- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Is Duke Energy's (DUK) SMR and Storage Push Quietly Redefining Its Long-Term Earnings Story?

Reviewed by Sasha Jovanovic

- Duke Energy recently reaffirmed its role in a US Department of Energy cost-share effort to advance GE Vernova Hitachi’s BWRX-300 small modular reactors, while also highlighting long-term plans to expand energy storage capacity toward 6,000 MW by 2035 and about 30,000 MW by 2050.

- This push into advanced nuclear and large-scale storage marks a meaningful evolution in Duke Energy’s future generation mix and grid reliability plans, with potential implications for its capital spending profile and long-term earnings resilience.

- We’ll now examine how Duke Energy’s commitment to small modular reactors could influence its existing investment narrative around the energy transition.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Duke Energy Investment Narrative Recap

To own Duke Energy, you generally need to believe in the long-term value of a regulated utility that is steadily modernizing its grid while managing heavy capital needs and regulatory oversight. The latest SMR and storage updates support the existing clean energy transition story, but do not appear to change the near term focus on executing large capital projects without overextending the balance sheet, or the key risk around rising financing needs and interest costs.

The most relevant recent announcement here is Duke’s reaffirmed participation in the U.S. Department of Energy cost-share project to advance GE Vernova Hitachi’s BWRX-300 SMR technology, including a planned early site permit filing for Belews Creek. This fits alongside Duke’s long term storage targets and its broader nuclear and renewables build out, which together sit at the heart of the company’s main catalyst of supportive regulation and cost recovery for major grid and generation investments.

Yet even as these projects progress, investors should be aware that growing capital requirements could increase reliance on external funding and...

Read the full narrative on Duke Energy (it's free!)

Duke Energy's narrative projects $35.4 billion revenue and $6.1 billion earnings by 2028. This requires 4.7% yearly revenue growth and an earnings increase of about $1.4 billion from $4.7 billion today.

Uncover how Duke Energy's forecasts yield a $137.47 fair value, a 18% upside to its current price.

Exploring Other Perspectives

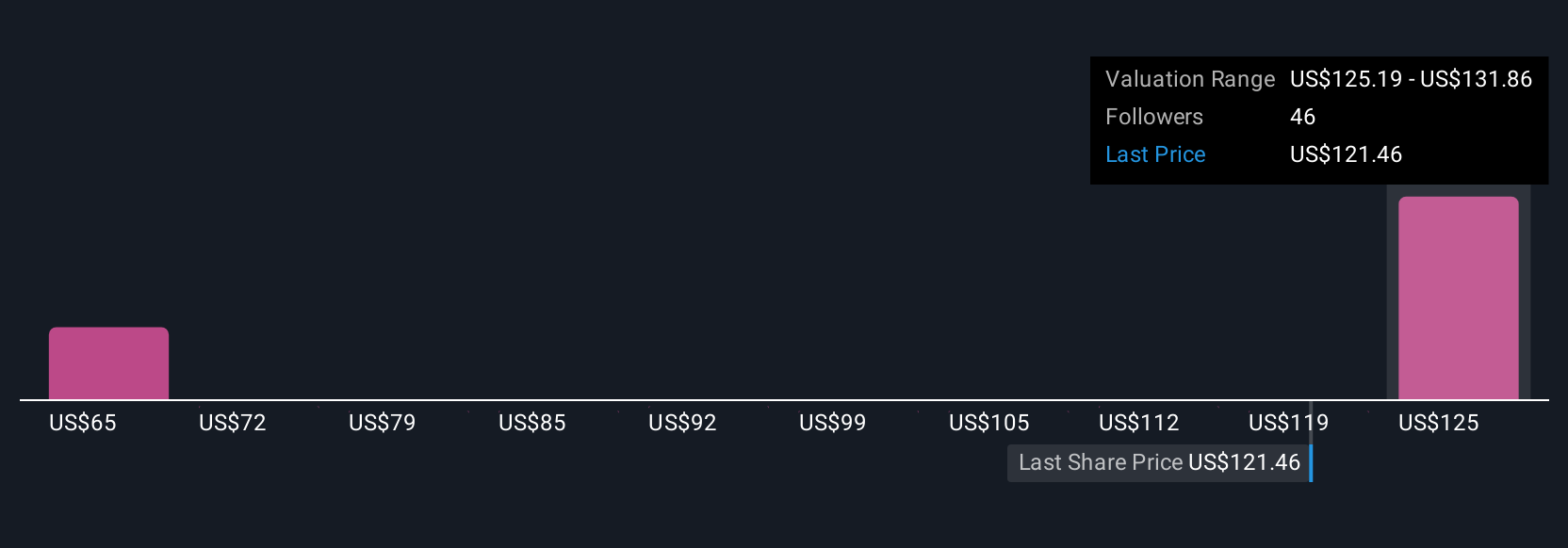

Seven fair value estimates from the Simply Wall St Community span roughly US$63 to US$137 per share, underscoring how differently individual investors assess Duke’s prospects. As you weigh those views against Duke’s heavy long term capital program and related financing risk, it can be helpful to compare several perspectives before deciding how this stock might fit your portfolio.

Explore 7 other fair value estimates on Duke Energy - why the stock might be worth as much as 18% more than the current price!

Build Your Own Duke Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Duke Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Duke Energy's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026