- United States

- /

- Electric Utilities

- /

- NYSE:IDA

The Bull Case For IDACORP (IDA) Could Change Following Proposed $110 Million Rate Hike Settlement

Reviewed by Sasha Jovanovic

- Earlier this month, IDACORP announced it reached a settlement with the Idaho Public Utilities Commission for a US$110 million annual retail revenue increase to take effect on January 1, 2026, if approved.

- This agreement revises IDACORP's allowed return on equity and defers wildfire mitigation expense recovery, potentially shaping the company's financial framework for years ahead.

- We'll explore how the proposed revenue increase and regulatory changes could influence IDACORP's future business and financial outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

IDACORP Investment Narrative Recap

To be a shareholder in IDACORP, you need to believe in its ability to manage strong regional electricity demand growth and navigate capital-intensive infrastructure investments while achieving supportive regulatory outcomes. The recently announced US$110 million annual retail revenue increase, if approved, would help address rising costs and support the company’s earnings capacity, but the biggest short term catalyst, regulatory approval of this rate case, and the primary risk, regulatory disallowance of cost recovery or return on equity, remain firmly tied to the Idaho Public Utilities Commission’s final decision.

One recent announcement that stands out in this context is IDACORP’s decision to raise the lower end of its 2025 earnings guidance following the settlement. This signals management’s confidence in future cash flow stability, should the settlement proceed, and ties closely to analyst and investor focus on the company’s ability to maintain returns amid regulatory and operational headwinds.

Yet, it’s important for investors to also consider the unanswered questions around regulatory lag and the possibility that...

Read the full narrative on IDACORP (it's free!)

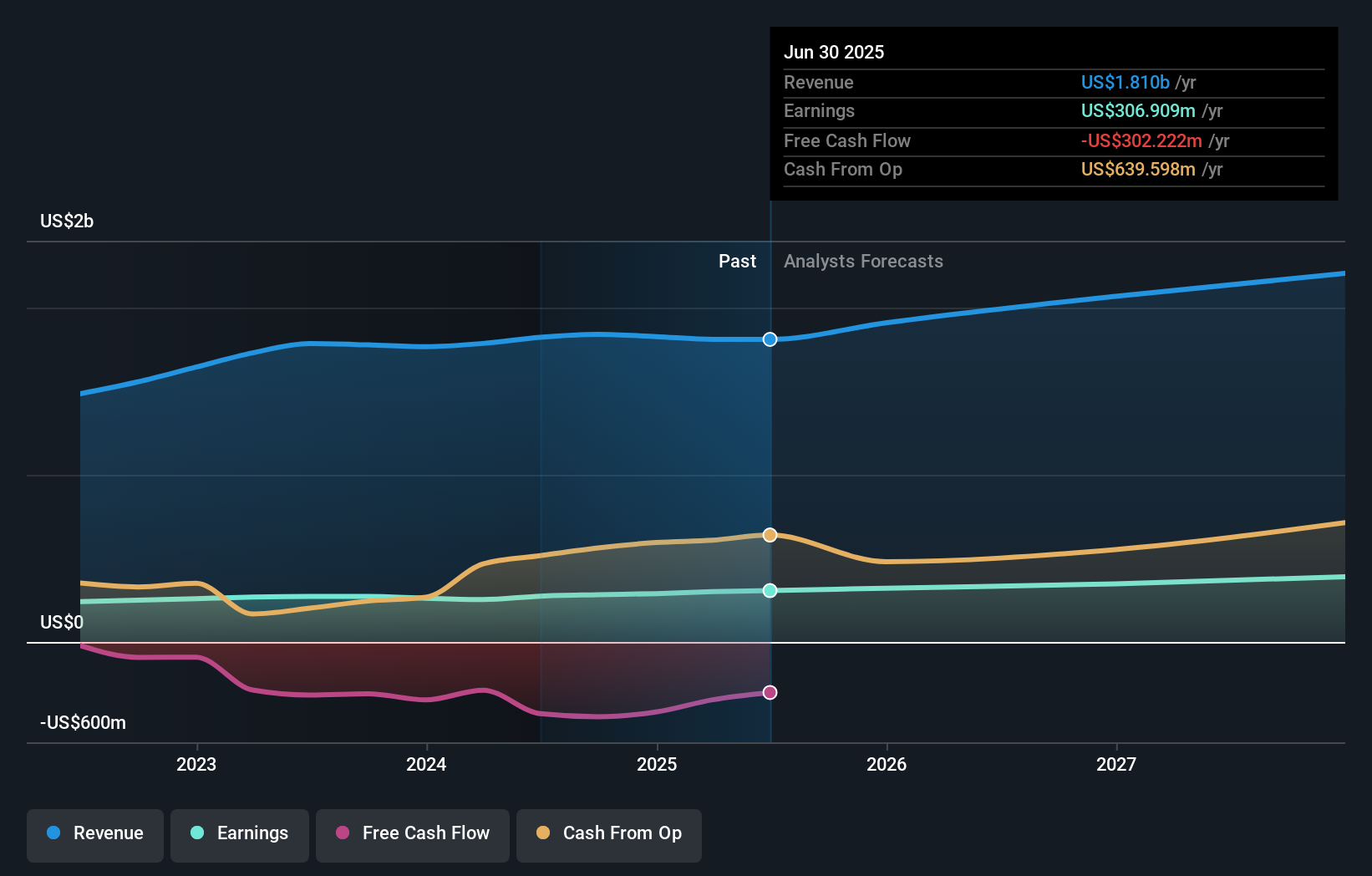

IDACORP's outlook anticipates $2.3 billion in revenue and $441.8 million in earnings by 2028. This implies an 8.3% annual revenue growth rate and a $134.9 million earnings increase from the current $306.9 million.

Uncover how IDACORP's forecasts yield a $140.43 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered fair value estimates for IDACORP ranging from US$102.47 to US$140.43 based on three analyses. Despite this spread, the potential for delayed or unfavorable regulatory decisions continues to shape broad investor expectations about future returns.

Explore 3 other fair value estimates on IDACORP - why the stock might be worth 24% less than the current price!

Build Your Own IDACORP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IDACORP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IDACORP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IDACORP's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives