- United States

- /

- Electric Utilities

- /

- NYSE:ES

Does Eversource Energy’s 15% Rally Signal a Shift in Market Sentiment for 2025?

Reviewed by Simply Wall St

If you are sitting on the fence about Eversource Energy stock, you are definitely not alone. The past year has seen some intriguing twists, from a near 15% YTD climb to a steadier, more cautious long-term performance. Eversource’s price movements have kept investors guessing, with short-term returns making up some ground after a tough multi-year stretch. Over the last month alone, the stock inched up 0.5%, and in the last quarter, it managed a 2.7% gain. While those numbers might not signal rapid growth, they reflect subtle changes in how the market values the company’s risk, stability, and future potential.

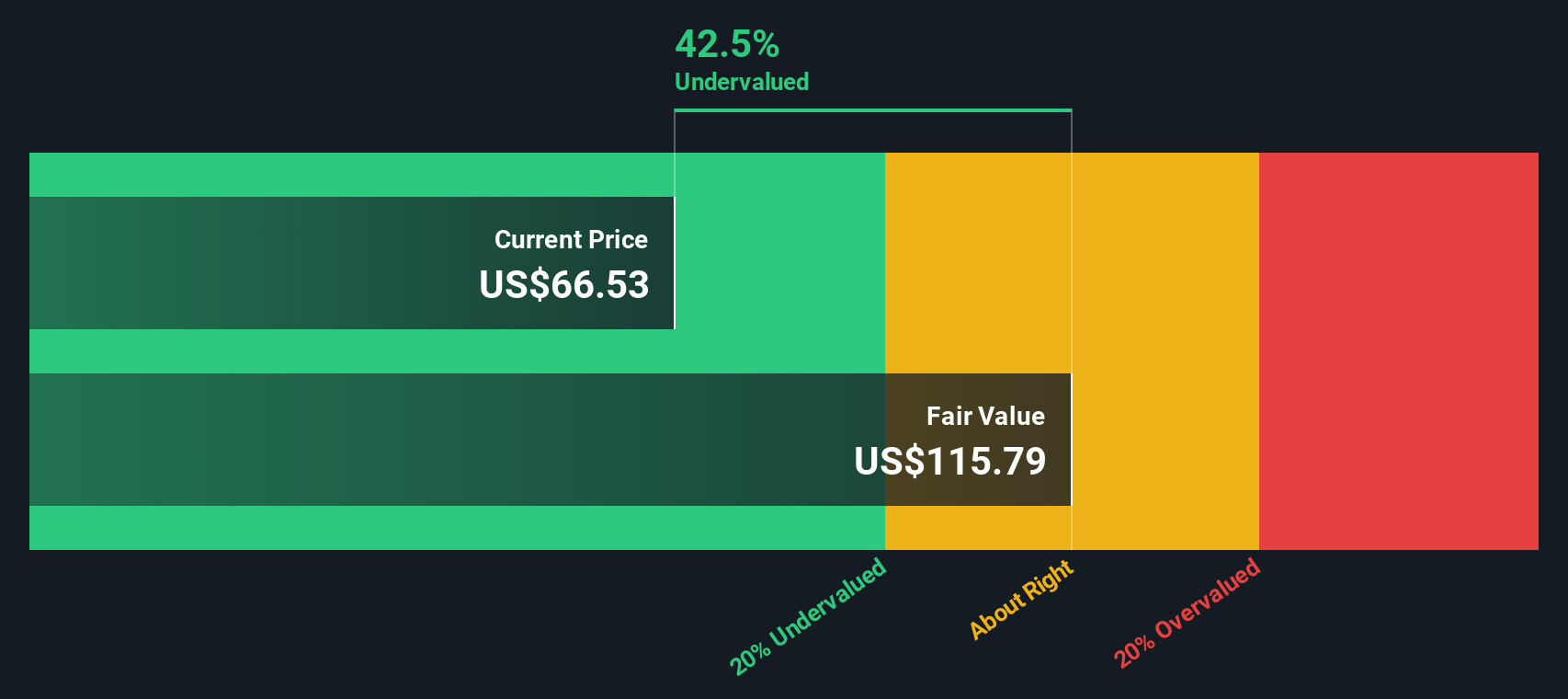

On the valuation front, Eversource Energy has a score of 3 out of 6 based on common undervaluation checks. That suggests it’s passing about half the typical “good value” tests, neither extremely cheap nor overpriced. Investors looking at analyst price targets will note a modest discount of nearly 9% to current prices, with a striking 60.4% intrinsic discount shown by cash flow models. These are the kinds of signals that tend to get value-oriented investors to sit up and pay attention.

But how should we really size up Eversource’s valuation opportunity? Let’s walk through the main valuation checks and see how they stack up, then move toward a more thoughtful way to consider what the numbers really mean for potential returns and risk.

Eversource Energy delivered 4.4% returns over the last year. See how this stacks up to the rest of the Electric Utilities industry.Approach 1: Eversource Energy Cash Flows

The Discounted Cash Flow (DCF) model estimates a stock's value by projecting the company's expected future cash flows and then discounting those amounts back to today's dollars. This method helps investors determine what a company is worth based on its ability to generate cash over time.

For Eversource Energy, the latest twelve months free cash flow stands at negative $1.18 billion, reflecting the company’s ongoing investments and expenditures. Looking ahead, analysts anticipate a significant turnaround, projecting free cash flow of $454 million by 2027. The longer-term outlook is even more optimistic, with projections reaching approximately $4.01 billion in 2035. These numbers suggest a pattern of strong growth over the next decade.

Based on these projections, the DCF model estimates Eversource Energy’s fair value at about $165.83 per share. Compared to the current share price, this indicates that Eversource may be approximately 60.4% undervalued according to the cash flow model. This represents a notable gap, suggesting that the market may be underestimating its future earning power.

Result: UNDERVALUED

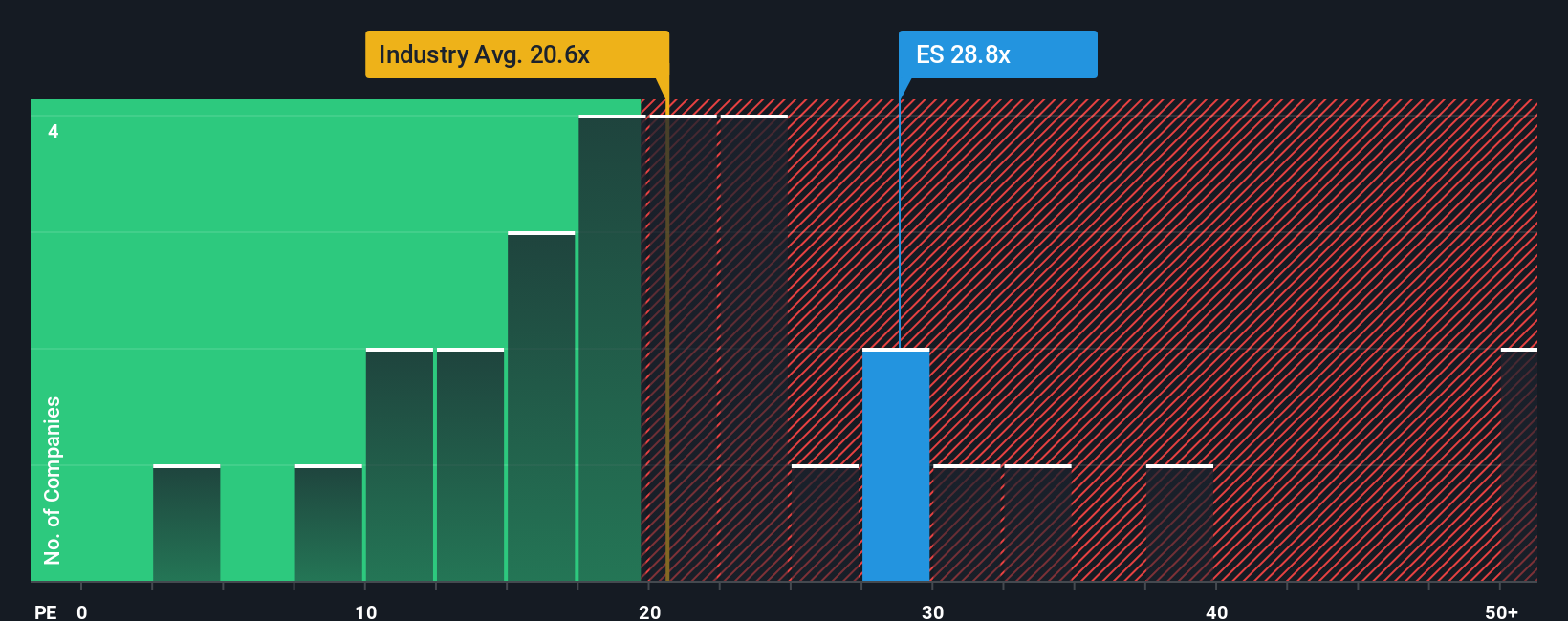

Approach 2: Eversource Energy Price vs Earnings

The price-to-earnings (PE) ratio is one of the most popular ways to value profitable companies. It gives investors a quick sense of what the market is willing to pay for each dollar of earnings, making it particularly relevant for companies like Eversource Energy that generate steady profits.

When evaluating what counts as a “normal” or fair PE ratio, it is important to account for factors such as future growth expectations and risks. Companies with faster expected growth or lower perceived risk often justify higher PE multiples, while slower growth or higher uncertainty can drag the ratio down.

Currently, Eversource Energy trades at a PE ratio of 28.4 times. This is just below the peer average of 29.5 times, but well above the electric utilities industry average of 20.4 times. However, Simply Wall St’s Fair Ratio for Eversource is calculated at 24.6 times, taking into account its unique mix of steady profitability, sector, and risk profile.

With the actual PE ratio sitting only about four points higher than the Fair Ratio, Eversource appears somewhat expensive compared to where the numbers suggest it should trade based on fundamentals. This gap indicates that the stock may be trading at a slight premium to its fair value, possibly reflecting investor optimism or perceived resilience.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Eversource Energy Narrative

Rather than relying solely on valuation ratios, investors can use Narratives to make smarter decisions. A Narrative is simply the story you believe about a company—your perspective on where it's headed and how its business will perform in the future. Narratives link your view of Eversource Energy’s future (like revenue growth, profit margins, and risks) to your own fair value estimate, and then compare that to today’s price.

This approach puts the numbers in context and helps you move from raw financial data to confident action. On the Simply Wall St platform, building a Narrative is as easy as expressing your view and assumptions. Millions of investors engage in this process every day. Narratives are continuously updated whenever important news or earnings are released, so your estimate stays relevant as circumstances evolve.

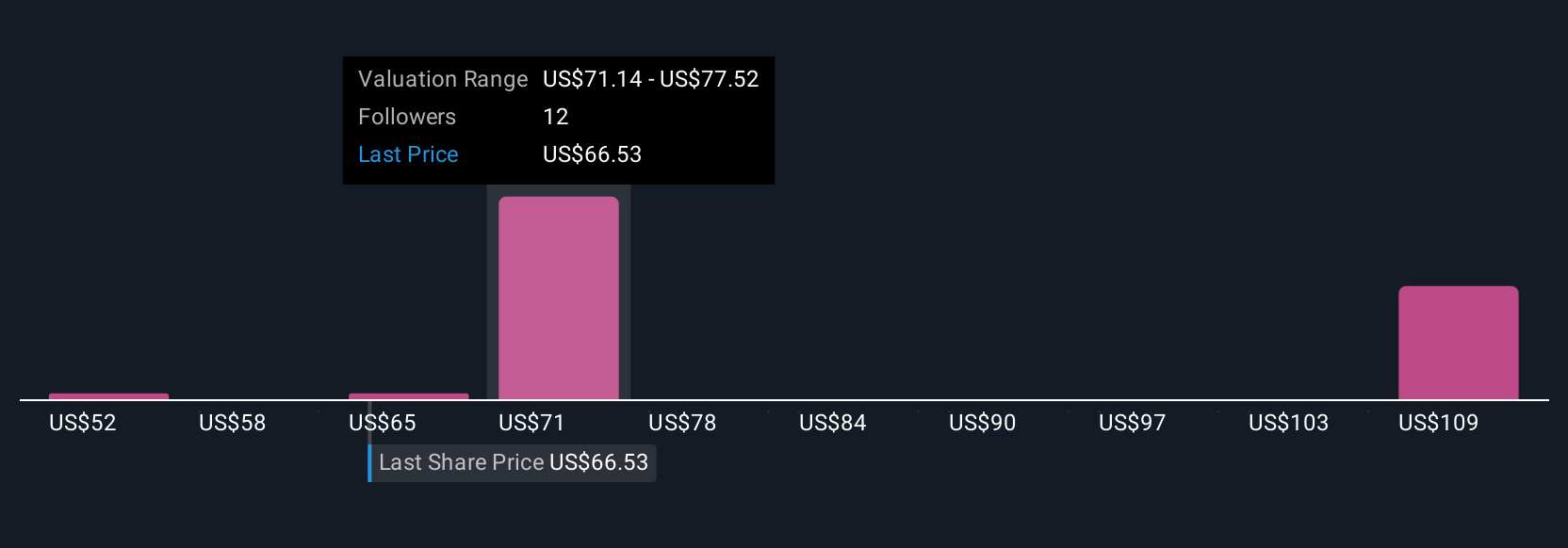

The real power of Narratives is in decision-making. They help clarify when to act by showing how your fair value compares to the market price, all grounded in your actual view of the company’s future. For Eversource Energy, different investors see the story differently. Some forecast a fair value as high as $87 per share based on grid modernization and policy support, while others are cautious with a value as low as $47 due to regulatory and cost risks.

Do you think there's more to the story for Eversource Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eversource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ES

Eversource Energy

A public utility holding company, engages in the energy delivery business.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives