- United States

- /

- Electric Utilities

- /

- NYSE:FE

Did FirstEnergy's (FE) $28B Grid Upgrade Initiative Redefine Its Reliability and Modernization Story?

Reviewed by Simply Wall St

- Earlier this week, FirstEnergy announced a major infrastructure upgrade project in East Akron, aimed at improving electric service reliability for 12,000 Ohio Edison customers, including Summa Akron City Hospital, with completion expected by the end of 2026.

- This initiative is part of the US$28 billion Energize365 investment program running through 2029, emphasizing the company’s long-term focus on grid modernization and operational efficiency.

- We’ll examine how FirstEnergy’s extensive grid upgrades and commitment to service reliability may influence its investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

FirstEnergy Investment Narrative Recap

To own FirstEnergy shares, investors need to believe in the value of regulated utility infrastructure and the company's ability to execute on large-scale modernization projects, like the Energize365 program. While the East Akron grid upgrade demonstrates progress toward reliability and operational improvement, this announcement does not materially shift the most immediate catalysts, successful regulatory settlements in Ohio, and the biggest risk remains uncertainty around those regulatory outcomes rather than infrastructure execution itself. Among recent events, the Board’s continued affirmation of the US$0.445 quarterly dividend stands out for its relevance, reinforcing FirstEnergy’s commitment to returning capital to shareholders even as it undertakes substantial infrastructure investment. Dividend stability often signals confidence in near-term cash flow and earnings visibility, which is closely tied to progress on regulatory and operational fronts. However, should Ohio regulatory settlements face delays or complications, investors should be aware that...

Read the full narrative on FirstEnergy (it's free!)

FirstEnergy's narrative projects $15.5 billion revenue and $1.7 billion earnings by 2028. This requires 4.1% yearly revenue growth and a $0.6 billion earnings increase from $1.1 billion today.

Uncover how FirstEnergy's forecasts yield a $44.76 fair value, a 7% upside to its current price.

Exploring Other Perspectives

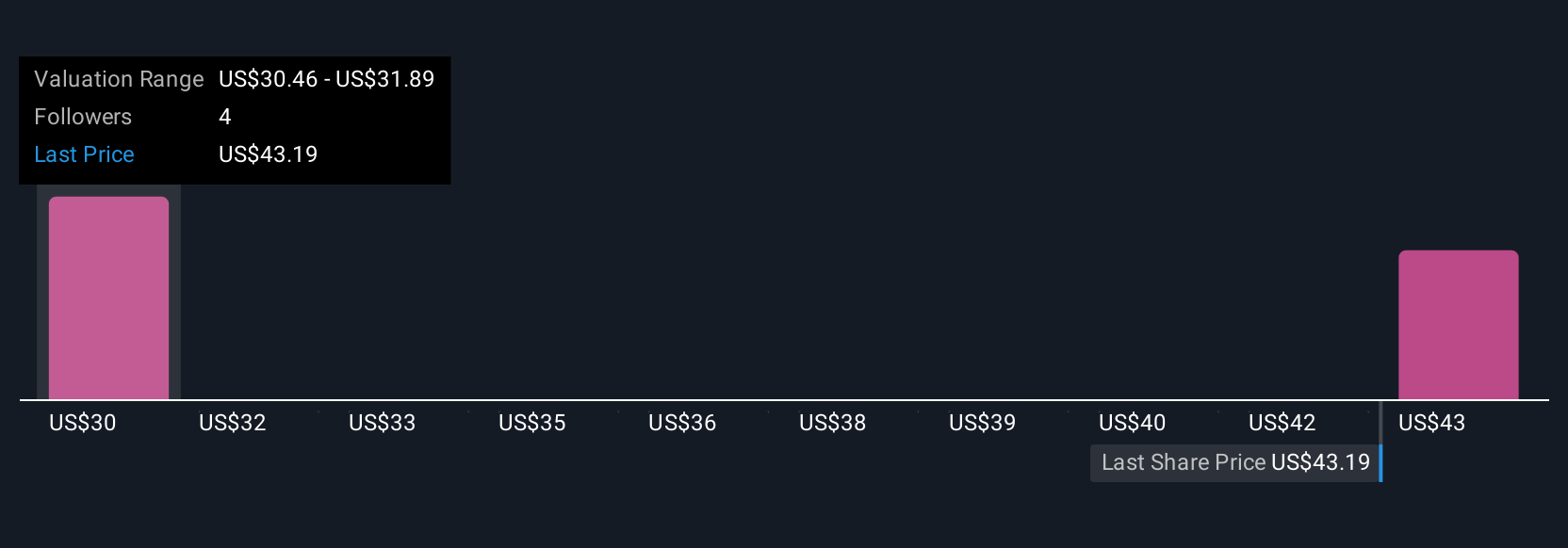

Simply Wall St Community investors offered fair value estimates for FirstEnergy ranging from US$30.47 to US$44.77, with two unique viewpoints represented. With regulatory results in Ohio still pending, your peers see very different scenarios for the company's future performance, consider exploring several perspectives before making up your mind.

Explore 2 other fair value estimates on FirstEnergy - why the stock might be worth as much as 7% more than the current price!

Build Your Own FirstEnergy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FirstEnergy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free FirstEnergy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FirstEnergy's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FE

FirstEnergy

Engages in the generation, distribution, and transmission of electricity in the United States.

Second-rate dividend payer low.

Similar Companies

Market Insights

Community Narratives