- United States

- /

- Electric Utilities

- /

- NYSE:IDA

A Look at IDACORP's Valuation Following Rate Case Settlement and Upbeat Analyst Coverage

Reviewed by Simply Wall St

IDACORP (IDA) reached a settlement stipulation with the Idaho Public Utilities Commission in its ongoing rate case, aiming for a $110 million revenue increase and outlining new terms for return on equity and wildfire mitigation costs.

See our latest analysis for IDACORP.

IDACORP’s share price has rallied 24.5% year-to-date, with momentum accelerating after the major settlement news and a fresh analyst Buy rating. Over the past year, total shareholder return reached 34%, and the company’s steady dividend keeps long-term investors well rewarded.

If you’re searching for more resilient names with upward momentum in today’s market, now is a great chance to broaden your perspective and discover fast growing stocks with high insider ownership

With IDACORP’s rally far outpacing the broader utilities sector and fresh analyst optimism pushing expectations even higher, investors now face a critical question: does the recent surge still leave room for upside, or has the market already priced in the next phase of growth?

Most Popular Narrative: 3.8% Undervalued

With IDACORP’s narrative valuation of $140.43 exceeding the most recent closing price of $135.08, the popular analyst view sees current price momentum as justified by a slightly higher fair value. The stage is set for more growth if those supporting trends materialize as projected.

Massive planned capital investments in transmission lines, energy storage, and generation assets, supported by a constructive regulatory environment and recent rate case filings, are set to expand IDACORP's rate base, enhancing regulated returns and long-term earnings growth.

Want to know what’s fueling this bullish estimate? Dive deeper to uncover the ambitious investment plans and aggressive earnings assumptions that underpin the consensus price target. Which growth levers are analysts betting on for the next phase? Find out what’s really driving this valuation.

Result: Fair Value of $140.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on hydroelectric power and regulatory uncertainties around major projects could quickly challenge IDACORP’s current growth expectations.

Find out about the key risks to this IDACORP narrative.

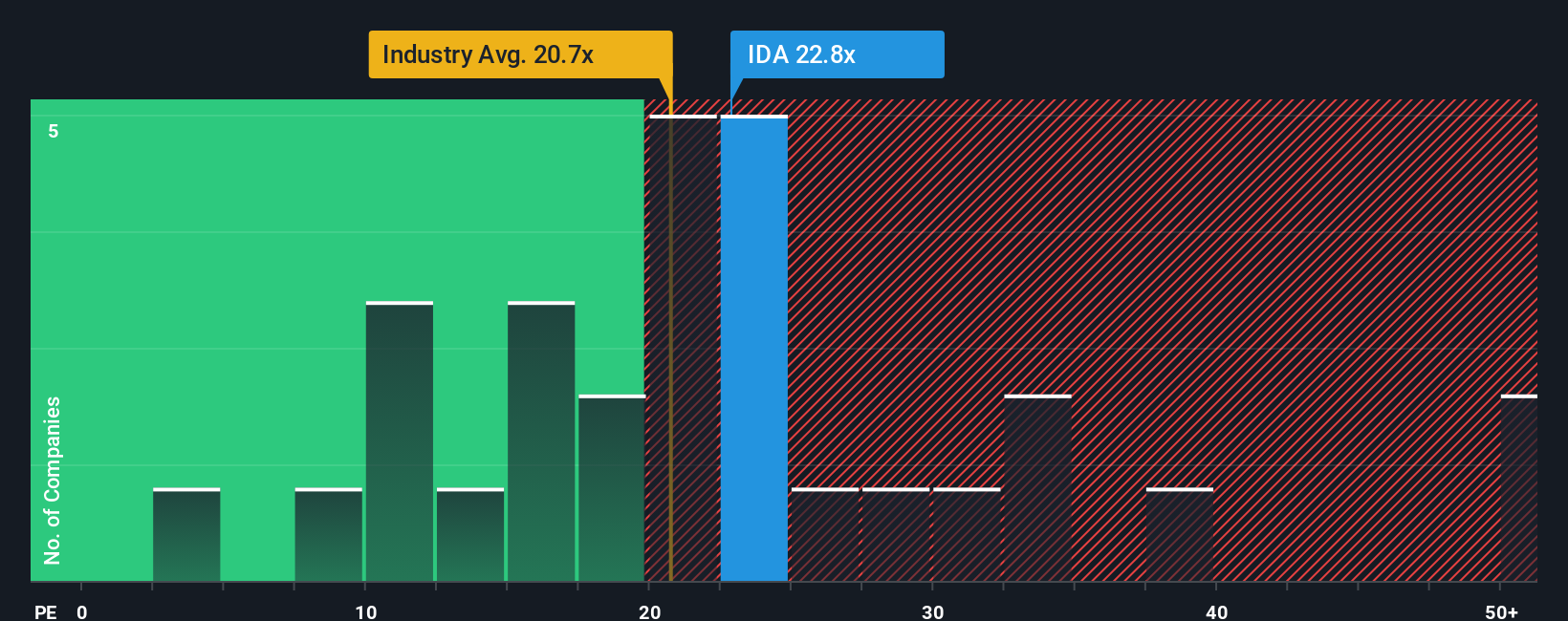

Another View: Trading at a Premium to Peers

Looking through a market multiples lens, IDACORP is currently trading at a price-to-earnings ratio of 23.8x. This stands out as more expensive than the US utility industry average of 21.3x, its peer group average of 22.3x, and even above its fair ratio of 19.8x. This premium suggests the market may be pricing in more growth or quality than fundamentals alone justify. Will investor optimism keep pushing the price higher, or could this premium become a risk if expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDACORP Narrative

If you want to challenge the consensus or dig into the numbers yourself, you can easily craft your own perspective in just a few minutes, so why not Do it your way.

A great starting point for your IDACORP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio with unique opportunities you might have missed. These hand-picked strategies could put you one step ahead of the crowd.

- Tap into future-defining healthcare with these 33 healthcare AI stocks, which leverage artificial intelligence to revolutionize patient care, diagnostics, and efficiency.

- Ride powerful dividend income streams by checking out these 17 dividend stocks with yields > 3%, featuring established companies with yields above 3% for reliable cash flow.

- Push the boundaries with these 28 quantum computing stocks, backing the pioneers shaping tomorrow’s breakthroughs in quantum computing and advanced technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDA

IDACORP

Engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives