- United States

- /

- Electric Utilities

- /

- NYSE:IDA

IDACORP (IDA) Margins Climb to 17.6%, Reinforcing Quality Narrative Despite Premium Valuation

Reviewed by Simply Wall St

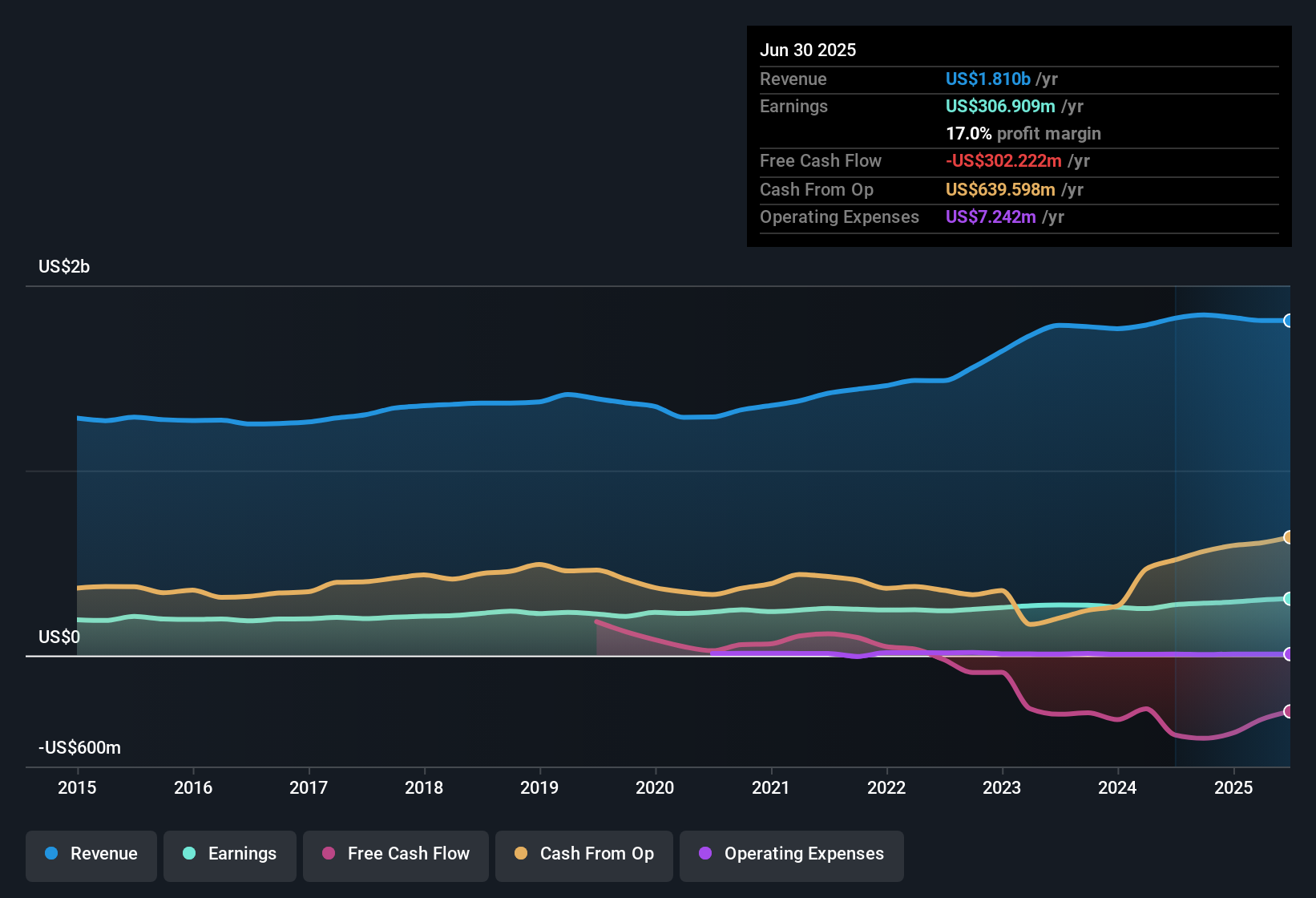

IDACORP (IDA) delivered earnings growth of 12.5% over the past year, outpacing its five-year average annual pace of 4.9%. Net profit margins climbed to 17.6% from last year’s 15.4%, setting a high bar for quality in its reported numbers. Looking ahead, forecasts call for annual earnings growth of 10.7% with revenue rising 7.6% per year, both trailing behind expected rates for the broader US market. At the same time, shares change hands at a Price-to-Earnings ratio of 21.9x, exceeding peer and industry averages, and currently trade above an estimated fair value. Growth prospects seem steady, but some investors may focus on the sustainability of the dividend and the company's financial position as key risks.

See our full analysis for IDACORP.Next, we'll put these headline results up against the prevailing narratives on Simply Wall St to see how the facts match up with market expectations.

See what the community is saying about IDACORP

Margins Set Sights on 19%

- Analysts forecast profit margins expanding from 17.0% now to 19.2% in three years, a substantial jump that could drive stronger bottom-line results even if revenue growth stays moderate.

- According to the analysts' consensus view, this margin boost is projected to flow from high-value infrastructure investment and regulatory support. However,

- these optimistic targets rely on rate approvals keeping pace with growing expenses and successful execution of new projects

- the consensus narrative notes that cost overruns or regulatory lag could quickly dampen these expected margin gains

- The latest numbers set up a clear test of whether operational effectiveness and supportive regulation can overcome hefty planned capex and exposure to industry-wide cost pressures.

📊 Read the full IDACORP Consensus Narrative.

PE Ratio Above Industry Standards

- IDACORP's current price-to-earnings ratio of 21.9x tops both its peer group (21.7x) and the broader electric utilities industry average (21.3x), signaling a valuation premium that puts pressure on future execution.

- From the consensus narrative, investors are weighing the company's track record, bolstered by a projected $441.8 million in earnings by 2028,

- against the expectation that the future PE will need to fall to 20.5x for the valuation approach to hold up

- and noting that rate base expansion alone may not justify paying more than the industry average without clear upside on load growth or cost recovery

Share Price Sits Above DCF Fair Value

- Shares currently trade at $129.02, significantly above the DCF fair value estimate of $102.47, and just shy of the consensus analyst price target ($140.43), marking a narrow 8.8% gap to the target but a notable 20.6% premium over modeled intrinsic value.

- Consensus narrative flags that this pricing reflects balanced views:

- The potential for customer and electrification-driven load growth may warrant a modest premium, compared to peers and sector averages.

- However, cost, regulatory, and execution risks mean shares could revert closer to modeled value absent strong future results.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for IDACORP on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures that others might have missed? Make your take known and craft your own narrative in just a few minutes. Do it your way

A great starting point for your IDACORP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Despite solid projected earnings, IDACORP’s premium valuation and share price present a risk that there may not be enough upside to justify paying more than peers.

If you want to pinpoint stocks trading at more attractive prices relative to their fundamentals, check out these 832 undervalued stocks based on cash flows where valuation is on your side.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives