- United States

- /

- Electric Utilities

- /

- NYSE:EIX

Edison International (NYSE:EIX) Reports Strong Q1 Earnings With Raised Guidance

Reviewed by Simply Wall St

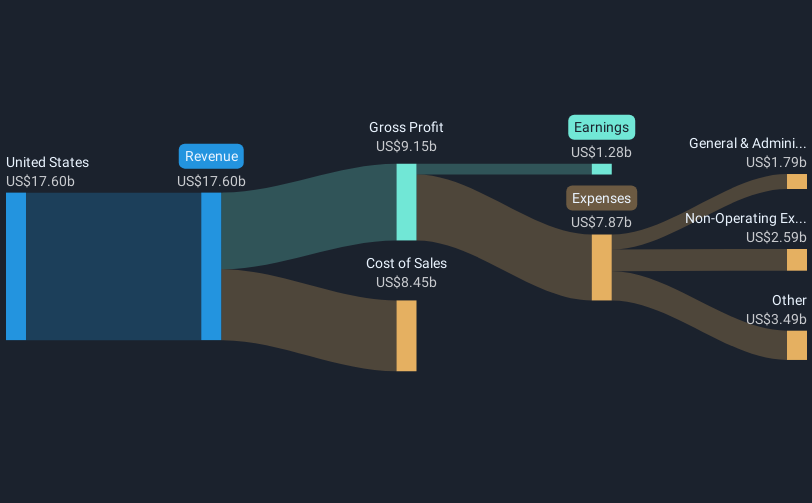

Edison International (NYSE:EIX) recently announced robust Q1 earnings, with significant improvements in net income and EPS from a loss last year, coupled with an upward revision in earnings guidance. These developments likely supported a 5% increase in the company's share price over the last quarter, in line with the general market movement of 5% growth. While broader market trends included economic contraction and investor caution around technology earnings, Edison's strong financial performance and raised guidance potentially lent additional credibility and strength to their stock, counterbalancing the market headwinds.

The recent announcement of Edison International's robust Q1 earnings, along with an upward revision in earnings guidance, could have a substantial influence on the company's future prospects. The enhancement in net income and EPS, alongside a positive earnings outlook, underscores the company's operational efficiency and could be viewed as supportive in the context of their longer-term strategy aimed at infrastructure upgrades and grid expansion.

Over the past five years, Edison International's total return, including share price appreciation and dividends, was 30.31%. This historical performance provides a broader context for evaluating its recent stock movement. However, it's important to note that, over the past year, the company underperformed both the US market, which returned 9.9%, and the US Electric Utilities industry, which saw a 17.7% return.

The impact of this earnings news on forward-looking revenue and earnings forecasts is vital. Analysts assume an annual revenue growth rate of 3.9% and an increase in profit margins to 12.1% within three years, potentially bolstered by infrastructure investments and regulatory support. The forecasted trajectory indicates optimism in future financial stability and growth.

With the current share price at US$57.82, the 5% price increase is a move towards the consensus analyst price target of US$69.54. This target reflects potential upside but also highlights the company's challenges in achieving anticipated growth figures, trading dynamics, and a favorable PE ratio transition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edison International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EIX

Edison International

Through its subsidiaries, engages in the generation and distribution of electric power.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives