- United States

- /

- Gas Utilities

- /

- NYSE:MDU

Assessing MDU Resources Group (MDU): Is There More Value After Recent Share Price Momentum?

Reviewed by Simply Wall St

MDU Resources Group (MDU) stock has caught some attention lately, especially as the shares have posted strong gains over the past month. Recent performance is prompting investors to take another look at the company’s value and growth prospects.

See our latest analysis for MDU Resources Group.

Momentum in MDU Resources Group’s share price has really picked up, with a 1-month share price return of nearly 16% and a year-to-date gain edging close to 8%. That said, the bigger story is the company’s long-term compounding effect, as shown by a 1-year total shareholder return of almost 25% and a massive 147% total return over five years. This suggests that recent optimism could be part of a sustainable pattern, rather than just a short-lived spike.

If this kind of consistent outperformance piques your interest, now’s a great opportunity to explore fast growing stocks with high insider ownership.

The stock’s rapid climb raises an important question: are investors late to the party, or does MDU still trade at an attractive price that reflects future growth potential?

Most Popular Narrative: 3.2% Undervalued

MDU Resources Group closed at $19.35, coming in below the narrative fair value estimate of $20. The gap, though modest, points to expectations that recent momentum could continue as infrastructure tailwinds and earnings upgrades feed into sentiment.

Strong ongoing and future investment in U.S. infrastructure, including large pipeline expansion projects and potential new transmission or generation to serve data centers, positions MDU to benefit from robust construction demand and growing energy needs. This could provide significant future revenue and earnings uplift.

Curious about the math behind this valuation boost? The secret mix involves aggressive revenue growth targets, higher profit margins, and a future profit multiple that stands out from industry norms. If you want to see which projections and assumptions might justify that premium, you’ll need to dig into the full narrative.

Result: Fair Value of $20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently rising operational costs or a faster transition to renewables could weaken MDU’s favorable outlook and put pressure on long-term earnings growth.

Find out about the key risks to this MDU Resources Group narrative.

Another View: Market Ratios Tell a Different Story

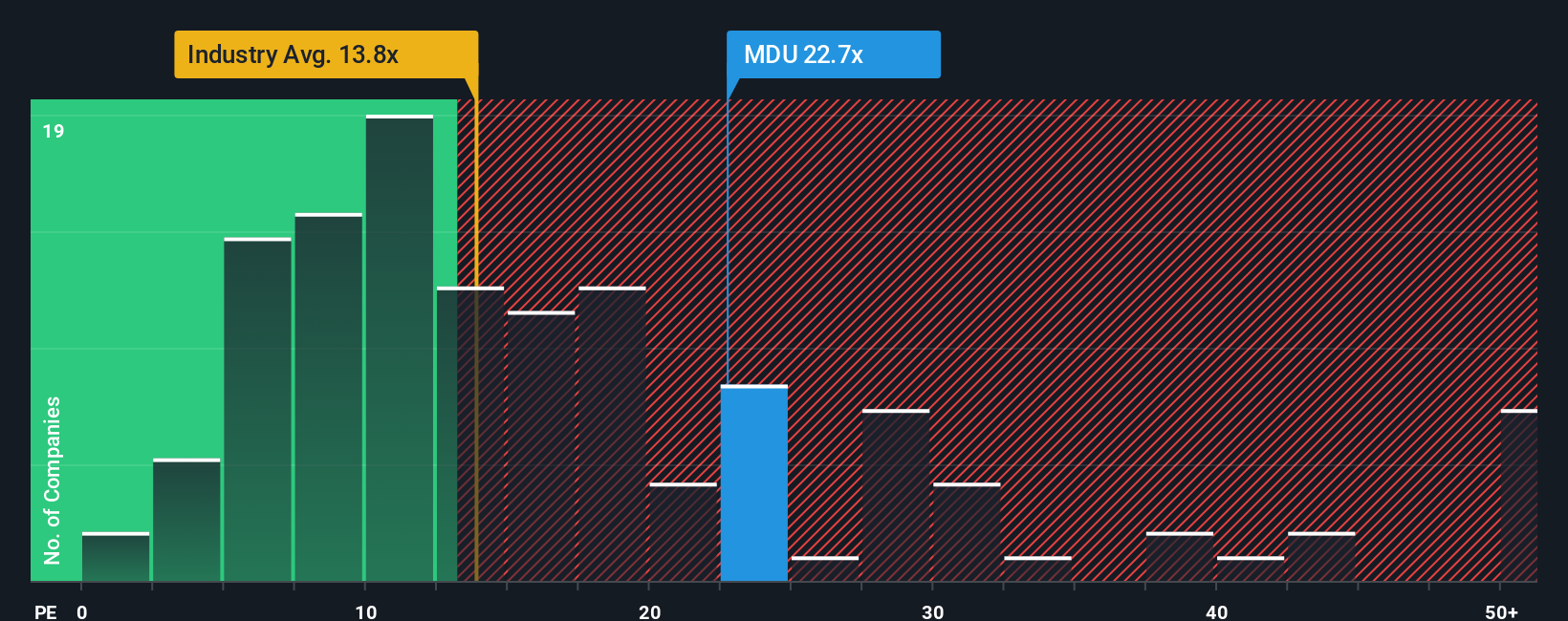

Looking at MDU Resources Group’s valuation through the lens of price-to-earnings, the shares trade at 21.6x earnings. That is above both the global gas utilities industry average of 13.7x and peer average of 16.8x, but still under the fair ratio of 24.6x. This premium could reflect future growth confidence, or it might signal added risk if projections miss the mark. Is the market too optimistic, or are investors seeing value others have missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MDU Resources Group Narrative

If you want to analyze the numbers differently or test your own assumptions, you can quickly craft your own take in just a few minutes. Dive in and Do it your way.

A great starting point for your MDU Resources Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t sit on the sidelines while these market trends unfold. Take the next step and put bold new opportunities on your radar with these tailored stock ideas:

- Capitalize on the artificial intelligence boom and kickstart your search for future leaders with these 24 AI penny stocks, which are shaping tomorrow’s innovations right now.

- Harness the potential for stable passive income by checking out these 17 dividend stocks with yields > 3%, featuring companies with strong yields above 3%.

- Seize early potential in breakthrough financial technologies as you look through these 79 cryptocurrency and blockchain stocks, which are adapting to blockchain and digital asset revolutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MDU

MDU Resources Group

Engages in the regulated energy delivery businesses in the United States.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives