- United States

- /

- Electric Utilities

- /

- NYSE:IDA

How Investors Are Reacting To IDACORP (IDA) Raising Guidance on Infrastructure-Fueled Customer Growth

Reviewed by Simply Wall St

- IDACORP recently reported its second quarter 2025 earnings, highlighting US$450.88 million in revenue and a rise in net income to US$95.78 million, prompting an increase in full-year earnings guidance to the range of US$5.70 to US$5.85 per diluted share.

- An important driver behind these financial results is the company’s new customer growth, fueled by major infrastructure investments from large-scale projects such as Micron’s plant, expanding data centers, and Tesla charging stations.

- We'll examine how IDACORP’s raised earnings guidance, amid accelerating customer expansion, could reshape the company’s investment narrative and risk profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

IDACORP Investment Narrative Recap

To be a shareholder in IDACORP, belief in the company’s large-scale infrastructure growth and its ability to successfully recover capital costs through regulatory channels is vital. The latest earnings release and raised guidance signal that new customer additions remain the central catalyst, while reliance on timely regulatory approvals continues to be the main risk; this news does not appear to meaningfully shift that balance for now.

Of the recent announcements, the company’s initiation of a $199 million rate increase through a general rate case in Idaho directly relates to the growth and earnings guidance discussed. Securing supportive regulatory terms and timely approval is closely tied to the company's ability to convert capital investment into sustained earnings, so this development stands out when considering the importance of new projects and rate base growth.

However, despite customer momentum and strong guidance, investors still need to be mindful of what could unfold if regulatory decisions fall behind expectations...

Read the full narrative on IDACORP (it's free!)

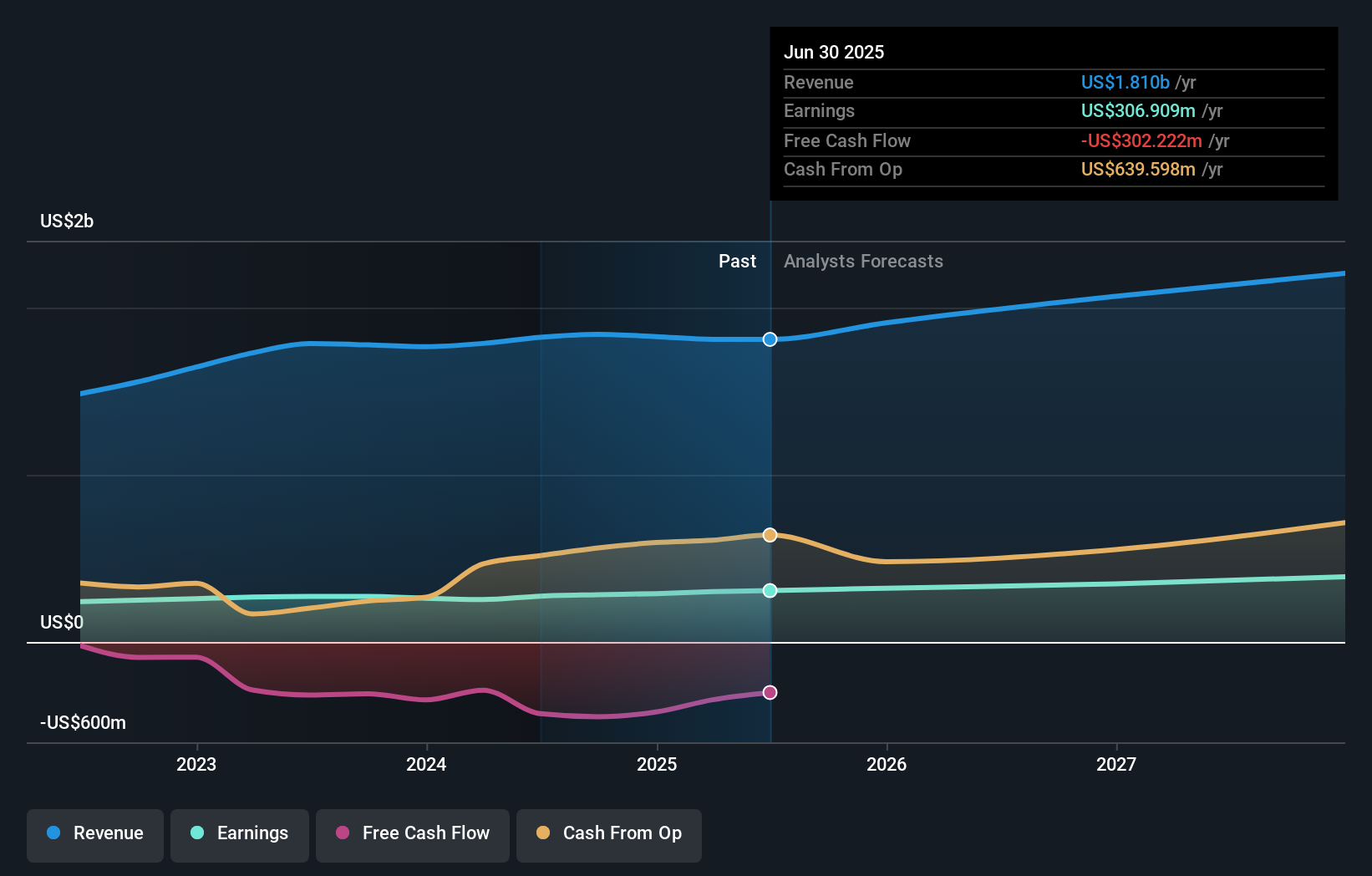

IDACORP's narrative projects $2.3 billion revenue and $425.5 million earnings by 2028. This requires 7.9% yearly revenue growth and a $124.9 million earnings increase from $300.6 million currently.

Uncover how IDACORP's forecasts yield a $126.43 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community’s sole fair value estimate of US$101.45 is well below consensus price targets. Given that regulatory outcomes remain a key risk, you may want to compare different viewpoints and expectations for future recovery rates.

Explore another fair value estimate on IDACORP - why the stock might be worth 19% less than the current price!

Build Your Own IDACORP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IDACORP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free IDACORP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IDACORP's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives