- United States

- /

- Other Utilities

- /

- NYSE:ED

A Closer Look at Consolidated Edison’s Valuation After New York's Clean Energy Investment Approval

Reviewed by Kshitija Bhandaru

Consolidated Edison, a major player in the U.S. utilities sector, is drawing attention after the New York State Public Service Commission approved new infrastructure investments related to clean energy. This move highlights the company’s evolving energy strategy.

See our latest analysis for Consolidated Edison.

Momentum has been picking up for Consolidated Edison, with the share price returning 15% year-to-date following recent approvals for clean energy projects and fresh Wall Street attention. While short-term enthusiasm is clear, its 3.6% total return over the last year lags its longer-term 39% three-year total return. This shows that the real gains have come for longer-term holders.

If you’re curious about what other companies have strong momentum and unique shareholder profiles, now’s an ideal time to search beyond the usual names and uncover fast growing stocks with high insider ownership

With investor optimism surrounding new clean energy projects and recent analyst coverage, the key question remains: Is Consolidated Edison’s stock undervalued at current levels, or has the market already factored in its future growth potential?

Price-to-Earnings of 19.1x: Is it justified?

Consolidated Edison’s current price-to-earnings (P/E) ratio stands at 19.1x, just below the average for its industry peers, and it also trades near the company’s recent close of $102.39. This suggests that the market valuation is slightly favorable compared to similar companies across the sector.

The price-to-earnings multiple measures how much investors are willing to pay for each dollar of the company’s earnings. For utilities, it is a widely used benchmark given the sector’s predictable profits and steady cash flows. A P/E of 19.1x indicates that the market values Consolidated Edison’s earnings close to the industry norm, but with only a modest discount.

Compared to the US Integrated Utilities industry average of 20.4x, Consolidated Edison’s P/E is lower, making it appear reasonably valued within its direct peer group. However, when compared to the global integrated utilities industry average of 18.4x, the stock appears slightly more expensive. According to our fair value regression, a P/E of 21.7x could be justified by the company’s fundamentals, so there is still potential for the market to revise its view upward should earnings growth meet expectations.

Explore the SWS fair ratio for Consolidated Edison

Result: Price-to-Earnings of 19.1x (ABOUT RIGHT)

However, slower revenue growth or unexpected regulatory changes could challenge the market’s current optimism and limit further gains for Consolidated Edison.

Find out about the key risks to this Consolidated Edison narrative.

Another View: Discounted Cash Flow Perspective

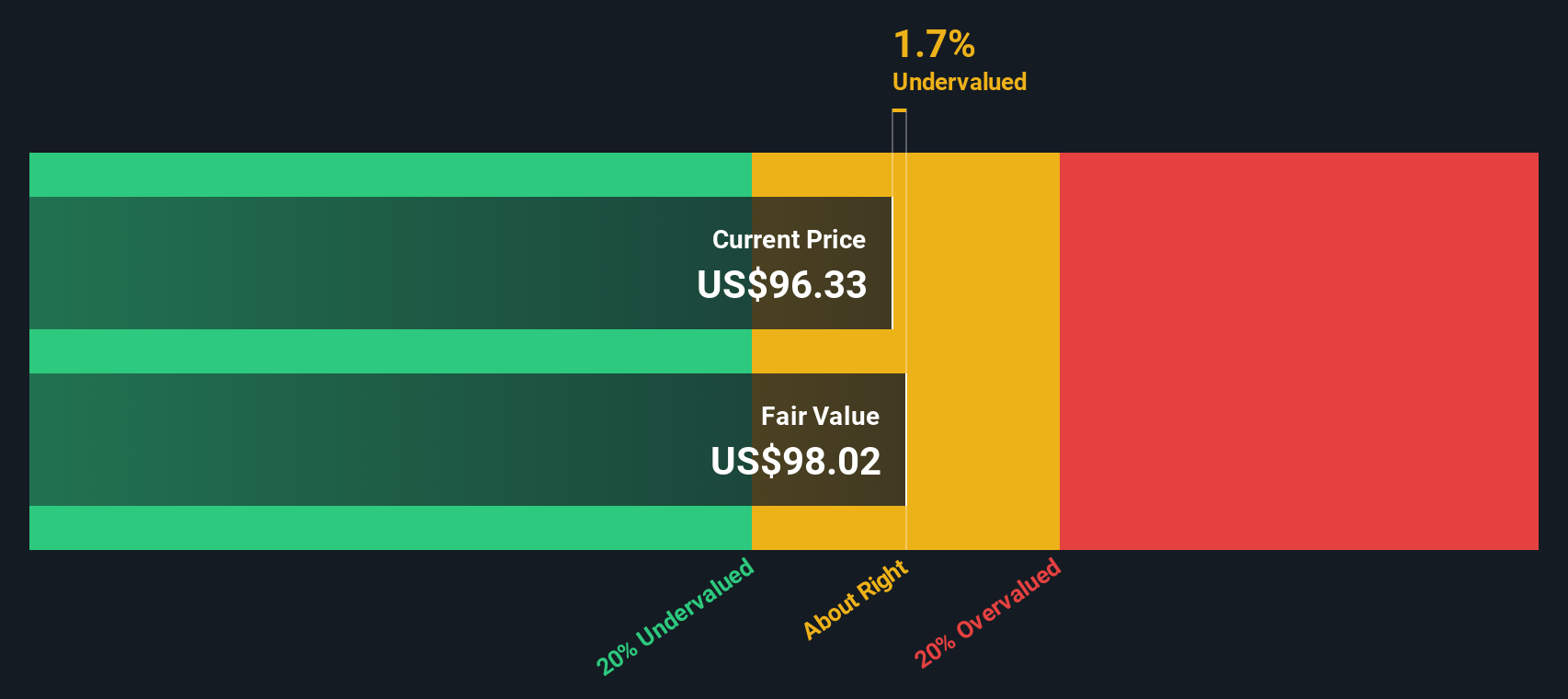

Looking at Consolidated Edison through our DCF model paints a more cautious picture. The current share price of $102.39 is above our estimated fair value of $97.33. This suggests the stock might be slightly overvalued based on projected cash flows. Does this challenge the more optimistic take from earnings-based valuation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Consolidated Edison for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Consolidated Edison Narrative

If you want to interpret the numbers differently or prefer an independent approach, you can quickly build your own view from scratch in just a few minutes. Do it your way

A great starting point for your Consolidated Edison research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Uncover valuable opportunities before the crowd does by searching companies that match your interests and strategy. Powerful tools like these give you the edge:

- Unlock strong income streams and steady cash flow by checking out these 19 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Spot promising trends in artificial intelligence and get ahead of the market with these 24 AI penny stocks making waves in this high-growth sector.

- Maximize your portfolio’s potential by targeting undervalued opportunities with these 893 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ED

Consolidated Edison

Through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives