- United States

- /

- Capital Markets

- /

- NYSE:PEO

Discover US Undiscovered Gems With Potential In June 2025

Reviewed by Simply Wall St

The United States market has shown resilience, with a flat performance over the last week and a 9.9% increase over the past year, while earnings are anticipated to grow by 14% annually. In this environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Nutex Health (NUTX)

Simply Wall St Value Rating: ★★★★★★

Overview: Nutex Health Inc. is a physician-led healthcare services and operations company in the United States with a market cap of approximately $679.28 million.

Operations: Nutex Health generates revenue primarily from its Hospital Division, which accounts for approximately $592.98 million, and its Population Health Management Division, contributing around $31.30 million. The company's financial structure highlights a focus on healthcare services with distinct revenue streams from these two divisions.

Nutex Health, a physician-led healthcare services company, is strategically expanding its micro-hospitals in high-growth areas like Texas to meet the rising demand for accessible care. The company's recent profitability marks a significant turnaround, with debt to equity dropping from 87.9% to 15.5% over five years and EBIT covering interest payments 9.6 times over. However, heavy reliance on arbitration for revenue poses risks amid potential regulatory changes that could affect reimbursement rates and revenue stability. Despite these challenges, analysts forecast an annual revenue growth rate of 14.5%, though profit margins are expected to decrease due to labor pressures and market constraints.

Genie Energy (GNE)

Simply Wall St Value Rating: ★★★★★★

Overview: Genie Energy Ltd. operates through its subsidiaries to provide energy services both in the United States and internationally, with a market cap of $668.73 million.

Operations: Genie Energy's primary revenue stream comes from Genie Retail Energy, contributing $423.35 million, while Genie Renewables adds $18.97 million.

Genie Energy, a nimble player in the energy sector, is making waves with its strategic expansions into California and Kentucky. Over the past year, earnings surged by 79%, outpacing the industry average of 7.6%. The company's debt-to-equity ratio has improved from 5.2 to 4.8 over five years, reflecting prudent financial management. Recent buybacks saw Genie repurchase over 127,000 shares for $1.88 million in early 2025 alone, indicating confidence in its growth trajectory. Despite potential hurdles like margin compression and fierce competition, Genie trades at a notable discount of nearly 59% below estimated fair value, suggesting room for appreciation.

Adams Natural Resources Fund (PEO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Adams Natural Resources Fund, Inc. is a publicly owned investment manager with a market capitalization of approximately $572.48 million.

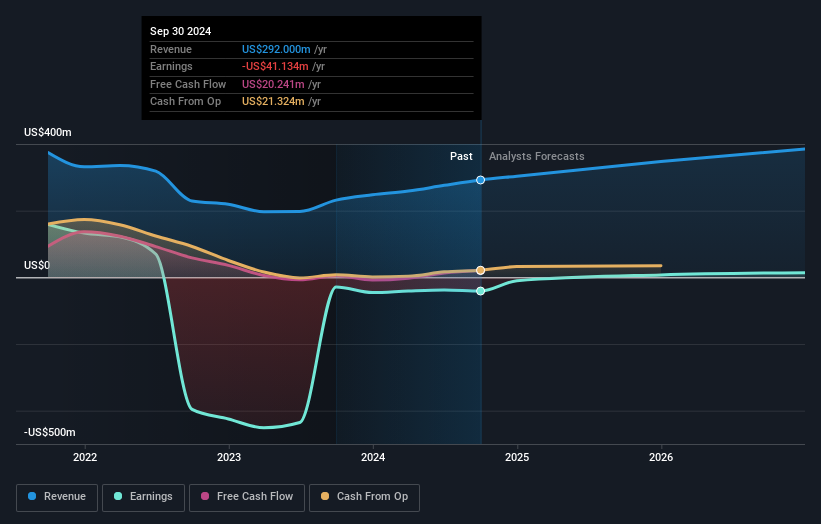

Operations: The fund generates revenue primarily from its financial services segment, specifically closed-end funds, amounting to $20.33 million.

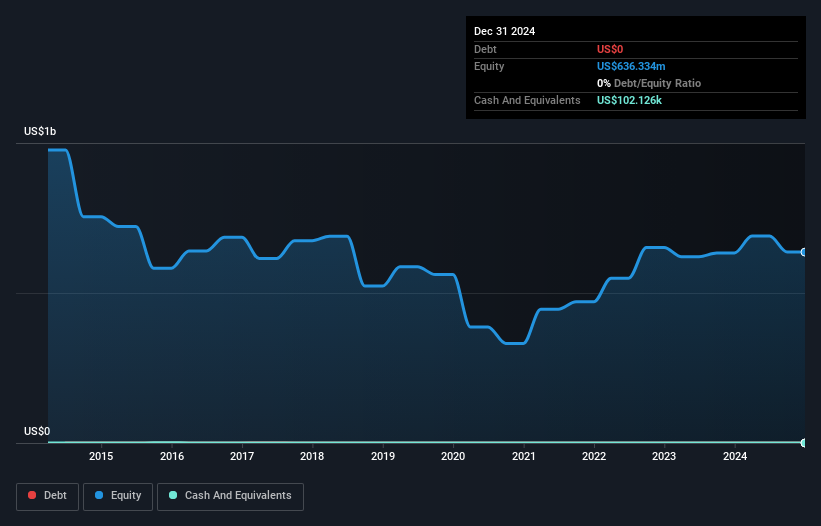

Adams Natural Resources Fund, a small cap player in the capital markets, is making waves with its impressive 218% earnings growth over the past year, outpacing the industry average of 14%. Trading at 59.4% below its estimated fair value suggests potential undervaluation. Despite being debt-free for five years, recent financial results were notably impacted by a $14.2M one-off gain. Leadership changes include Gregory W. Buckley's election as President, bringing extensive experience from roles at BNP Paribas and Citadel LLC. The recent dividend adjustment to $0.52 per share offers flexibility with optional stock or cash payouts to shareholders.

- Navigate through the intricacies of Adams Natural Resources Fund with our comprehensive health report here.

Understand Adams Natural Resources Fund's track record by examining our Past report.

Summing It All Up

- Click here to access our complete index of 289 US Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEO

Flawless balance sheet unattractive dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion