- United States

- /

- Electric Utilities

- /

- NYSE:IDA

Taking Stock of IDACORP (IDA) After Morgan Stanley’s Upgrade: What the New Growth Story Means for Valuation

Reviewed by Simply Wall St

Morgan Stanley’s upgrade of IDACORP (IDA) to a buy is centered on future demand, with expected power needs from a second Micron fab, increased mining activity, and potential data centers reshaping the company’s long term growth story.

See our latest analysis for IDACORP.

Even after a muted recent stretch for the share price, with short term moves roughly flat, IDACORP’s year to date share price return near 16 percent and five year total shareholder return above 50 percent suggest momentum is quietly building behind the upgraded growth story.

If this kind of infrastructure driven growth theme interests you, it is a good moment to widen the lens and explore fast growing stocks with high insider ownership.

Yet with the stock already up strongly, trading close to fresh highs and only a modest discount to analyst targets, investors now have to ask whether IDACORP still offers upside or whether future growth is fully priced in.

Most Popular Narrative Narrative: 10.4% Undervalued

Compared with IDACORP’s last close at $125.82, the most widely followed narrative points to a higher fair value anchored in steady, regulated growth.

Massive planned capital investments in transmission lines, energy storage, and generation assets, supported by a constructive regulatory environment and recent rate case filings, are set to expand IDACORP's rate base, enhancing regulated returns and long-term earnings growth.

Want to see the math behind that higher fair value? The narrative leans on accelerating revenue, rising margins, and a richer future earnings multiple. Curious which assumptions really move the needle? Dive in to unpack the full growth blueprint and how it all compounds into that valuation target.

Result: Fair Value of $140.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent hydro dependence and heavy capital needs leave earnings and returns vulnerable if weather patterns worsen or regulators resist timely cost recovery.

Find out about the key risks to this IDACORP narrative.

Another View: Market Signals Look Less Generous

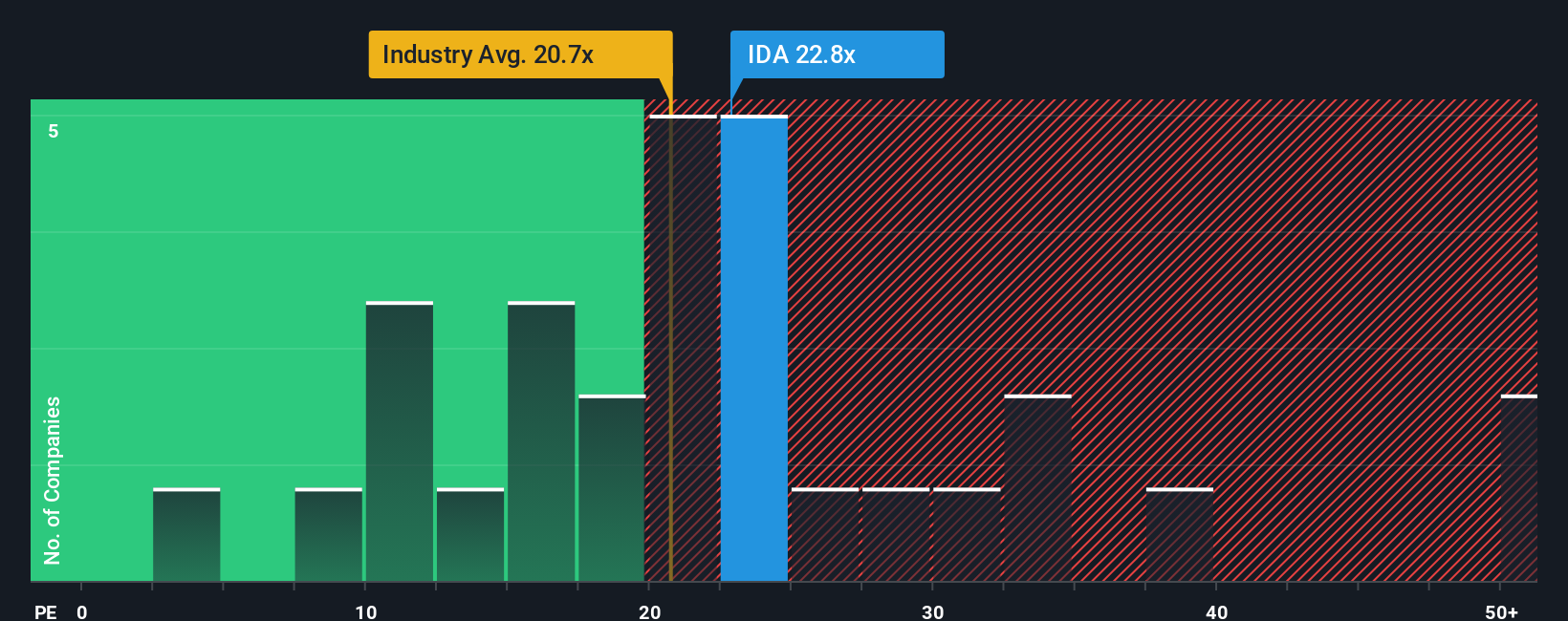

Our valuation shows a different angle. On a price to earnings basis, IDACORP trades at 21.4 times, a touch above the US Electric Utilities average of 19.4 times and slightly above its own fair ratio of 21 times, hinting that optimism may already be priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out IDACORP for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own IDACORP Narrative

If you see the numbers differently, or want to stress test your own assumptions, you can build a personalized IDACORP story in just a few minutes: Do it your way.

A great starting point for your IDACORP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, you may want to scan a few hand picked stock ideas on Simply Wall St to help avoid overlooking potential opportunities.

- Explore early stage potential by tracking these 3632 penny stocks with strong financials that pair smaller market caps with underlying financial strength rather than relying solely on speculation.

- Consider companies at the center of these 29 healthcare AI stocks, where data driven medicine is reshaping how healthcare is delivered.

- Review these 12 dividend stocks with yields > 3% to find businesses that aim to provide a steadier income stream, even when markets are volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion