- United States

- /

- Electric Utilities

- /

- NYSE:NEE

NextEra Energy, Inc.'s (NYSE:NEE) Shareholders Might Be Looking For Exit

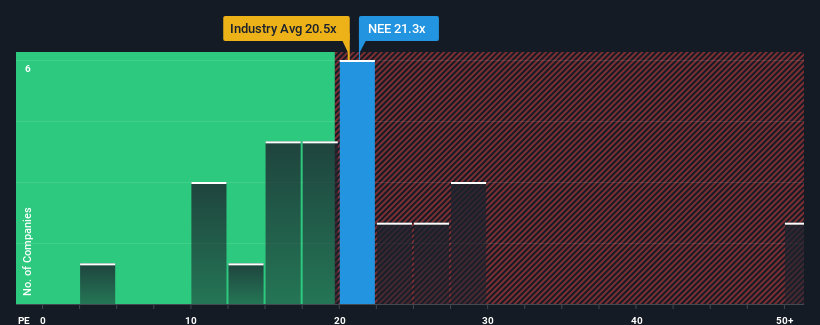

With a price-to-earnings (or "P/E") ratio of 21.3x NextEra Energy, Inc. (NYSE:NEE) may be sending bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

NextEra Energy hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for NextEra Energy

Is There Enough Growth For NextEra Energy?

The only time you'd be truly comfortable seeing a P/E as high as NextEra Energy's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 181% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 8.2% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 11% per annum, which is noticeably more attractive.

In light of this, it's alarming that NextEra Energy's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From NextEra Energy's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that NextEra Energy currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 3 warning signs for NextEra Energy (1 is a bit concerning!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NEE

NextEra Energy

Through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.