- United States

- /

- Electric Utilities

- /

- NYSE:ES

Eversource Energy (NYSE:ES) Maintains Dividend Approves Earnings Projection Amid Strong Sales Growth

Reviewed by Simply Wall St

Eversource Energy (NYSE:ES) recently declared a dividend of $0.75 per share and reported solid financial results for the first quarter of 2025, highlighting increased sales and a steady rise in net income. The company's reaffirmation of its earnings projections contributed to shareholder confidence. Over the last quarter, Eversource Energy's share price rose by 2.43%, in line with the broader market's positive trend driven by a series of strong earnings reports from major companies. This share price uptick was consistent with overall market gains, bolstered by optimism following robust employment data and potential U.S.-China tariff discussions.

The recent developments at Eversource Energy, including the dividend declaration and solid financial results, could reinforce shareholder confidence and align well with the planned Greater Cambridge Energy Project. Over the past year, Eversource saw a total shareholder return of 1.91%. This compares with a 15% return from the US Electric Utilities industry, highlighting Eversource's competitive discrepancy over the same period.

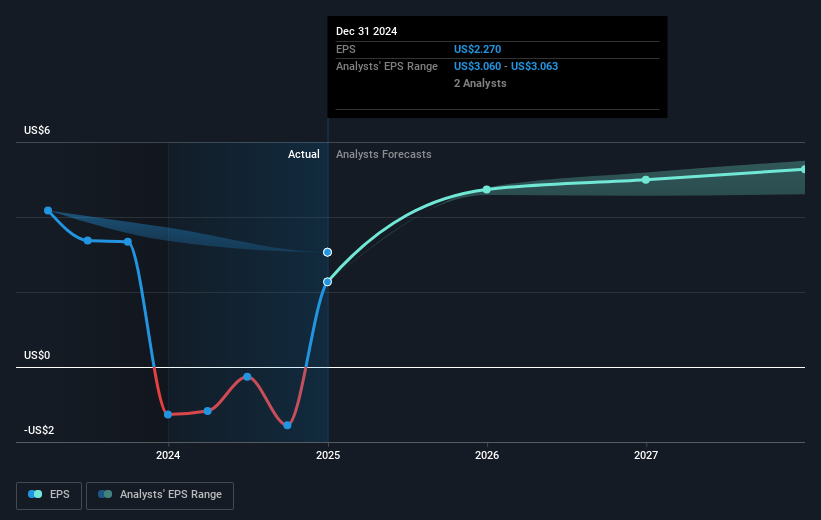

Eversource's revenue is projected to grow by 5.3% annually, supported by the sale of Aquarion Water and infrastructure investments that aim for financial stability. However, regulatory challenges might temper potential revenue gains. Analysts expect earnings to increase significantly to US$2 billion in three years, though rising operational and capital expenses could present hurdles.

With the current share price at US$59.42 and an analyst consensus price target of US$68.74, there's a potential appreciation of 13.6%. This target reflects expectations of improved profits and efficiency gains. Yet, the path to these targets may be influenced by broader economic conditions and industry trends, necessitating cautious optimism from investors.

Gain insights into Eversource Energy's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Eversource Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eversource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ES

Eversource Energy

A public utility holding company, engages in the energy delivery business.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives