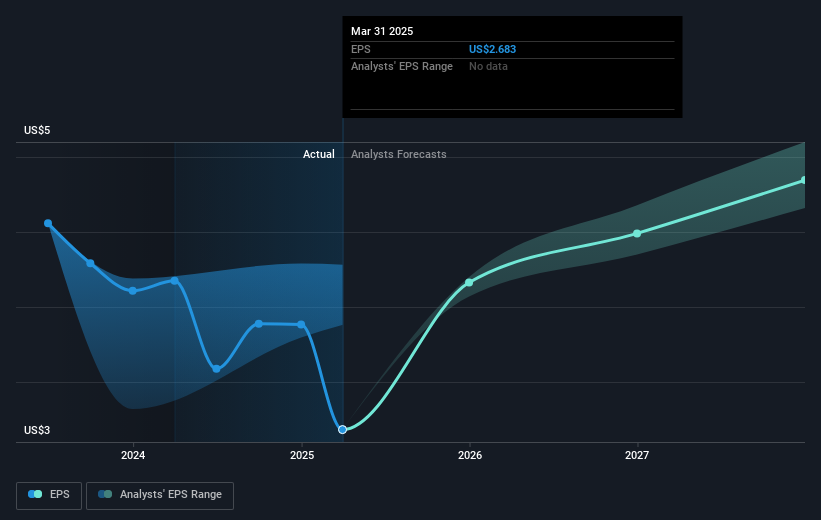

The earnings report might temper the optimistic growth narrative centered around renewable expansion, raising questions about future revenue and earnings forecasts. If the current challenges persist, the anticipated sustained revenue growth and consistent earnings could face headwinds, impacting the bullish analyst projections of 15.4% annual revenue growth. Additionally, potential changes in regulatory or economic conditions might alter the company's future financial landscape.

While NextEra's recent share price movement aligns with short-term market trends, it's crucial to consider the longer-term trajectory in context. Currently trading around US$66.64, the stock remains below analyst price targets, with consensus estimates suggesting a rise to US$82.65. If realized, this target could indicate a significant upside, but much depends on operational improvements and external factors aligning with growth forecasts. The gap from the highest bullish price target of US$103 underscores differing expectations surrounding NextEra's future performance, warranting cautious optimism among investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion