- United States

- /

- Electric Utilities

- /

- NYSE:ES

Will Fresh Debt and Wind Project Charges Reshape Eversource Energy's (ES) Balance Sheet Story?

Reviewed by Sasha Jovanovic

- Earlier this week, Eversource Energy completed a US$600 million fixed-income offering of 4.45% senior unsecured notes due December 2030 and recognized a US$75 million after-tax non-recurring charge tied to increased liabilities from its offshore wind project divestitures.

- This combination of a fresh capital raise and higher contingent wind project costs has led Eversource to narrow its full-year recurring earnings guidance and heighten investor focus on its balance sheet resilience.

- With Eversource recording a significant non-recurring charge, we’ll explore how these liability adjustments could shape its investment outlook going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Eversource Energy Investment Narrative Recap

To be a shareholder in Eversource Energy, you need to believe in steadily growing demand for electricity and the company’s ability to harness infrastructure upgrades, rate base expansion, and regulatory approvals to deliver recurring earnings over time. The latest US$600 million debt offering and non-recurring charge linked to offshore wind project liabilities focus investor attention on Eversource’s ability to manage rising financing costs and maintain guidance, however, the immediate impact on its major catalyst (rate base growth from infrastructure investments) appears limited, while execution risk on asset sales and regulatory decisions remains the biggest near-term threat. Eversource's recent narrowing of its full-year recurring earnings guidance, following increased wind project costs, directly ties to these concerns, upcoming third-quarter results and management’s response will be a test of how well the company can balance capital spending, debt, and asset monetization. However, investors should be aware that new contingent liabilities from wind divestitures may amplify challenges if...

Read the full narrative on Eversource Energy (it's free!)

Eversource Energy is projected to achieve $14.8 billion in revenue and $2.1 billion in earnings by 2028. This outlook assumes a 4.4% annual revenue growth rate and an increase in earnings of $1.24 billion from the current $858.0 million.

Uncover how Eversource Energy's forecasts yield a $71.69 fair value, in line with its current price.

Exploring Other Perspectives

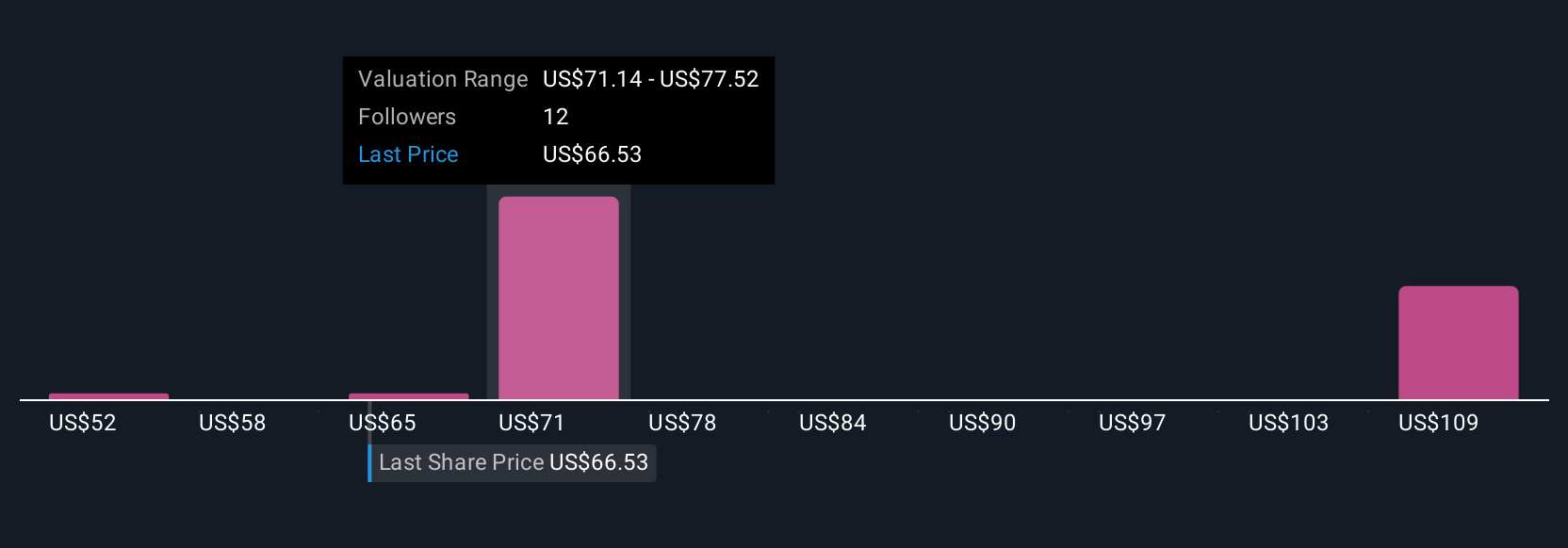

Four Simply Wall St Community members submitted fair value estimates for Eversource Energy, ranging widely from US$52.00 to US$116.81 per share. With asset sales and regulatory approvals shaping capital structure, these varied viewpoints underscore how expectations around balance sheet strength can influence future confidence in Eversource’s performance.

Explore 4 other fair value estimates on Eversource Energy - why the stock might be worth as much as 61% more than the current price!

Build Your Own Eversource Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eversource Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Eversource Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eversource Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eversource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ES

Eversource Energy

A public utility holding company, engages in the energy delivery business.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives