- United States

- /

- Electric Utilities

- /

- NYSE:NEE

NextEra Energy (NEE): Valuation in Focus After Fresh Analyst Coverage and Renewed Optimism on AI-Driven Growth

Reviewed by Kshitija Bhandaru

NextEra Energy (NEE) has been drawing attention after Evercore ISI initiated coverage with an upbeat outlook. Several analysts have also reaffirmed positive recommendations. The company’s leadership in renewables and its exposure to growing demand from AI data centers are in focus.

See our latest analysis for NextEra Energy.

After a prolonged lull, NextEra Energy’s share price has surged in recent weeks, jumping over 20% in the past month as investors responded to upbeat analyst coverage and a wave of renewed interest in clean energy growth stories. This fresh momentum has helped propel the stock to an 18% year-to-date share price return. Total shareholder returns now stand at 3% over the past year and nearly 29% over three years. The recent action suggests optimism is building once again, driven by the company’s expanding footprint in renewables and potential upside from accelerating demand in the AI and data center sectors.

If you want to see how other fast-moving names stack up, it might be the perfect chance to discover fast growing stocks with high insider ownership

With this sharp rally and multiple analysts assigning bullish ratings, the question now is whether NextEra Energy is truly trading at a bargain or if the market has already priced in all the forthcoming growth opportunities.

Most Popular Narrative: 2.6% Undervalued

With the current narrative implying a fair value of $86.79 for NextEra Energy compared to its last close at $84.53, there is a modest premium suggested by analysts. The modest undervaluation hinges on expectations of continued renewable buildout, regulatory tailwinds, and robust earnings growth. But what is the real driver powering this price target?

"Declining costs and rapid deployment timelines of renewables (solar, wind, and especially battery storage), along with NextEra's unrivaled supply chain and perpetual construction capabilities, allow the company to extract significant pricing and operational advantages over competitors. This helps to expand margins and accelerate earnings as cost pressures mount elsewhere in the sector."

What bold assumptions are at the heart of this call? There is a hidden growth math under the hood: profit margins, rising earnings, and ambitious future multiples. Want to see the earnings leap and specific projections analysts are banking on? Dig into the full narrative for the blockbuster figures and logic driving this fair value.

Result: Fair Value of $86.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and higher financing costs could dampen NextEra’s growth outlook and serve as catalysts for a shift in the current narrative.

Find out about the key risks to this NextEra Energy narrative.

Another View: What Do Valuation Ratios Tell Us?

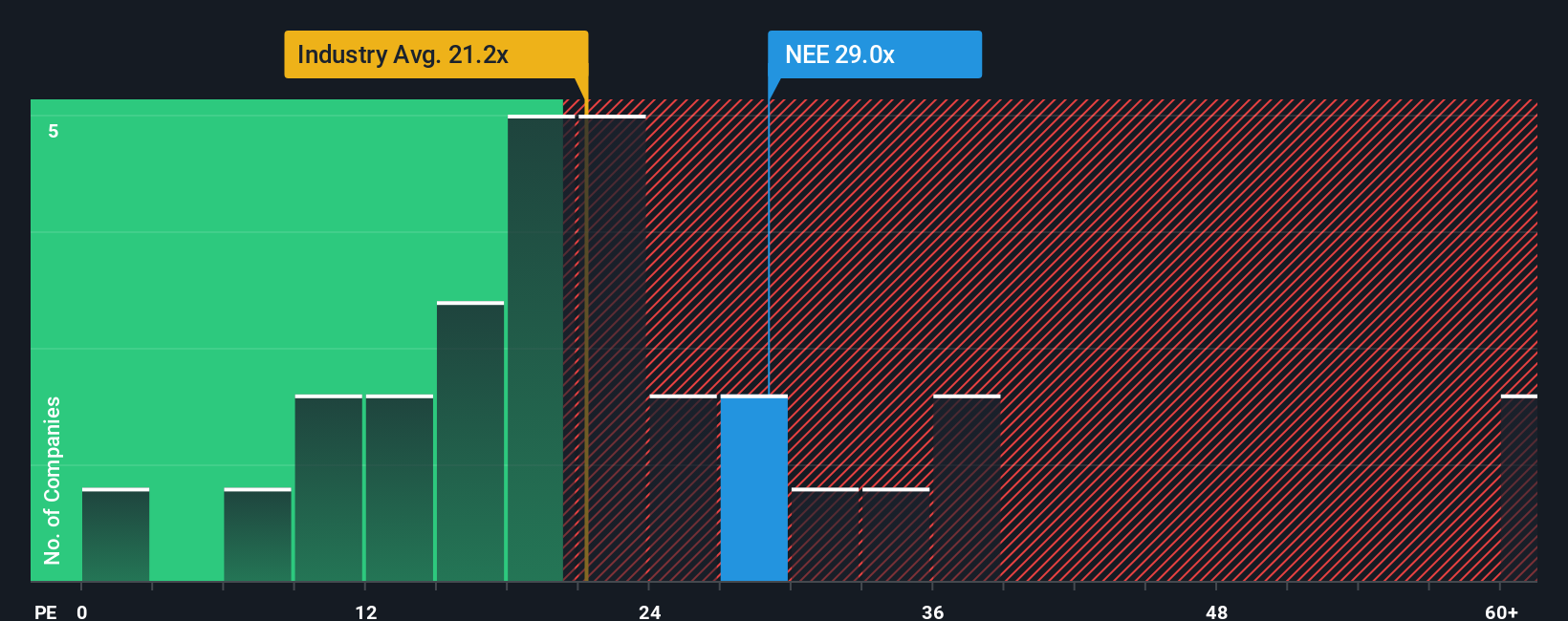

When we look at NextEra Energy’s price-to-earnings ratio of 29.4x, it stands out as higher than both the US Electric Utilities industry average of 21.3x and its closest peers at 25.9x. Even compared to the fair ratio the market could revert to (28.5x), the stock appears expensive. Does this premium mean investors are overconfident, or is there something in NextEra’s story the market sees as unique?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NextEra Energy Narrative

If you have a different perspective or want to test your own assumptions with the numbers, you can build a personalized view in just a few minutes. Do it your way

A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next big headline. Put your money to work by finding standout companies with the Simply Wall Street Screener. The right ideas could transform your portfolio and keep you ahead of other investors.

- Supercharge your income potential by tracking these 18 dividend stocks with yields > 3% offering yields over 3% and solid financials.

- Unlock innovation and disruptive growth by following these 24 AI penny stocks driving breakthroughs in artificial intelligence technologies.

- Spot tomorrow’s leaders with these 3596 penny stocks with strong financials showing strong fundamentals and promising financial health before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives