- United States

- /

- Electric Utilities

- /

- NYSE:ETR

A Fresh Look at Entergy’s Valuation After Sealing Major Clean Energy Deal With Google

Reviewed by Simply Wall St

Entergy is making headlines after announcing it will supply power for Google’s $4 billion technology expansion in Arkansas. This strategic partnership includes a new 600 MW solar project as well as a substantial 350 MW battery storage system.

See our latest analysis for Entergy.

Entergy’s clean energy push, highlighted by its deal with Google and plans to upgrade nuclear plants, appears to be energizing the stock. The share price has surged 28% year to date, and total shareholder return over the past year reached an impressive 47%, signaling growing investor confidence in its transformation and prospects.

If you’re interested in seeing what other companies are building momentum, now’s a perfect moment to discover fast growing stocks with high insider ownership

With shares soaring and analyst price targets drifting only slightly above current levels, the question now is whether Entergy’s impressive run still leaves room for upside or if the market has already priced in all its future growth potential.

Most Popular Narrative: 1.3% Undervalued

The most-followed narrative pegs Entergy's fair value at $97.98, just above the latest close of $96.71, suggesting a market nearly in sync with analysts’ expectations. The stage is set for a closer look at what is driving this near-parity between price and valuation.

Capital investment of $40 billion over four years (with an expanded pipeline for renewables, grid modernization, and resilience upgrades) is expected to grow the company's rate base and support above-average EPS and earnings growth for several years.

Wondering what numbers could justify such massive capital outlay? The underlying narrative bets big on accelerating earnings growth and a future profit multiple that is rarely seen in traditional utilities. The specific forecasts analysts use to reach this price might surprise even seasoned investors.

Result: Fair Value of $97.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant new capital needs or unexpected regulatory changes could challenge Entergy’s growth momentum and risk undermining the optimistic valuation outlook.

Find out about the key risks to this Entergy narrative.

Another View: What the SWS DCF Model Says

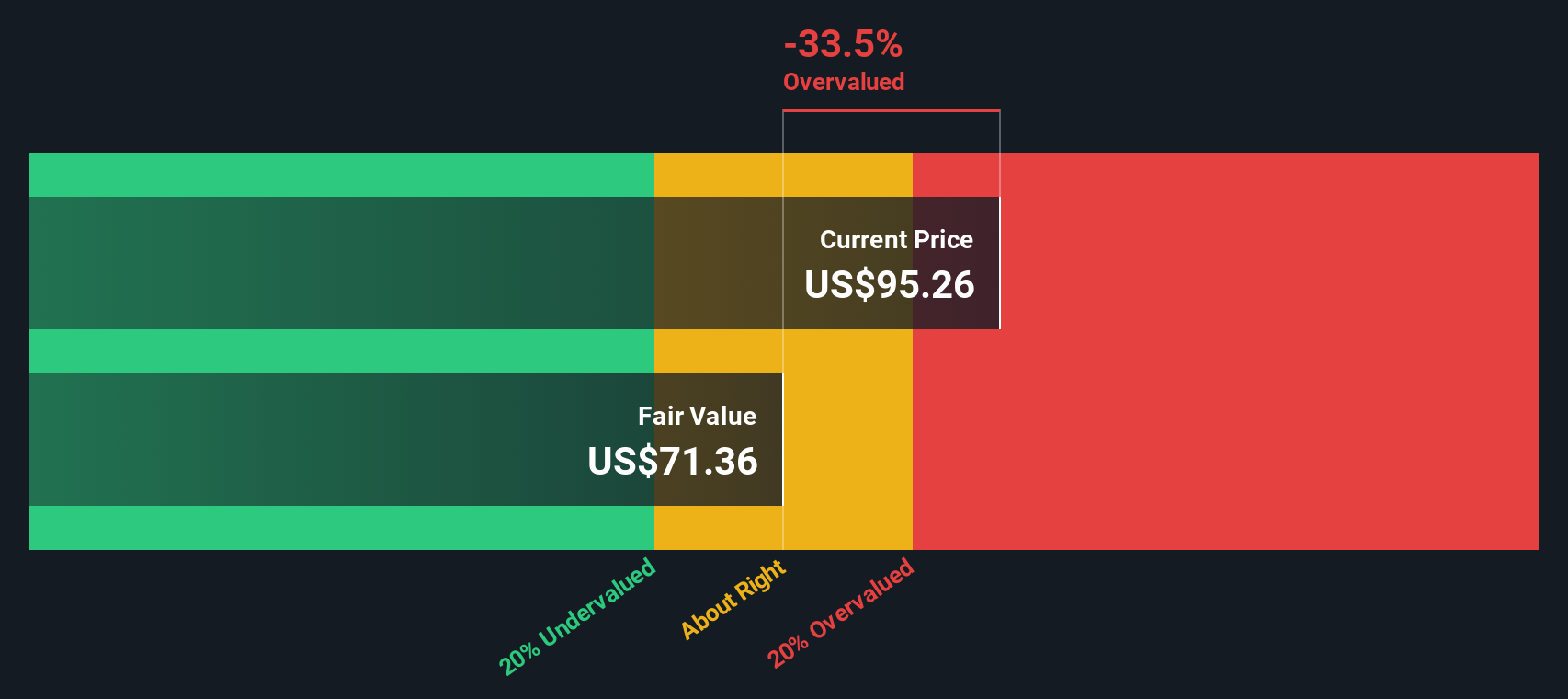

While analysts currently see Entergy as fairly valued based on future earnings multiples, our SWS DCF model tells a different story. The DCF places fair value at $71.92 per share, about 26% below the latest price. This suggests the stock could be overvalued if cash flows disappoint. Which valuation should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Entergy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Entergy Narrative

If you have a different perspective or want to dig into the figures on your own terms, creating a personal narrative takes just a few minutes. Why not give it a try and Do it your way?

A great starting point for your Entergy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize your chance to get ahead and open up a world of fresh stock opportunities. Target the next winning theme before the crowd catches on.

- Pinpoint income-generating plays by tapping into these 17 dividend stocks with yields > 3% with above-average yields for bolstered portfolio returns.

- Spot trailblazers in artificial intelligence and position yourself early by checking out these 24 AI penny stocks reshaping industries right now.

- Strengthen your strategy and uncover tomorrow's bargains through these 876 undervalued stocks based on cash flows based on cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives